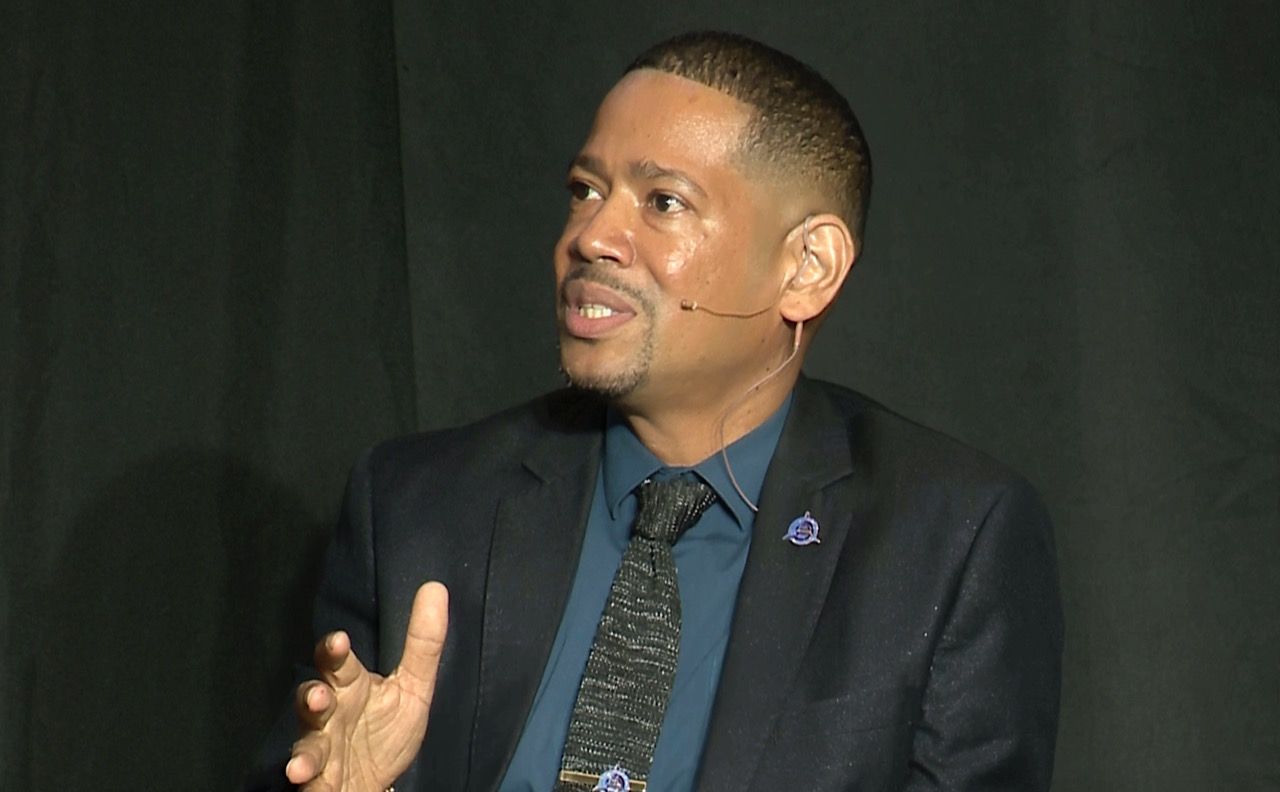

Above: WiPay Group Chief Executive Officer with his team at WiDay 2025. Photo by Shannon Britto, courtesy WiPay.

The WiPay GROUP staged its fifth WiDay at the Hyatt Regency Trinidad with a reveal of its regional ecosystem. Group Chief Executive Officer Aldwyn Wayne explained how the Group has moved beyond “payments as a product” to an integrated operating system for Caribbean life and business, spanning Communications, Finance and Lending, Travel and Logistics, and Government Services, with Payments as the backbone connecting them all.

Wayne framed the transformation as a shift from startup to infrastructure built for the realities of the region. “We did not patch the past, we built a new network here,” he said. “One engine, one mission, designed for how the Caribbean earns, pays, travels, communicates, and accesses public services.”

He emphasised that WiPay’s strength lies in how the divisions interlock to remove friction for citizens, merchants, and ministries. WiPay leaders detailed how the pillars operate as one network. Payments enables fast, traceable acceptance and settlement for merchants, creators, and institutions. Finance and Lending, via WiLoan, delivers responsible, salary-linked micro-credit with clear terms and rapid decisions.

On Communications, Abraham Sutherland, Chief Product Officer for nimble mobile, affirmed that connectivity is now a basic utility for a generation that learns, earns, and creates on the go, with immediate activation, simple plans, and service that reflects the cultural rhythm of Caribbean life.

Travel and Logistics, through WiTravel, addresses long-standing checkout and settlement failures so more value stays in Caribbean supply chains. Government Services unifies court payments, national eKYC, permits, licensing, vouchers, reconciliation, and reporting on modern rails that launch in weeks, with auditability and standards built in.

