- The CBTT allows fintech companies to onboard clients with a single form of photo ID

- National e-ID system is a crucial component for significant changes in digital payments

- The implementation of the UPI system raises questions about the role of e-money issuers

Above: Illustration by skypistudio/DepositPhotos

BitDepth#1500 for March 03, 2024

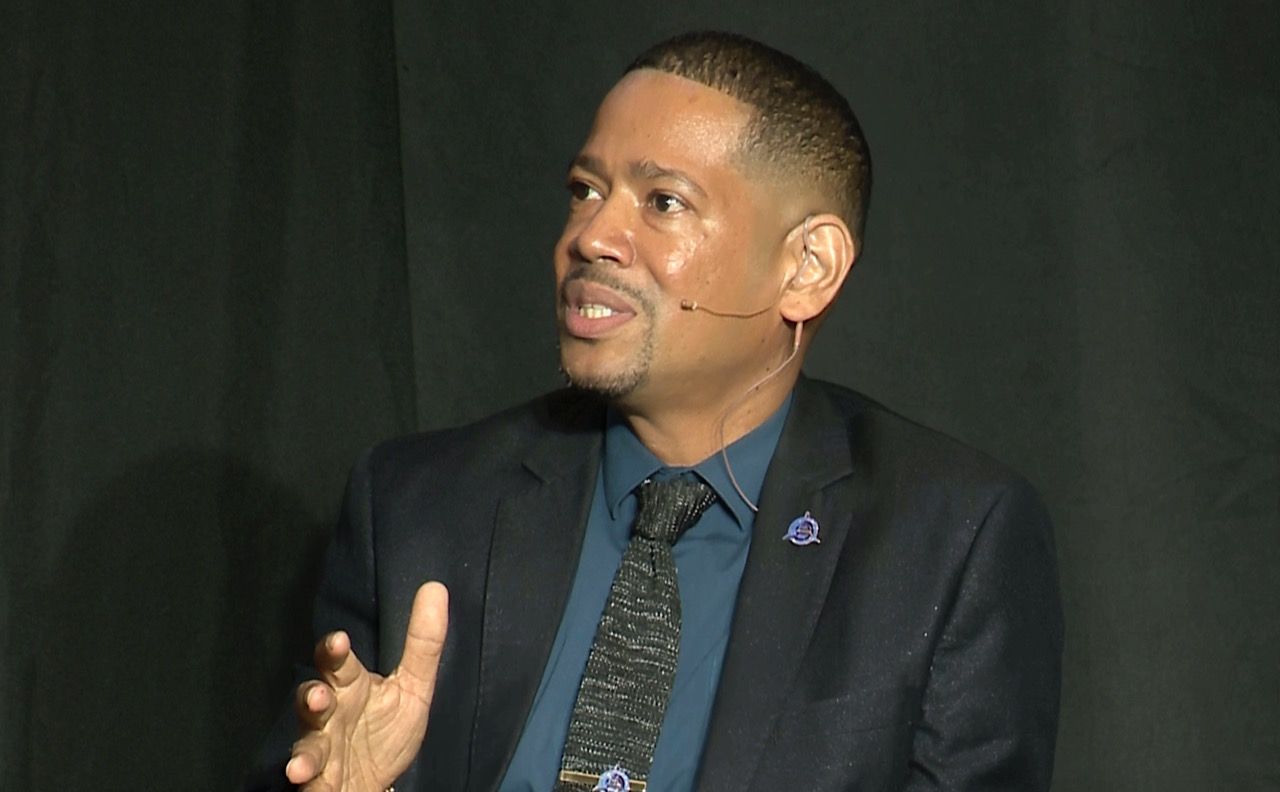

“The unbanked represents a large, untapped market,” said Ian T Alleyne at the TTIGF forum discussing fintech on January 31.

“We were talking recently with the Central Bank (CBTT) about [the challenges with onboarding clients] and they reiterated that fact that there is now simplified due diligence which allows clients to sign up with one form of [photo] ID.”

“That would be enough for a fintech company to provide citizens with access to financial resources, so fintechs must harmonise that into their own systems and bring the unbanked into the financial space.”

