- Trinidad and Tobago recently tabled a bill banning the use of virtual assets.

- The consequences of non-compliance: increased capital costs and potential loss of correspondent banking relationships.

- Bans on crypto are costly to enforce and ineffective as illegal trading persists through alternative methods.

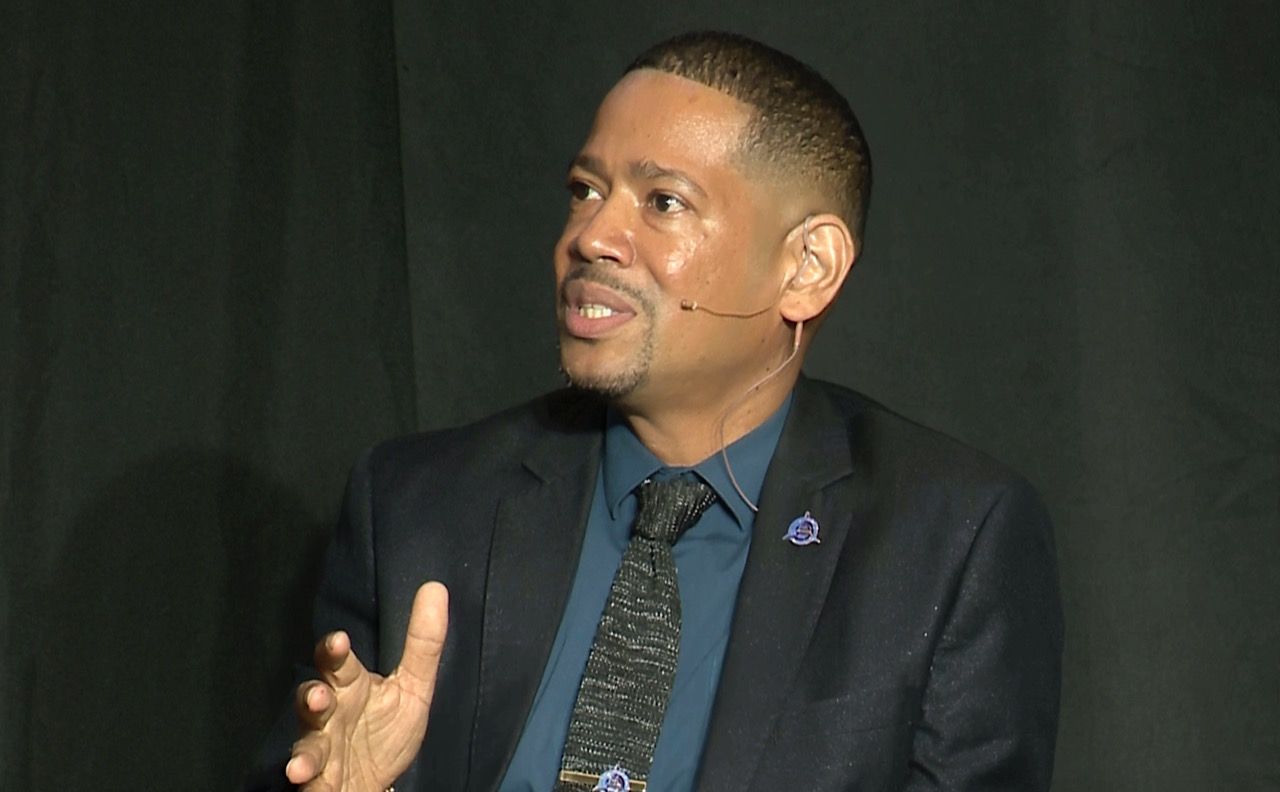

Above: Professor Louis De Koker.

BitDepth 1532 for October 13, 2025

At a webinar on October 02, a group of fintech professionals discussed cryptocurrency regulation in the Caribbean, exploring a wide range of concerns, some of them triggered by TT’s recent tabling of a bill banning the use of virtual assets.

The Caribbean Digital Finance Alliance (CDFA), which will be formally launched in November by fintech minds from across the archipelago, hosted the event.

