- The bill prohibits virtual asset activities without authorization from the Trinidad and Tobago Securities and Exchange Commission, which is not allowed to grant authorization until December 31, 2027

- The Financial Action Task Force (FATF) mandates Caribbean jurisdictions to educate themselves on cryptocurrencies and design regulations for service providers

- Real-world action on virtual assets has been slow, with the Central Bank showing little progress on digitizing fiat currency

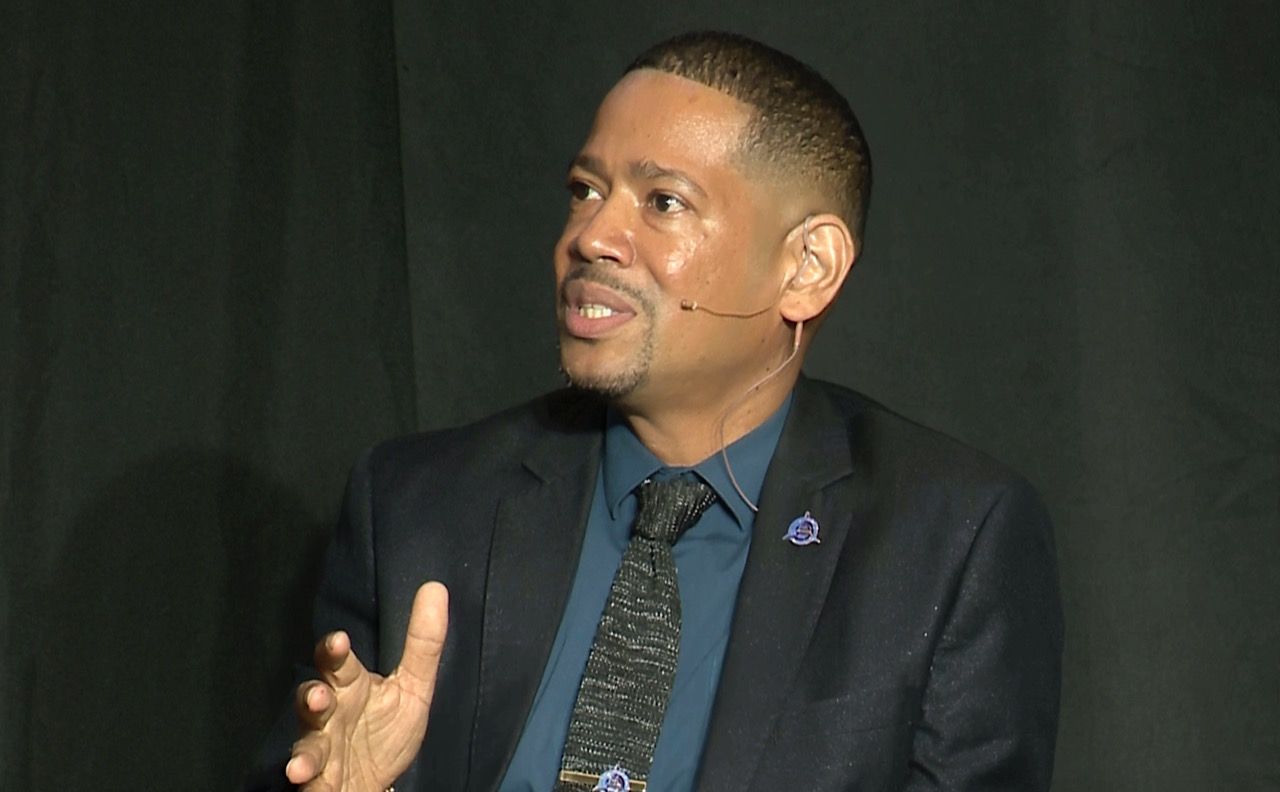

Above: Minister of Finance Davendranath Tancoo

BitDepth#1530 for September 29, 2025

On September 19, Finance Minister Davendranath Tancoo introduced the Virtual Assets and Virtual Assets Service Providers Bill, 2025 (VAVASP) which will, if passed into law, ban the use of cryptocurrency in Trinidad and Tobago until December 2027.

Specifically, the bill states that, “Clause 4 of the Bill would prohibit the conduct of a business or in the course of a business to carry on virtual asset activities in or from within Trinidad and Tobago, unless authorisation is given by the Trinidad and Tobago Securities and Exchange Commission to conduct such activities.”

