- Investing in 4G is the best path to 5G

- 5G adoption has been slow in the Caribbean and Latin America

- Services delivered over 5G will offer the best monetisation opportunities

Above: Dr Mohamed Madkour, VP Global Wireless Marketing and Solutions Huawei Technologies

Originally published in Newsday’s BusinessDay for August 05, 2021

At CANTO’s 36th Annual Conference last week, a panel of experts gathered to discuss “How 5G can be rolled out in the Caribbean.”

There weren’t many revelations coming from a panel composed of vendors, regulators and stakeholders for a discussion that will, ultimately, be decided by governments and regional telecommunications companies, neither of which were represented in the discussion.

What did emerge were some proven best practices and the results of some limited deployments in the Latin American region. What did emerge were some proven best practices and the results of some limited deployments in the Latin American region.

According to Dr Mohamed Madkour, VP Global Wireless Marketing and Solutions Huawei Technologies, 5G has not started big in Latin America.

In the Caribbean, Liberty Puerto Rico can point to its successful deployment over the last year, but most regional telecommunications operations are still recouping the cost of their 4G LTE network upgrades.

China has embraced 5G; particularly for Internet of Things (IoT) applications. The wireless technology is being actively used there in more than 20 industries in over 1,000 projects with a collective value of US$1.2 billion.

China is finding, according to Madkour, productivity enhancements in industry of 20 per cent and the country has reduced the number of workers labouring underground.

Huawei has built 170 5G networks globally.

“Those who are adopting 5G want to raise their profile on the technology map,” Madkour said.

“Investing in 4G is the best way to lower investment barriers to adopting 5G, that way in two to three years you can just turn on the 5g switch.”

“You cannot cultivate good 5G until you have good soil of 4G, you have to have the anchor of 5G and you have to be able to aggregate 4G and 5G [bandwidth].”

“Every 4G dollar is a 5G dollar.”

Ericsson has built 93 live 5G networks said Fabian Monge Muñoz, Head of Networks and Managed Services Sales for the company.