In a recent letter to the editor, commentator Dennise Demming drove home the problem.

“Most people in Trinidad and Tobago have six different numbers that identify them—their Board of Inland Revenue (BIR) number, National Insurance Scheme (NIS) number, birth certificate number, national ID card number, driver’s permit number, and passport number. While this may seem normal, it is an outdated and inefficient way of managing citizen records.”

Compounding the problem is the reality that if a citizen chooses not to acquire a national ID card, never travels outside the country and doesn’t drive a car, they may have no identification beyond their birth certificate.

The long standing requirement for two forms of photo ID to participate in the formal financial sector was a powerful and largely unnecessary disincentive.

Underlying any significant change to digital payments will be the implementation of a national e-ID system, long on the agenda of the government.

“If I have to go home and get a copy of my birth certificate or a copy of my passport, that creates friction for the end user,” said John Outridge, CEO of the TTIFC.

“The point of the e-ID is that I have this number, this authenticator that says John Outridge is who he says he is. [That would reference] a database of documentation that I don’t have to provide. Simplifying due diligence was a really important move by the Central Bank.”

Outridge believes that simpler due diligence in an electronic payment system might begin with smaller financial transfers with more validation required to be able to move larger amounts.

“For the Eastern Caribbean, when we did the DCash project, we had two versions of the wallets, we had one version for licensed financial institutions for their customers and we had a version specifically for people off the street who may not have a bank account,” said Shiva Bissessar.

“That second wallet used simplified due diligence with fewer identity requirements with a corresponding reduction in the limits [in the spending values]. That wallet had a higher uptake than the one issued by financial institutions. But it’s for each territory to define what is the opportunity, what frictions and documentation are considered necessary.”