It then states with admirable government double-speak, that sub-clause (3) will “prohibit the Commission from granting authorisation to conduct of virtual asset activities on or before 31st December, 2027.”

How did we get to a point at which a sitting Finance Minister decides to pull out the rug from anyone using cryptocurrency in their business, as an investment instrument or providing cryptocurrency exchange services?

UN ECLAC studied opportunities and risks associated with digital currency use in the Caribbean in 2014, seeking input from stakeholders and surveying the region’s central banks.

Stakeholders, including entrepreneurs and innovators, were also given an opportunity to share their views and the research was published in January 2016.

A 2023 study examining unlawful virtual asset use in the Caribbean noted the importance of regulation and the need for law enforcement able to police virtual asset use.

The IMF, in a technical assistance report on Trinidad and Tobago in January 2023, had already noted the need for an impact assessment for legal and regulatory reforms and the need to develop a strategy to manage crypto assets.

The Financial Action Task Force (FATF) has mandated jurisdictions in the Caribbean to educate themselves on cryptocurrencies and design regulations to govern the licensing or registering of service providers delivering this fintech solution.

The Bahamas, referenced as an example of regulatory discipline in the Bill Essentials document produced by Parliament for the House of Representatives does not mention that the jurisdiction introduced legislation governing cryptocurrencies in 2020 and revised that legislation in 2024.

The VAVASP Bill introduced by the Finance Minister is a stopgap measure to buy time for the work that the Bahamas has done and it proposes to do so with staggeringly punitive fines for any perceived contravention of the wide-ranging ban.

What’s particularly galling about the situation is that we are here because talk-shops and position papers on the subject never moved to an actionable stage and the FATF requires compliance with its requirements regarding cryptocurrency trading and exchanges.

The government has not made it clear to what extent the new bill is intended to deepen compliance requirements with the FATF, which will assess TT’s progress in achieving international standards in financial governance during 2026.

A brisk response to the proposed bill authored by representatives of the Fintech Association of TT, Guap, WAMNow, PayWise, Crypto Caribbean, CoinSher and TT Exchange pointed out that the definition of a virtual asset is so broad in the first draft of the bill that it could capture activities outside of FATF requirements.

