- InfoLink, established in 1994, introduced the Linx cash payments system in 1995 after overcoming challenges related to interbank cooperation.

- InfoLink manages 41% of total electronic payments, roughly 78 million transactions annually.

- Instant payments solve the problem of delayed fund transfers and provide immediate access to money.

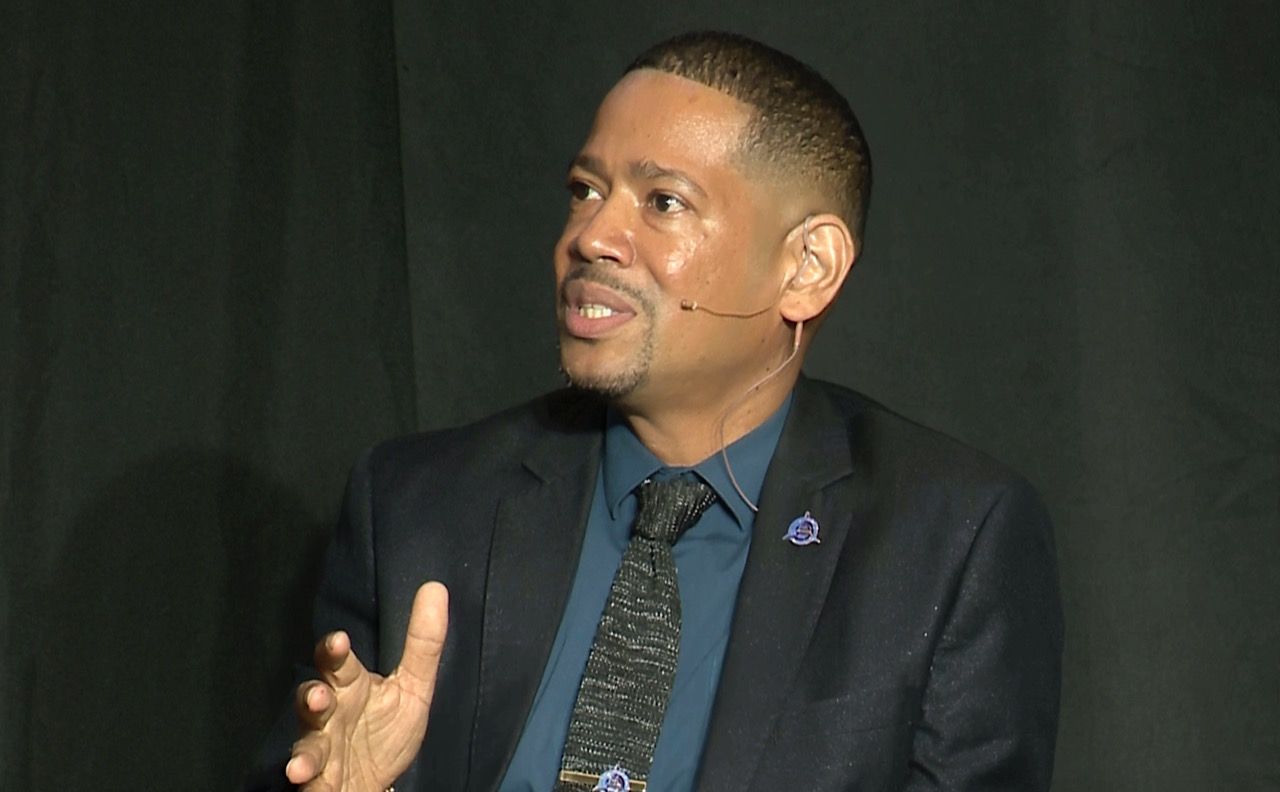

Above: InfoLink General Manager Glynis Alexander-Tam speaking at the company’s 30th Anniversary celebrations. Photo by Mark Lyndersay.

Originally published in Newsday’s BusinessDay on November 20, 2025

On November 14, InfoLink Services, the interbank agency responsible for ACH electronic transfers and the Linx cash payments system, celebrated 30 years of operations in Trinidad and Tobago.

Amid the celebrations, there were notes of both concern and forward looking optimism for an agency that faces new competition in the electronic cash transfer business and heightened customer expectations for speed and security.

Central Bank Governor Larry Howai noted in greetings on behalf of the financial regulator that, “InfoLink plays a critical role in ensuring that payments are processed smoothly, safely, and efficiently, and is considered a significant retail payment system in Trinidad and Tobago.”

“Consumers are demanding faster, more convenient, and more secure payment options. Businesses are seeking digital solutions to expand their reach and the regulator, the Central Bank, must ensure that innovation does not come at the expense of stability or inclusion. Our commitment at the Central Bank is clear, to enable innovation while safeguarding consumer interest. We must ensure that our regulatory frameworks remain agile, responsive, and fit for purpose.”

InfoLink began operations in 1994 and introduced Linx in September 1995, when the first Linx transaction was processed at an ATM. But those formal beginnings don’t tell the story of the effort to make interbank cooperation happen.

Conversations about customer-level open banking had been going on since the late 1980’s but it wasn’t until two of the major banks operating at the time decided to make the connections happen that the others joined the effort.