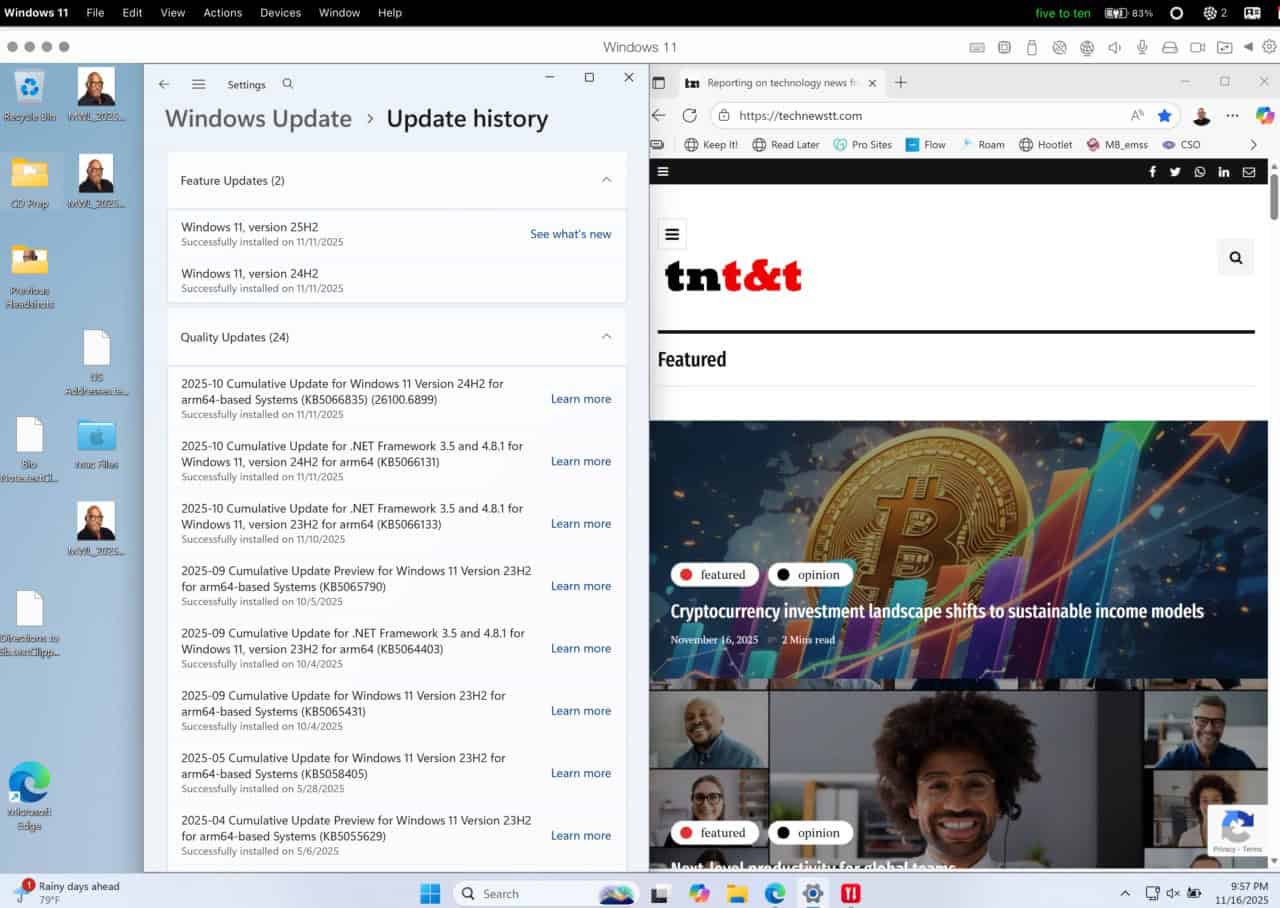

This is a big push and the CBTT, in response to questions states that a pilot project is to be conducted by mid-year with full implementation to follow by the end of 2025.

“Digital payments provide a faster, safer, and more efficient way to transact, and we believe adoption will only accelerate as more people experience the benefits,” said Simon Fortune of Pesh in response to questions.

“However, widespread adoption also requires a cultural shift. Trinidad & Tobago remains a cash-based society, and for e-money to reach mass adoption, it must be as simple, fast, and universally trusted as cash.”

“Real-time payments eliminate friction in everyday transactions, reduce delays, and unlock new possibilities for digital finance.”

According to John Outridge, when he joined the TTIFC three years ago, there wasn’t much progress in fintech.

“The entire mandate of the TTIFC was shifted to focus on enabling fintech in TT. One, because it was seen as a big enabler of digital transformation and to facilitate trade.”

It might be argued that the TTIFC, originally established as a regional, internationally focused financial hub, is now almost entirely local, focused on software to enable fintech.

It also calls into question exactly what the role of e-money issuers will be when a government sanctioned fast payments system is in place.

Alleyne may be hopeful that it would lubricate onboarding of new clients to Paywise, but it also means that he will have to offer a unique selling proposition for his service.

For his part, Fortune noted that “We are optimistic about the potential of the UPI project and believe that, if implemented successfully, it could be a transformative moment for Trinidad & Tobago.”

The impact of that transformation is still to be seen, but consumers will naturally gravitate to the electronic system that is cheapest and offers the least friction in practice.

The CBTT previously implemented the Automated Clearing House (ACH) system, now in private hands, and the Real Time Gross Settlement (RTGS) system, managed by the bank.

Asked about its plans for the UPI system, the CBTT responded that, “Consistent with our role as regulator, CBTT would license and regulate the payment system under established regulatory and supervisory practices.”

Interviewed on IMF TV after a panel discussion in October 2024, CBTT Governor Alvin Hilaire explained that, “The Central Bank, has to juggle the role of operator, of supervisor, and of overseer and promoter. So we have to deal with that, and we need staff who can embrace this sort of activity and embrace this balancing act spending a lot of time educating the public and knowing how to deal this new animal as a tool, so we are optimistic.”

The UPI project is also likely to delay any efforts at pushing forward with a CBTT digital currency, which Bissessar believes should end up being a conduit for wholesale currency exchange instead of a consumer based retail exchange medium.

With the insular sabre-rattling happening in Washington, a regional effort to de-link Caribbean central banks from the US dollar as a basis for exchange and a move to a regional digital currency exchange happening at the top level of each country’s financial sector will increasingly begin to look like a good idea.