- After facing challenges in Trinidad and Tobago, WiPay expanded to Jamaica and Grenada

- The Colour app aims to be a hub for services targeting the next generation of digital customers

- Within six months of launch, WiLoan received over 750 loan applications and served more than 400 customers

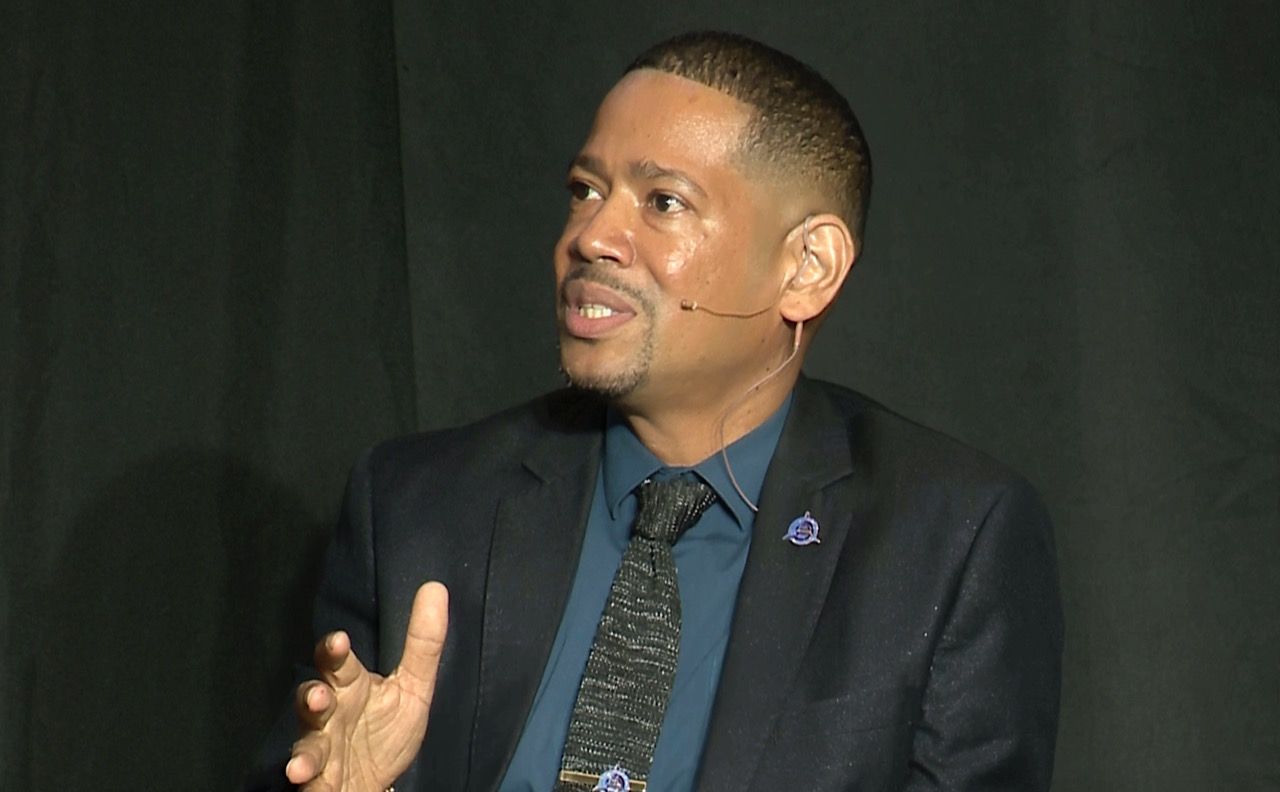

Above: Aldwyn Wayne speaking during the Panel Discussion at WiDay 2025. All event photos by Shannon Britto, courtesy WiPay.

BitDepth#1542 for December 22, 2025

At WiDay 2025 on December 04, the first WiDay held in TT in this decade, WiPay Group CEO Aldwyn Wayne announced a bolder and more pervasive local presence for the predominantly Trinbagonian fintech company.

After the successful introduction of CourtPay in 2018, WiPay faced dramatically diminished interest by the government of the day.

The professional snubs ended in 2020 as covid lockdowns became more widespread and Wayne took his systems to Jamaica and Grenada, where they enjoyed a quite different reception.

WiPay would eventually move its headquarters to Jamaica in 2021. Wayne would strike robust partnerships with Republic Bank and MasterCard, expand his base of operations to the US, while reaching further afield with his Colour card.

Aldwyn Wayne never tired of trying to reignite his company’s business presence in TT.

After his successes implementing digital payment and identity confirmation systems in Jamaica with the ENDS project and Grenada’s SEED programme, he offered a digital distribution system to the Ministry of Social Development in June 2022. The offer was ignored.