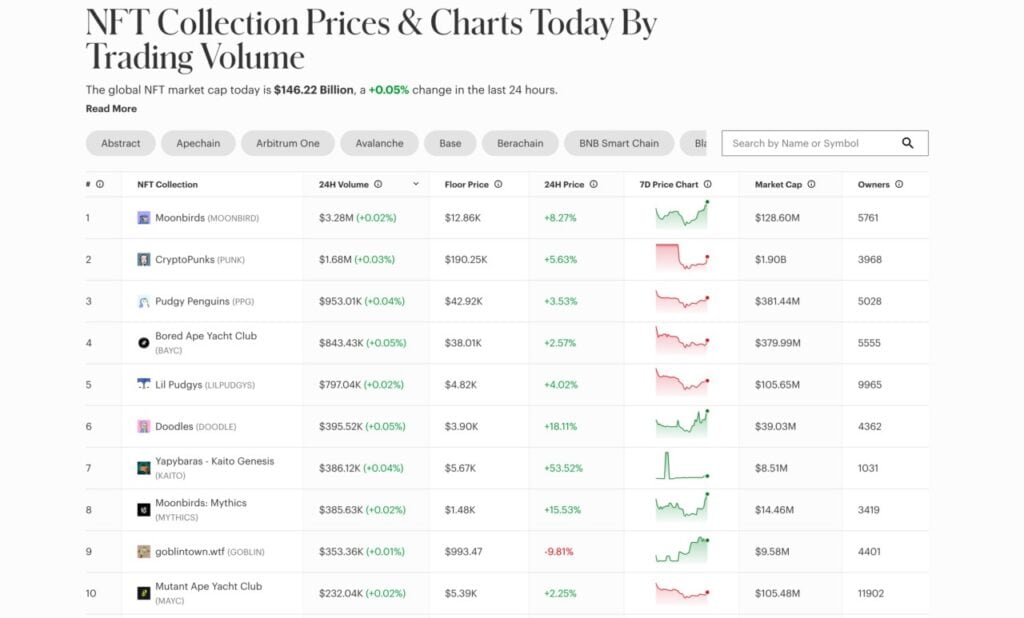

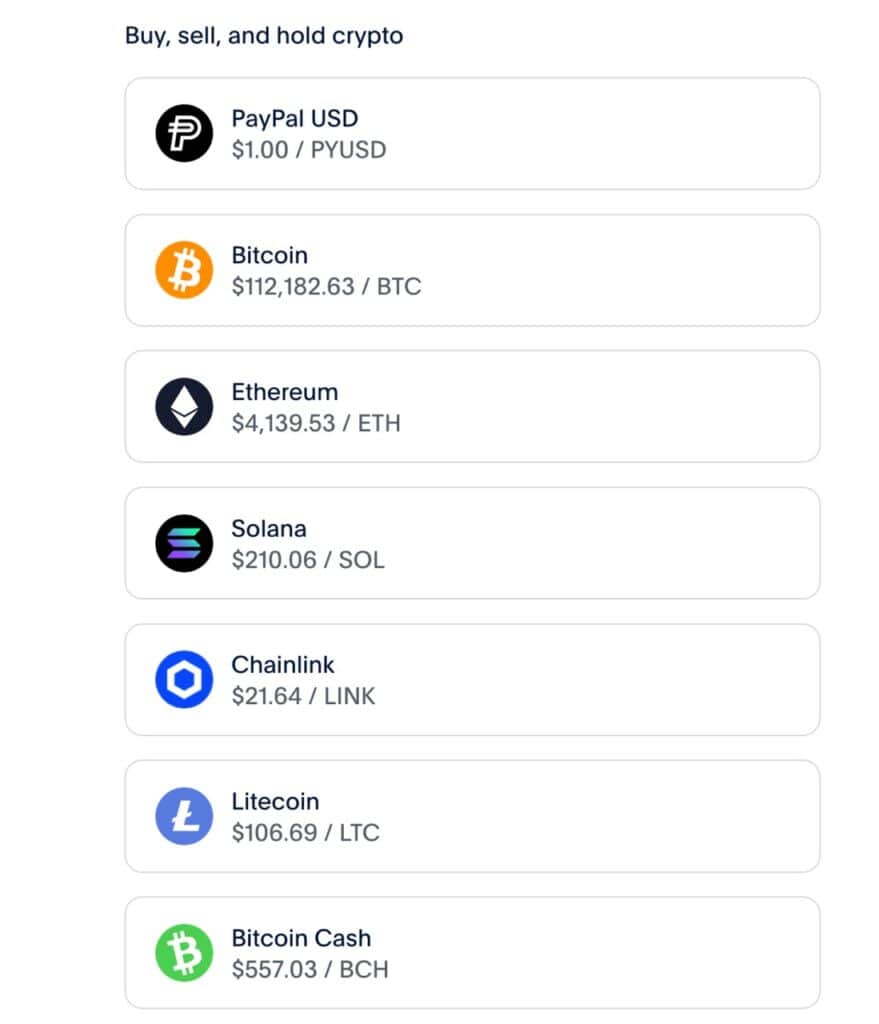

Without clearer language, the Virtual Asset Working Group argues that, Its “scope could extend to NFT creators, software developers, loyalty point systems, or even in-game tokens that are not designed as financial instruments.

“In most legislation, ‘carrying on business’ is interpreted broadly: it can cover any activity done with continuity, repetition, or expectation of gain, even on a small scale.”

Pressed for time to act, the Government has followed the examples of Belize and Guyana in instituting a blanket ban until an arm of government can effectively grant licenses and register virtual asset providers.

Some caution is sensible. Inexperienced investors are easy prey for sophisticated cryptocurrency scams and the entire NFT market now seems to have been a particularly short lived bubble at best or at worst, a Ponzi scheme with 96 per cent of NFTs on the market declared worthless, completely non-viable as assets.

Real-world action on virtual assets has been glacial at best. The Central Bank dithered over the safest form of digitizing fiat currency, the Central Bank Digital Currency framework, apparently doing little to shape an environment to regulate cryptocurrency transactions.

The enthusiasm with which the new Central Bank Governor, retired career banker Larry Howai, has endorsed even a crude first draft of the bill suggests that the new government is not eager to embrace virtual assets as a method of value transfer.

The time to press for a framework for regulating virtual asset transactions in TT is rapidly drawing to a close. Stakeholders claim to be ready for a regulatory regime.