Moderator Dennis Augustine from Dominica noted that, “Our purpose today is not to analyze a particular bill, but rather to use the broader regional and global experience to explore the fundamental policy question.”

“In our Caribbean context, is it the more prudent posture to pause and prohibit virtual assets, or is it to proceed with caution under proportionate and risk-based approaches?”

The resulting discussion didn’t always honour that intent. Total bans on virtual asset trading and use, even within in the region are rare, and TT’s Virtual Asset and Virtual Asset Service Provider (VAVASP) bill landed hard.

For TT’s Mark Pereira of Z (ed) Labs, the issue is foreign exchange (forex) constraints.

“One key point in TT to understand is the managed float introduced in 1993,” Pereira said.

“The Central Bank of Trinidad and Tobago allocates US to banks, and the banks distribute the US dollars to the private sector, economy and individuals. The distribution of that currency has not been transparent and in times like this, it generally favors the more fortunate.”

“What’s been happening since 1993 is the growth, because of this managed control and the reduction in forex because of reducing exports, of a black market. On the open market, individuals are finding creative ways to purchase US dollars.”

One of those ways has been the use of cryptocurrency, which Pereira sees as a way to improve forex accessibility with effective regulation and the use of stablecoins based on US currency.

He believes existing virtual asset providers in TT operating under the FintechTT umbrella are already doing what’s required of any financial institution in TT, including required Know Your Customer onboarding and other customer identification checks.

Annie Bertrand, Financial Inclusion Advocate of the CDFA, noted the impact of the Financial Action Task Force (FATF) in the region through its mutual evaluation reviews of each Caribbean country’s financial compliance money laundering and terrorism financing regulations which evaluate existing laws and regulations and their effectiveness.

“[Failure to comply can have] terrible economic consequences, increasing the cost of capital. Sometimes it removes access to capital. It reduces investments and for us in the Caribbean, it can cut off our correspondent banking relationships.”

But the FATF has noted a tendency to over-compliance with its standards, particularly in developing countries, with “unintended consequences.”

The FATF requires that virtual asset service providers (VASPs) be licensed or registered with risk assessments and risk-based supervision active.

Since 2021, jurisdictions can prohibit or limit virtual asset activities and 20 per cent of them, 33 nation states, have chosen to do so.

The FATF acknowledges that full prohibition is both difficult and expensive.

Only one of the 33 has met the requirements of Recommendation 15, which outlines regulation and customer due diligence requirements for VASPs.

According to Professor Louis De Koker, an expert on anti-money laundering law and pragmatic regulatory frameworks, both pausing and banning are problematic.

In a pause with a defined timeline, operators may move outside the jurisdiction or take government to court and hope it drags on (a very real possibility in TT).

Bans require informed and expensive enforcement and policing, making fintech a cost, not an opportunity. Passing a bill is easy, but acting on it is costly, particularly for smaller countries.

Meanwhile, criminals are gonna criminal. Illegal trading continues using peer to peer transfers or unhosted wallets, where most of the movement in criminal money happens today.

Pereira would like to see a TT public-private partnership framework, with the government engaging in strategic regulation and private sector fintech players offering expertise on innovation and changing technologies.

A regulatory sandbox would allow the Central Bank to see if its systems and procedures are properly protected and prepared to manage fintech operations in practice.

“Criminals are our enemy too,” he said.

“The Virtual Asset Working Group, [would sit with] the Minister of Finance and members of the SEC and FIU to engage on amending the bill.”

“There’s maybe two or three simple additions that could allow the sandbox and already existing financial institutions to engage in the regulatory frameworks that they’re already adhering to, to move into a sandbox with the other players. The Central Bank gains insight from [industry practitioners] and implements a progressive virtual asset bill.”

“[The private sector] knows the market,” De Koker explains.

“They speak with their customers; they know about other options. That’s a tremendous source of information that can be provided to government that lessens the burden on government and provides it with high grade information, with the market playing a role in ensuring that the right information is provided to the regulator.”

“The crypto market is now {valued] around US$4 trillion. It is now part of the mainstream financial system. All countries need to respond to that.”