- Jamaica’s digital transformation was driven by the need to support small businesses during COVID-19 lockdowns.

- WiPay, a key player in Jamaica’s delivery ecosystem, offered its digital solution to the TT government but was ignored.

- There's a growing demand for faster government services, driven by the expectations of the next generation.

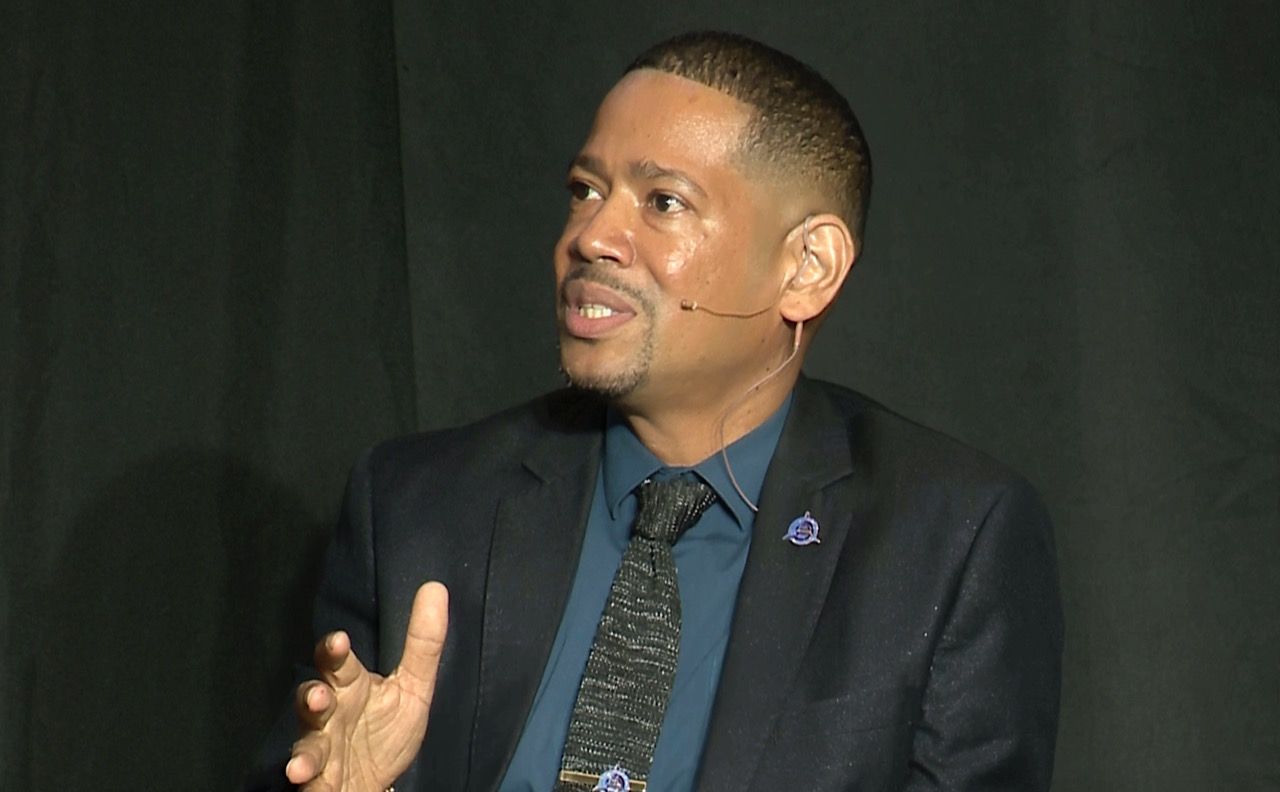

Above: Chris Reckord. Photo courtesy the Jamaica Betting Authority.

BitDepth#1525 for August 25, 2025

Chris Reckord is Chairman of Jamaica’s National Artificial Intelligence Task Force, Chairman of the Innovation & Digital Transformation Committee for the Private Sector Organization of Jamaica (PSOJ), and Deputy Chairman of the Jamaica ICT Authority.

He’s one of the key architects of Jamaica’s drive to transform the country through effective, targeted use of technology.