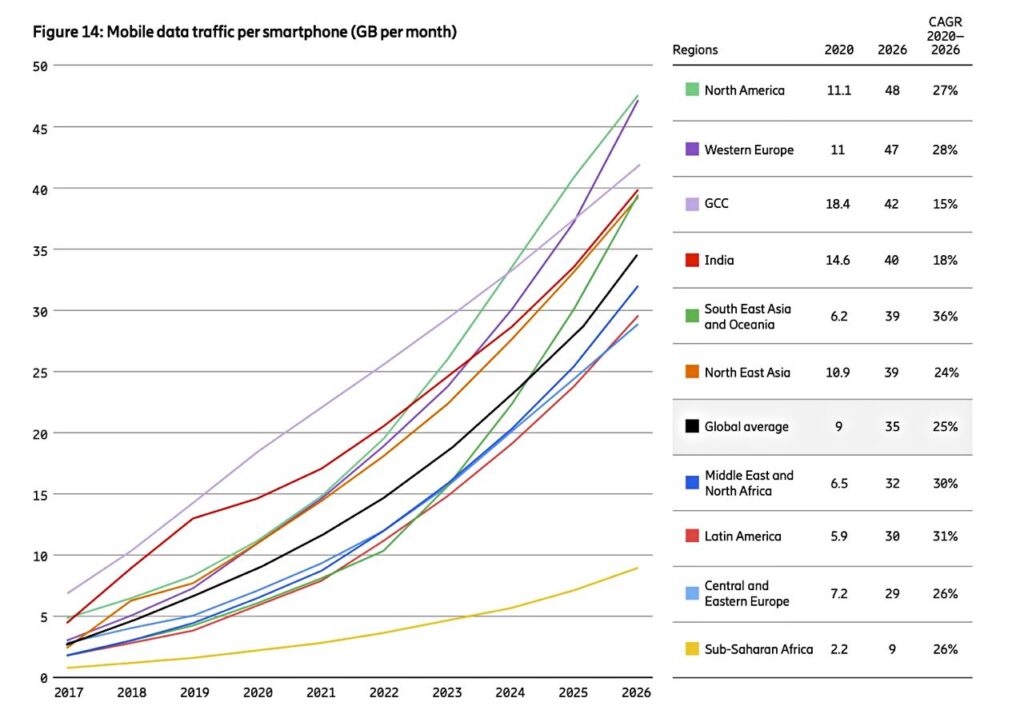

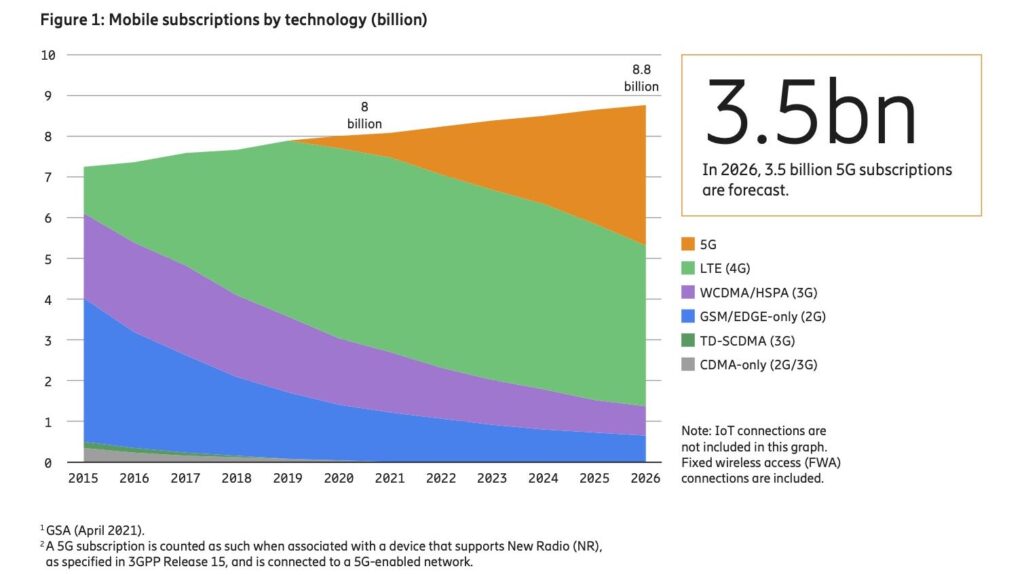

Ericsson has connected 580 million subscribers to 5G, and expects to have 3.5 billion by 2026.

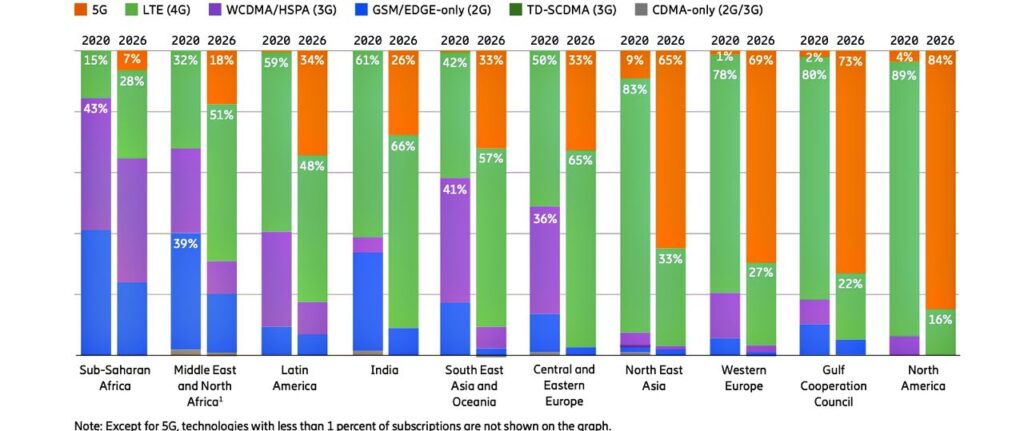

“The Caribbean has a 40 per cent penetration of 4G, which makes for a potentially robust foundation,” said Muñoz.

“A year ago for the Caribbean and Latin America, Ericsson was estimating 13 percent growth in 5G traffic by 2025, but now we are seeing regulators setting out midband and highband frequencies and adoption should be faster.”

Ericsson estimates that there will be 7.7 per cent economic growth directly attributable to introducing 5G in the region.

“The faster we introduce the technology in the Caribbean, the faster we can bridge that technology gap,” he said.

Ericsson believes the new technologies that 5G will enable will act as a considerable driver for telecommunications companies, expanding the range of services they can deliver to monetize their investments in the technology.

Muñoz noted that two-thirds of the most valuable use cases for additional services are either technology showcases or are still under development, but estimates that 20 – 30 percent of customers are willing to pay more for 5G is the value of the technology is properly explained.

Dr. Bruno Soria of Nera Economic Consulting noted that customers have shown little willingness to pay more for additional speed.

Telecommunications companies switching to 5G will face investments that will include the cost of new spectrum licenses, new network equipment and the implementation of a much denser fibre backhaul.

Soria sees immediate improvement vectors in IoT, particularly in farming technology and fixed broadband, in improving connectivity for rural broadband and for integrating fixed and mobile networks to increase capacity for mobile customers.

Soria believes that there is US$3.78 billion in revenue to be earned globally from the digitization of industries by 2030.

For Huawei’s Madkour, the change is not just a matter of technology adoption. “The process must be open and collaborative relationships between all of the stakeholders,” he said.

“Everyone has to be in one place to make decisions about licensing spectrum, to understand industry requirements, to establish telecommunications regulations.”

“5G is not just a technical issue or a commercial issue or even a social issue. 5G has become a political issue, and we need to get rid of that.”