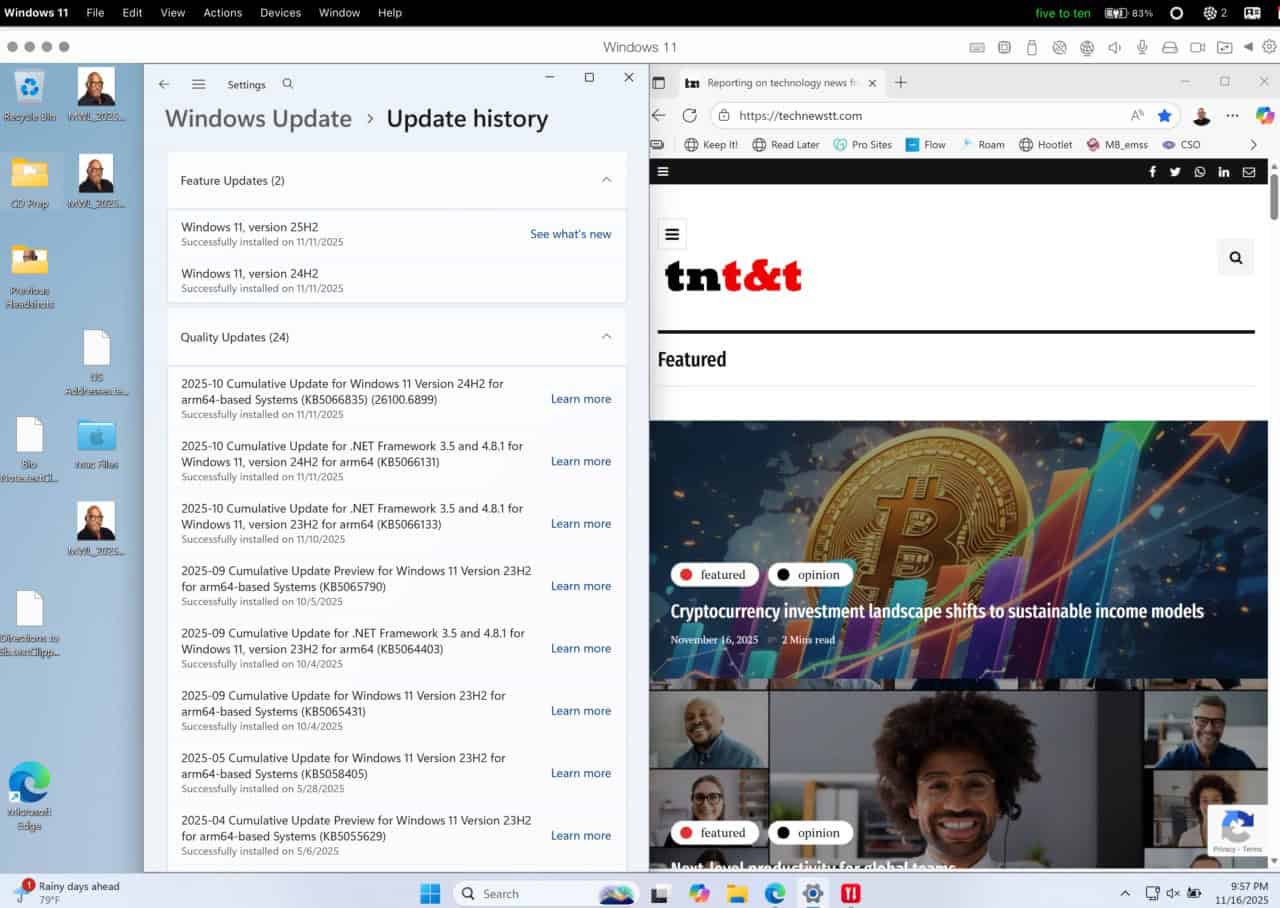

In the foreground, panelists Joel Julien, John Outridge and Keino Cox. Photo by Shannon Britto, courtesy WiPay.

National Payments Fireside Chat

A dedicated National Payments Fireside Chat moved the programme from vision to application. Senator Dr. the Honourable Kennedy Swaratsingh, Minister of Planning, Economic Affairs and Development, and Senator the Honourable Dominic Smith, Minister of Public Administration and Artificial Intelligence, joined Jason Julien, Group Chief Executive Officer, First Citizens Group Financial Holdings, and Keino Cox, Acting Chief Executive Officer, TSTT.

The discussion focused on digitising public services at scale, applying AI to front-line and back-office processes, and enforcing shared standards and security across identity, payments, and registries.

Financial inclusion remained a core theme. Wayne underscored WiPay’s role in bringing the unbanked online through a cash-to-digital voucher network. Citizens purchase a top-up code at authorised outlets, enter the code on a phone, and load value to complete payments or fund a wallet. Merchants receive settled funds, citizens gain a receipt trail, and agencies gain auditable flows. Cash in, digital out, using rails built for Caribbean realities.

Group Chief Marketing Officer, Kibwe McGann, connected the strategy to everyday life. “The stakes are human, not transactional. Behind each payment is a person, a face, a family. When the rails work, people move with dignity. We are global where needed, regional by design, local in impact,” he said.

WiDay 2025 served as WiPay’s most comprehensive statement of intent to date. The ecosystem presented was engineered for the region’s currencies, compliance requirements, and cultural tempo, creating one network that public and private partners can rely on at scale. Wayne concluded, “A fully digital Caribbean economy is not a future promise. It is here, working, and ready to scale.”