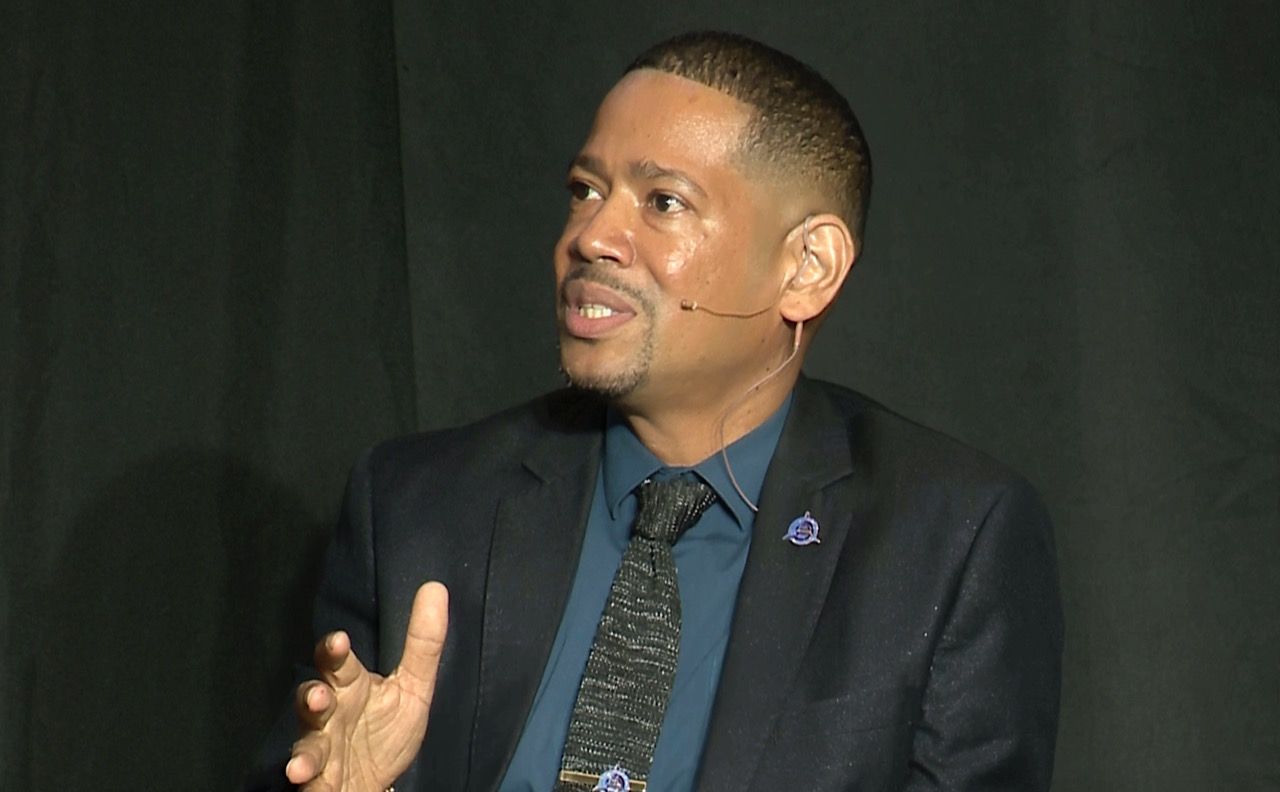

Above: Dr. Nigel Fulchan, the Chairman of NPICTT

The National Payment and Innovation Company of Trinidad and Tobago (NPICTT) and Telecommunications Services of Trinidad and Tobago Limited (TSTT) today announced a strategic national partnership that moves Trinidad and Tobago’s digital transformation agenda into live operation.

The partnership delivers two major outcomes at the same time. TSTT has now been onboarded as the first organisation to process live payments on the NPICTT national payments platform, and has also adopted Nobis as its official electronic Know Your Customer (eKYC) solution, delivered through the NPICTT Innovation Centre. Together, these developments mark a shift from planning and platform build-out to real, consumer-facing digital services.

TSTT goes live on the National Payments Platform

Through this integration, and as part of the partnership, TSTT will be the first payment-processing client on the NPICTT platform, being its official online payment channel for customer bill payments across its brands and services. Customers will be able to pay digitally using infrastructure that is locally owned, nationally governed, and designed to scale across Government.

“This is a major step in operationalising the national payments framework,” said Dr. Nigel Fulchan, the Chairman of NPICTT.

He further stated, “TSTT’s onboarding as the first live payment-processing client underscores that the platform is not merely conceptual, but fully operational and production-ready with the capacity to support high-volume, public-facing services. This partnership illustrates how shared national infrastructure can be strategically leveraged to modernise service delivery across the State.”

Digital onboarding and eKYC via the NPICTT Innovation Centre

At the same time, TSTT is strengthening its digital onboarding capabilities by adopting NOBIS as its official eKYC solution.

NOBIS has been deployed through the NPICTT Innovation Centre, which serves as the eKYC solution intended for public-sector use.

The acting Chief Executive Officer of TSTT, Mr Keino Cox said the initiative supports the company’s broader digital strategy.

“This partnership allows TSTT to accelerate our transition to digital services in a structured and secure way. By going live on the national payments platform and adopting NOBIS through the Innovation Centre, we are improving the customer experience while maintaining strong governance and compliance. It also positions TSTT to scale digital services efficiently as demand grows.”

Government endorsement of NPICTT’s Growth and national role

Welcoming the announcement, Senator Dr. the Honourable Kennedy Swaratsingh, Minister of Planning, Economic Affairs and Development and Minister in the Ministry of Finance, indicated that the partnership reflects the steady growth and increasing national infrastructure to improve customer services across government entities.

“The National Payment and Innovation Company of Trinidad and Tobago (NPICTT) was launched in August 2025 to support this Government’s mission to reach every citizen, in every community, for every government transaction.”

“The Telecommunications Services of Trinidad and Tobago Limited, TSTT, positioning itself as the first state owned entity to adopt the NPICTT platform for online bill payments and digital customer onboarding is a milestone in the NPICTT’s thrust to become the unified gateway for all public-sector financial interactions.

“We are about revolutionising the citizen experience by taking services that for years were complicated, time-consuming and often frustrating and making them simple, fast and secure. TSTT is manifesting the goal of ensuring that every citizen, regardless of where they live or how they choose to pay, will have access to the same high standard of service. This is a leap forward in convenience, transparency and public trust. This is a first of its kind with more public agencies to follow. On behalf of the Minister of Finance, the Honourable Dave Tancoo and myself, we extend congratulations to the NPICTT and TSTT on a job well done.”

Beyond TSTT, the partnership establishes a practical and repeatable model for Government digital transformation as the approach taken—using shared platforms and a central innovation and enablement framework—reduces duplication, improves efficiency, and accelerates the rollout of digital public services.

NPICTT now operates as the national payments infrastructure provider, while its Innovation Centre functions as the entry point for certified digital solutions to be rolled out across the public sector. This approach allows Government entities to adopt digital services more quickly, without duplicating systems or fragmenting standards.

Importantly, the partnership does not change existing statutory or regulatory responsibilities. TSTT remains fully responsible for delivering services to its customers, while NPICTT provides the shared platforms and enablement framework.

Laying the foundation for scale

With TSTT live on the payments platform and operating NOBIS through the Innovation Centre, the groundwork has been laid for broader expansion. Additional utilities, State-Owned Enterprises, and Ministries can now follow a proven path to digital payments, online services, and secure onboarding using shared national infrastructure.