The bill feels like a quick fix to a complicated problem, but a sweeping ban will not stop individuals from finding ways to move elusive forex into cryptocurrencies.

It will, however make the process riskier for inexperienced individuals and increasingly invisible to financial oversight.

The lack of clarity on how deep the FATF compliance will go in this bill makes me wonder what the real impact on crypto businesses will be.

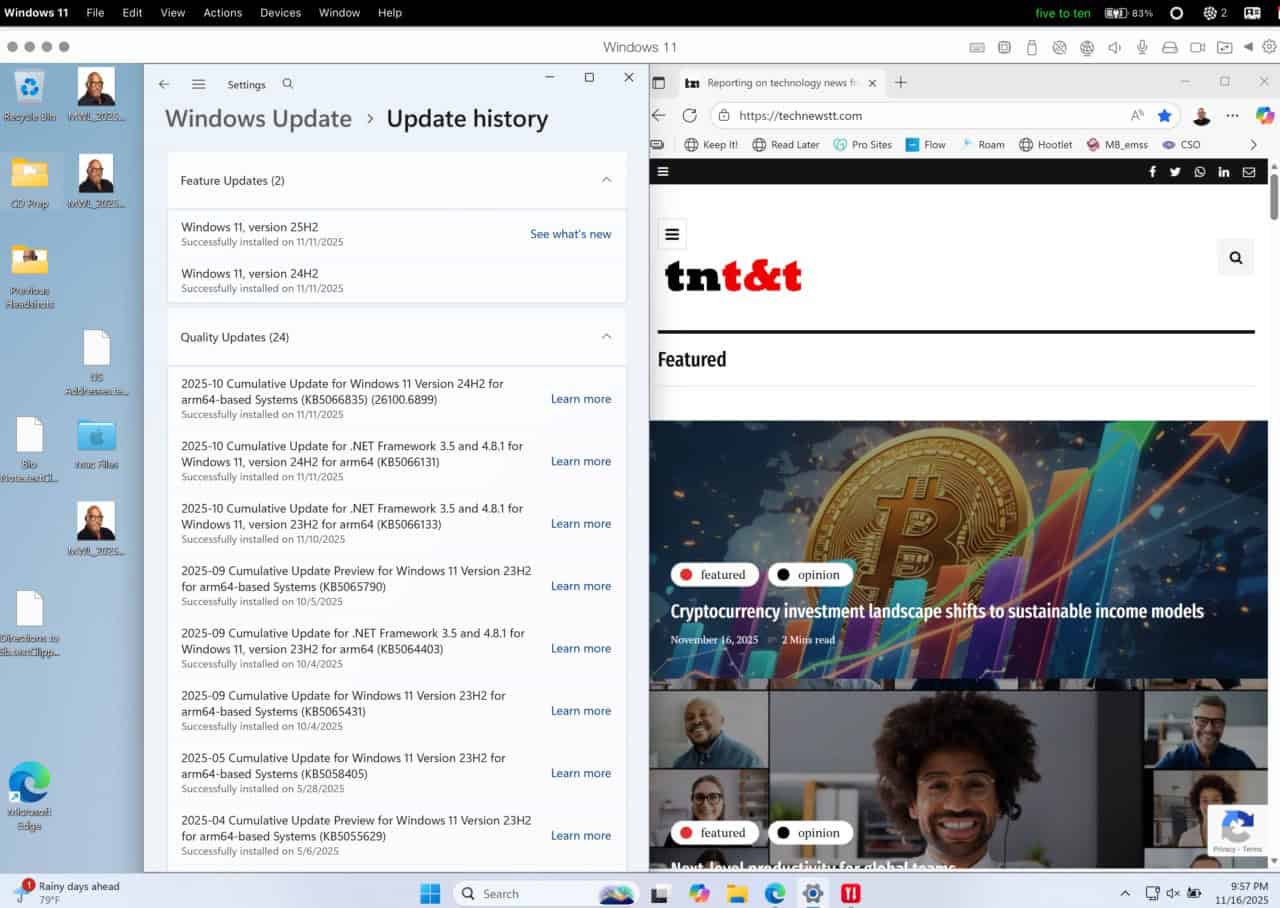

[…] TechNewsTT article, A blanket ban on cryptocurrency is a Luddite’s strategy […]