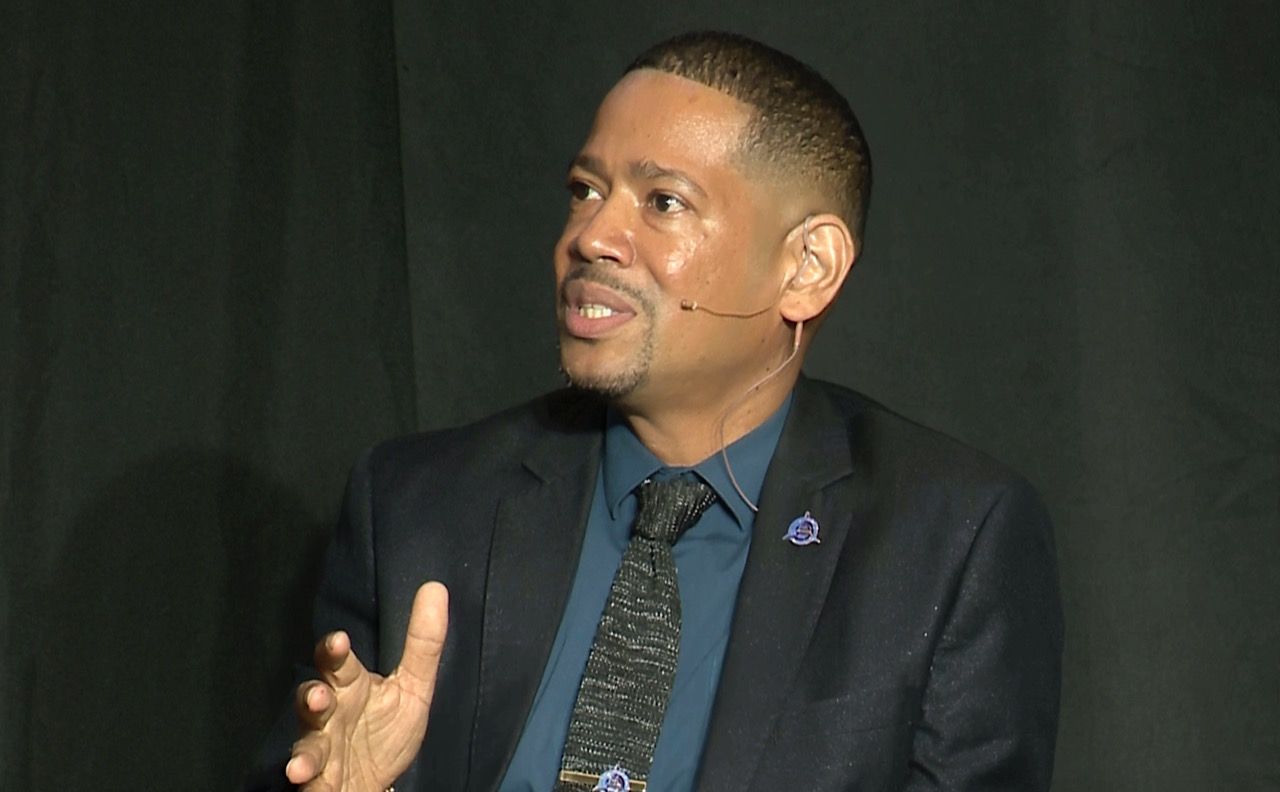

Above: John Outridge, CEO, TTIFC.

Visa and the Trinidad and Tobago International Financial Centre (TTIFC) announced the renewal of their strategic collaboration in March, aimed at strengthening efforts to further accelerate the access and usage of digital payments and financial inclusion in Trinidad and Tobago.

As part of this extended agreement, both organizations will continue to expand digital acceptance capabilities for micro, small and medium enterprises (MSMEs), digitalize government payments, disbursements and financial services and strengthen the FinTech sector — all while advancing the National Financial Inclusion agenda to create a more accessible financial landscape for all.

Visa’s Cybersource, an industry-leading global payment and fraud management platform, is at the core of these efforts, through which Visa is helping to scale next-generation digital acceptance solutions and online fraud detection capabilities among local merchants and the government. This initiative is helping to simplify and enhance security for payments locally by providing access to Visa’s leading security technologies, including tokenisation, Cybersource Decision Manager and 3D Secure 2.0.

“This renewed collaboration with TTIFC reaffirms our commitment to continue digitalising and supporting digital transformation efforts in Trinidad and Tobago to bring more innovation and prosperity for consumers and businesses in the country,” said Jorge Salum, Country Manager at Visa Trinidad & Tobago.

“By combining our global payments expertise with TTIFC’s proven leadership in driving a cashless economy, we are confident that together we’ll foster a more agile and inclusive digital ecosystem—one that enhances convenience, security and greatest access to the future of commerce.”

“We’re excited to extend our collaboration with Visa as we continue accelerating growth of the local and regional FinTech sectors through One FinTech Avenue, the first FinTech innovation centre in the region. Visa has been a crucial partner in our mission to drive sector growth, and with their continued support, we will make significant strides in enhancing financial inclusion and digital payment solutions in Trinidad and Tobago,” said John Outridge, CEO, TTIFC.

“United by a shared vision of creating a top-tier digital payments landscape, we are taking steps to expand digital payment acceptance to more constituents, particularly MSMEs. This renewed partnership will strengthen our FinTech ecosystem by unlocking new digital financial capabilities, empowering more citizens to fully engage in the digital economy.”

Visa’s collaboration with the TTIFC builds on a broader joint effort to drive a cashless economy in Trinidad and Tobago. Visa has been proactively enabling the development of the local FinTech ecosystem. Visa is leveraging its Cybersource platform to enable secure payment processing and connectivity between fintechs and financial institutions. Visa is also currently working to drive digital commerce locally with entities such as AnglPay, and food drop to providers which enable merchants and fintech to expand digital commerce.