The banks agreeing to cooperate were Royal, Republic, First Citizens, Scotia and CIBC. By then, CIBC was acquired by Republic, so the count was regarded as four.

Today, ANSA Bank, which purchased the assets of Bank of Baroda, First Caribbean and the Eastern Credit Union, the first non-bank financial partner, are also part of the network of financial institutions participating in the InfoLink network.

Robert Boopsingh, General Manager of InfoLink from 1997 to 2007, remembers the caution of the participating banks as the greatest challenge.

“The question of how to actually transfer the information and know each transaction uniquely and securely was the first thing,” he said in an exclusive interview along with current GM Glynis Alexander-Tam after the anniversary formalities.

“Setting up what we call the mailbox to be able to receive, send on, and then wait for the response to come back from the acquirer [was one technology hurdle],” Boopsingh said.

To manage that, the team worked with W3 Consulting who were implementing a similar system in Canada, then there was the implementation of fully redundant servers, but those issues were, he believes, a distant third to overcoming banker skittishness.

“Getting [them] all to the table and agreeing to one standard for the messaging, that was the bigger challenge. Putting in place all the operational things to handle thousands of transactions per hour that must balance to the penny? Building that was another significant challenge as well.”

Today InfoLink faces new challenges in an increasingly fragmented and fiercely competitive electronic payment landscape.

Linx began point-of-sale debit transactions in 1996 and switched to PIN and chip secured debit cards in 2019.

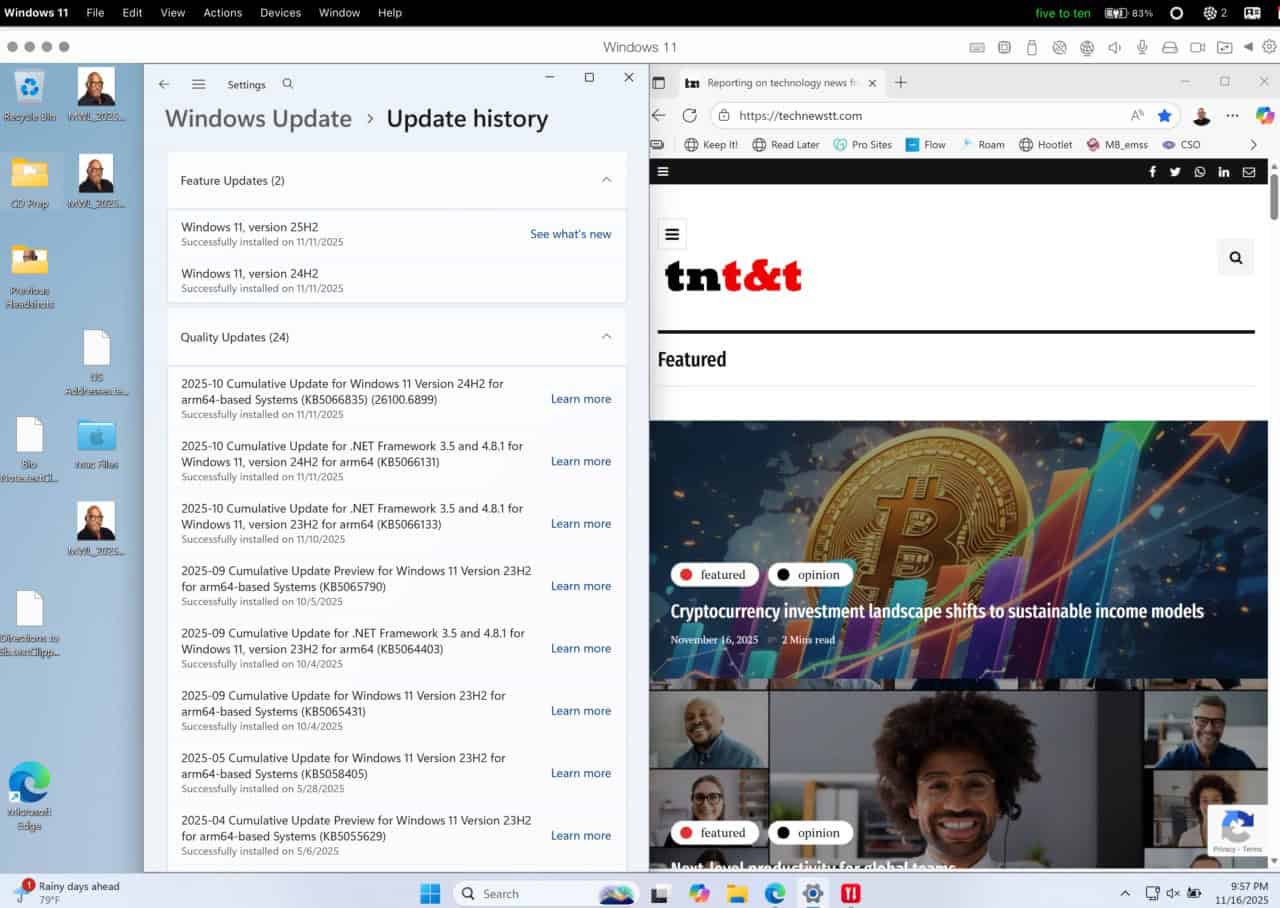

InfoLink acquired the TT Interbank Payment System of Tariffs in 2019 and began offering Automated Clearing House via electronic transfer (ACH EFT) in 2019. Electronic Check Clearing (ACH ECC) was added in 2023.