For Jamaica, a key pivot point came when multi-day lockdowns to manage covid-19 were mandated.

According to Reckord, speaking at the 2025 AmCham Tech Hub Islands Summit, Jamaica’s PM Holness called a meeting.

“We need to ensure that the small businesses can still survive,” Reckord recalled being told. “We don’t want to kill small business. We don’t want the chicken man on the side of the road, the soup man, we don’t want those people to be affected, so let’s try and find a way.”

The 12-month project needed to happen in ten days. The problems to solve were myriad.

How to identify people who were authorised to be on the road doing deliveries. Clarifying that the government wasn’t getting into the payment business and was only creating the rails of the system that the private sector would use.

“A complete new delivery ecosystem was actually created. Some of it was there before, but this [happened] suddenly. You cannot drive on the road right now and not see a bike with a big box on the back zipping past at way more than the speed limit is supposed to be and this is the system that created that whole ecosystem.”

A key part of that ecosystem was Aldwyn Wayne’s WiPay. In April 2020, WiPay issued a press release offering access to its system and terminals.

The company got no response from the TT government and turned its attention to the wider Caribbean. By June 2020, WiPay began to deploy its solution in Jamaica and then in Grenada as year later, introducing a digital fiat system.

WiPay would play no part in the TT digital response to covid-19. The TT government ignored Wayne’s offer of a digital solution for disbursement of social support in June 2022. By then, WiPay had moved its headquarters from Port of Spain to New Kingston.

The success of the Jamaican system, the E-commerce National Delivery System (ENDs) prompted a deeper commitment to financial inclusivity and e-governance.

Jamaica has moved on to implementing a national identification system; a discussion point for 50 years that’s now becoming a reality, though cybersecurity and privacy concerns have stalled efforts at including biometric data on the new ID cards.

Reckord participated in this process with a clear eye on what causes digital transformation projects to fail.

“Failure to share the vision and mission and instill it in everyone [which can lead to] misalignment of that business or ministry with the IT plan. There’s always an overestimate of the benefits and an underestimation of the costs.”

“Sometimes the minister has not ‘logged on,’ so there is a disconnect between the leadership and [what’s expected of] the actual operations people. Implementations in which the servers are old, the infrastructure is horrible. Implementing new tech on broken systems, it’s not going to end up in the right place, nor is underestimating the importance of people and change management.”

But from Reckord’s perspective, there is a growing force to digitise government services. The next generation expects responses at lightning speed and governments aren’t always equipped to respond to those demands.

“Bureaucracy is real, but bureaucracy was put there for good reason. It was there to protect citizens, to ensure that there’s less corruption. But that causes a fair amount of delay.”

In comparison to the Jamaican perspective, the summit’s participants were treated to the revelation that John Outridge, CEO of TT’s International Financial Centre had only in this year of our Lord discovered that credit unions are a major force in the country’s financial sector.

“I wasn’t aware [that] we have 145 credit unions,” Outridge said.

“They have 700,000 members with a goal to get a million members by 2030. Seven hundred thousand members with $20 billion under management is equivalent to the size of banks.”

It also didn’t help that he also seems to still believe that kiosks and community centre training are important in a country with 145 per cent mobile device penetration, most of them smartphones capable of connecting to the internet.

Key to driving change, Reckord believes, is consultation, discovering what the citizen-customer wants most urgently and delivering solutions that positively impact a mass of the population.

“Choose just one process, and give it to them, let them use it and let them realize, wow, it works. Then add another process. Oh that works too! India has over 90% of their people using their platforms for certain types of processes and that’s a testament to the fact that you can reduce bureaucracy and increase trust.”

“Bureaucracy is not a flaw of government; it’s a design choice of legacy. We now have the tools, the case studies, to build a smarter, faster, and more inclusive public sector. Let us design with citizens, not for them. Let us invest in talent, not just in tech, and let us measure transformation in minutes, not mandates.”

[…] Trinidad and Tobago – Chris Reckord is Chairman of Jamaica’s National Artificial Intelligence Task Force, Chairman of the Innovation & Digital Transformation Committee for the Private Sector Organization of Jamaica (PSOJ), and Deputy Chairman of the Jamaica ICT Authority… more […]