Above: Advertising spending charted by Media InSite.

BitDepth#1349 for April 11, 2022

On Wednesday, Media InSite, a firm that tracks advertising placement and brand mentions, offered its assessment of the current state of advertising in TT.

It’s not a complete assessment of the state of advertising in the country.

Media InSite’s emphasis is on the business sectors that its clients want marketing intelligence on and the big advertisers.

The tracking agency also does not currently track direct advertising placements on media house website platforms or Google advertising, but is investigating how it will add this information to its arsenal of digital ad tracking.

The company also bases its numbers on “open-rate” advertising costs, or the stated cost of advertising.

It has no access to information on bulk discounts or client-specific deals that may be privately offered by media houses.

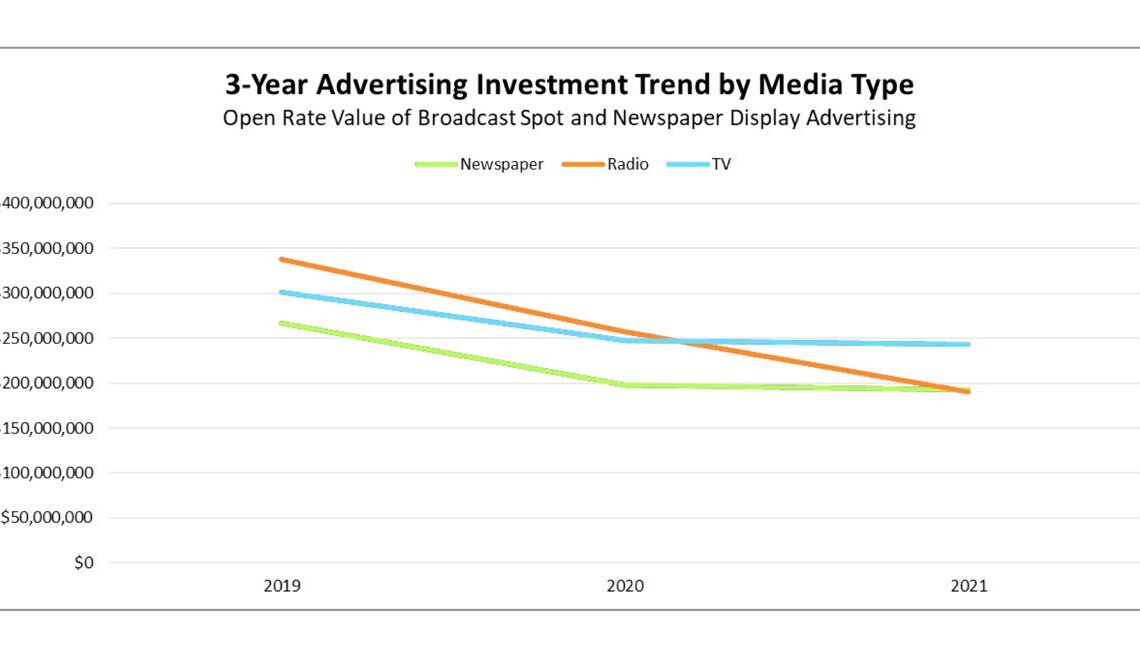

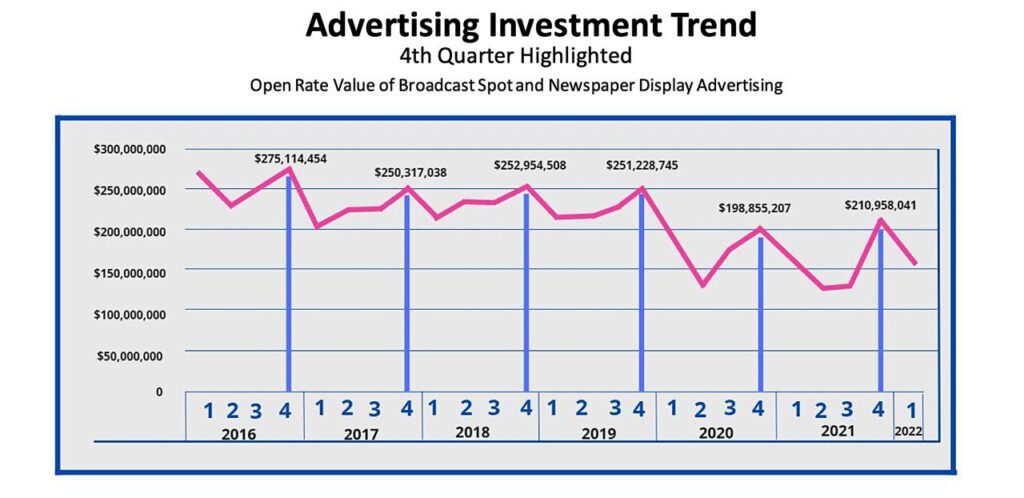

Even with those caveats, the spending on spot broadcast and newspaper display advertising that Media InSite has tracked since the fourth quarter of 2016 shows a marked decline, dropping from an average of $225 million to $175 million over the five years under review.