As of 2024, the market for electronic payments breaks down as debit cards with 57.6 per cent, credit cards (24.1) ACH EFT (14.9) and ACH ECC (4.4). InfoLink manages 41 percent of total electronic payments, roughly 78 million transactions annually.

The volume of InfoLink business for the third quarter of 2025 continues to be led by Linx with 15,713,044 transactions, ACH EFT (3,350,031) and ACH ECC (1,101,797).

It’s InfoLink’s market to lose now.

“[EFT) funds transfer has been very healthy and growing,” said InfoLink’s GM, Glynis Alexander-Tam.

“You saw that take off particularly during covid because there was all this fear of touching money, people actually discovered it from a personal point of view,” she said.

“The corporate sector always knew you could do ‘domestic wire transfer.’ The consumer, the Linx users, really got familiar with that during covid when companies started to encourage people to just transfer money. You saw it online. Just transfer money when you reach, we’ll give you our bank account and just transfer. “

Electronic check clearing was too little too late for consumers. Fraud involving checks was becoming unsustainable and with ACH volumes rising, the banking community removed check guarantees at point-of-sale in 2000.

The Central Bank, through which a river of checks flowed, was happy to be rid of the burden.

InfoLink achieved Payment Card Industry Data Security Standard (PCI DSS) certification in 2021 and has maintained that status over four consecutive years, implementing the vulnerability assessments, and cybersecurity training required, but the threat landscape is increasingly sophisticated.

According to featured speaker (full address here), Shiva Bissessar of Pinaka Consulting, “Artificial intelligence is not just transforming how we build payment systems, it’s revolutionizing how criminals attack them.”

“Deep fake social engineering has moved from theoretical concern to operational threat. Criminals are using AI-generated voice cloning to impersonate CEOs authorizing wire transfers. They’re creating synthetic videos of CFOs approving fraudulent transactions.”

“Your treasury officer receives a video call from someone who sounds exactly like your CEO, looks exactly like your CEO, and is calling from your CEO’s actual phone number. They’ve urgently authorized a large permit to a new beneficiary for a confidential acquisition. The voice cadence is perfect. The visual appearance is flawless.”

“Every authentication factor you’ve trained your staff to verify, they all check out. Except none of it is real. Traditional security training [requires] staff to verify the caller’s identity by recognizing their voice. AI voice cloning has made that advice obsolete.”

“AI security tools require constant investment, expertise, and constant updating. International banks deploy cutting-edge fraud detection, while local institutions rely on rule-based systems designed for a pre-AI era, guess where the criminals will target their banks? This creates dangerous fragmentation, sophisticated institutions becoming more secure, while smaller ones become increasingly vulnerable.”

I asked Alexander-Tam, on behalf of everyone who has ever used ACH EFT, why does a digital handshake between two banks take two days?

“Instant payments would actually solve that problem, it’s all part of validation,” said Alexander-Tam.

“The system that runs the ACH is a switch. Linx is a switch. ACH is a switch. But you have to ensure on the back end that the money goes where it’s supposed to go. That process used to take longer, three to five days. Now you see many banks doing it in two days, but again, it depends on their internal processing. Each bank has their own timing with respect to internal process.”

To change that, she explained, is an upgrade, using the technology that banks use for SWIFT transactions.

“That would require the industry to decide that’s where we’re going. It could either be mandated by the Central Bank or we could all agree this is where we know we have to go and there’s a timelines to doing it.”

Alexander-Tam is also sanguine about the changes that are likely to come with the adoption of India’s UPI payment system.

“We are about providing options for the channel. Every payment is a channel. Linx is a channel. A credit card is a channel. What we’re focusing on is that instant payments element, ensuring that we are part of that evolution of payments. At the end of the day, in my closing [speech], I said that it’s about the customer. You have to focus on what the customer is asking for. Customers don’t want to wait two days. You want your money now. Business people want their money now. If people are transferring money to you, want your money now. So it’s about focusing on the customer.”

“Trinidad is small and it’s a small group of people who are very focused on improving the payment landscape in this country. So it’s all about collaboration, communication and sharing information. “I always tell people that information is power, but sharing information is to the nth power. That’s a strength. I have been fortunate in this industry that in relationships [with the National Payments Company] and people like iGovTT, we constantly talk about what if, what can be and how we can collaborate. With NPCL, we’ve been talking for many years now about ACH and ACH in government payments and what that would look like and how we can help.”

“But it takes an effort and collaboration to move in that direction. We’re now seeing a movement to electronic payments [in Government]. We saw Customs finally embracing Linx. Other ministries have embraced it before, but it’s a huge milestone because they have always been very cash [oriented].”