A restless thinker, Wayne kept thinking about the challenges of local digital payment settlement and, as he told his audience at WiDay, “The problem was way bigger [than payments].”

“After I make a payment, how do I get that product? Who handles the logistics? Who handles communication? Who handles the backbone of the entire infrastructure of the country, which is the government, also the largest employer, who handles that? It was fragmented.”

The National Payment and Innovation Company, which replaced the TT International Finance Centre, is, he said, “Powered by WiPay’s GovPay solution.”

On WiDay 2025 new services were announced by the rebranded WiPay Group, some of them already in use, others appear to be in the process of being rolled out.

Tying everything together is the company’s payment system, which is tied to the Colour app, a software solution that allows users to accept card payments using their mobile phones.

Wayne’s strategy will make the Colour app a hub for services that target the next generation of citizens, whose expectations of fluid, digital payments haven’t been met by existing systems and solutions.

WiTravel is a booking system for travel. How it works isn’t clear from the website because you have to join the service to go deeper than the promises of its front page, which claims that its services “move different.”

WiTravel promises a uniquely Caribbean experience that will exceed that of established online services like Expedia.

Aldwyn Wayne’s ambition and boldness are a force unto themselves. I once described his presentation at a seminar in 2019 as being characterised by “barrel chested bluster.” He’s lost weight since then, but none of his signature outspoken brashness.

It’s going to be interesting to see how WiTravel tackles the sophisticated criminality of online travel bookings, which are weighted against customers from the minute they begin to search for a flight online.

His payment systems promise to address today’s issues with foreign exchange.

“US limits? It’s tough. We will fix that,” Wayne said.

“We’re going to provide you an option to pay with your Linx card online to go to that trip to Miami or to go to Amsterdam.”

Payments are described with evangelical zeal by Chief Marketing Officer Kibwe McGann.

“Payments are not just transactions. Payments are connections. Payments are the lifeline of an economy,” McGann said.

“When a small business finally accepts digital payments, that is dignity. When a public office goes cashless? That is progress.”

“For years, global companies looked at the Caribbean and said too small, too complex. Then WiPay went to work. We didn’t ask for permission. We built our own rails for our own reality.”

“We connected citizens, small businesses, institutions, ministries and islands. Every day we are helping move the Caribbean forward. We are part of the story that ushers [in] the future.”

That same enthusiasm to meet new customer needs infuses the pitches for services such as WiLoan, introduced in March.

“[Customers of] traditional financial institutions, face long lines, outdated systems and very rigid processes,” said Lyron Marlow, CEO of WiLoan.

“In my opinion, those processes present unnecessary barriers [and] WiLoan is here to change that. WiLoan was created to make credit simple and approvals fast.”

“We have made opportunities for every single person across each category in a company, from the frontline worker to the supervisor to the manager, to the executive, approvals and solutions for all.”

“[When we launched in May], we had no networks, we had no loan book, we had no payroll integrations and we had no brand presence. But what we did have was belief and most important, we had urgency.”

“In 6 months, we have over 750 loan applications, more than 400 customers, a growing employer partner network and we boast an average of five working days in turnaround time from loan application to disbursement.”

“Our delinquency ratio is under one per cent. We are now working closely with the government ministries to be on-boarded to their national payroll system.”

Despite Abraham Sutherland’s colourful insistence that the Nimble Mobile service “Feels like a real Caribbean new culture that is bright, creative, funny, bold and spontaneous,” it is also a well-dressed reseller relationship with telecommunications partners.

TSTT is WiPay Group’s partner for voice and data services in TT, but the company declined to disclose its partner for its international e-SIM travel connectivity services for data.

A voice plan in 2025 is largely unnecessary. Travel data will serve most needs. Travel e-SIM plans are local data plans that are usually resold to visitors with set data limits and access times. Nimble’s plans are roughly in line with the cost of most of its international competition.

WiPay’s aggressive return to the TT financial space is likely to add some spice to an already lively fintech space and its new pillars of business align with the sprightly, country-hopping character of its leader.

But are there enough bread and butter customers who need new options for travel, phone service and loan services to make those add-on businesses worth the time of a small, albeit feisty contender?

After the hot blast of 2021’s “1,000 e-commerce websites in one hour” launch event for WiShops, the project is now in maintenance mode and has disappeared as a presence from WiPay’s business profile.

WiTravel, WiLoan and Nimble are likely to be subject to Wayne’s ‘fail fast’ principles, the successful bits going forward, the others eventually falling away.

Less sexy are services like NOBIS, the company’s e-KYC (Know Your Customer) platform and the Caribbean Settlement Network, still at the stage of navigating regional regulatory approvals, which chart a clearer path forward for Wipay’s growth.