The biggest dips were in 2020 and 2021, when all commerce slowed, and it remains unclear to what extent advertising in traditional media will recover as covid19 is increasingly managed as endemic instead of pandemic.

The hardest hit media sector is the newspaper industry, which dropped half of its advertising income between 2016 and 2021.

The drop between 2020 and 2021 was the lowest in five years at just 1.4 percent, compared to 2017 to 2020 span, which shed almost $200 million in income from the ledgers of local newspapers.

These revenue dips hit an industry that has significant running costs for paper and ink that will only rise in the current environment of constrained shipping and soaring energy costs.

While twice as many advertisers use radio, delivering a 17.4 per cent increase in advertising between first quarter 2020 and 2021, there has also been a steady decline in overall revenue dropping from an average of $320 million in 2019 to roughly $190 million in 2021.

Ten radio stations out of the 34 tracked accounted for half of all radio spots aired.

Emerging from pandemic conditions, it’s probably only tangentially important to note that the biggest spending increases in 2021 were from the government, commercial banks and supermarkets and groceries, all of whom had important messages to share with the public.

Where has the ad spending been going?

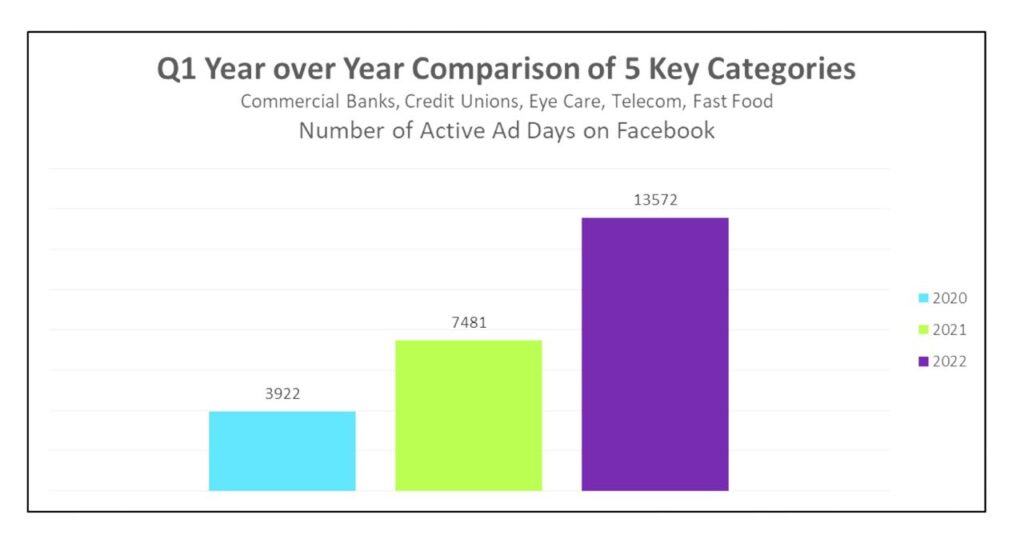

Media InSite has also been tracking platform activity on Meta’s social media properties, including Facebook, Instagram, Messenger and Audience Network, the company’s system for placing Facebook ads on mobile websites and apps.

Active ad days, the instance of a digital advertising placement on a single day, have been tracked since 2019.

Across the five categories tracked by the agency, commercial banks, credit unions, eye care, telecom and fast food, these ad placements have tripled since 2019.

Facebook and Instagram lead these placements with Digicel and Republic Bank demonstrating significant surges in spending on social media platforms.

At a February 2020 Media InSite local market briefing, there was general agreement on the need for more information about the local advertising landscape.

That consensus remains present, but two years later, the surveys haven’t been done and the data remains conspicuously absent.

Kiran Maharaj of Caribbean Lifestyle Communications believes that local media houses haven’t done a good job of educating clients about TT advertising landscape and the respective value propositions of traditional media and social media ad placement.

A new Caribbean Publisher Alliance has been announced to improve revenue from programmatic advertising, but the effort needs to embrace a wider pool of media houses to have any real effect.

Any successful collaboration between regional media has to run deeper and broader to deliver a useful alternative to the elegantly structured revenue vampirism of Facebook and Google.