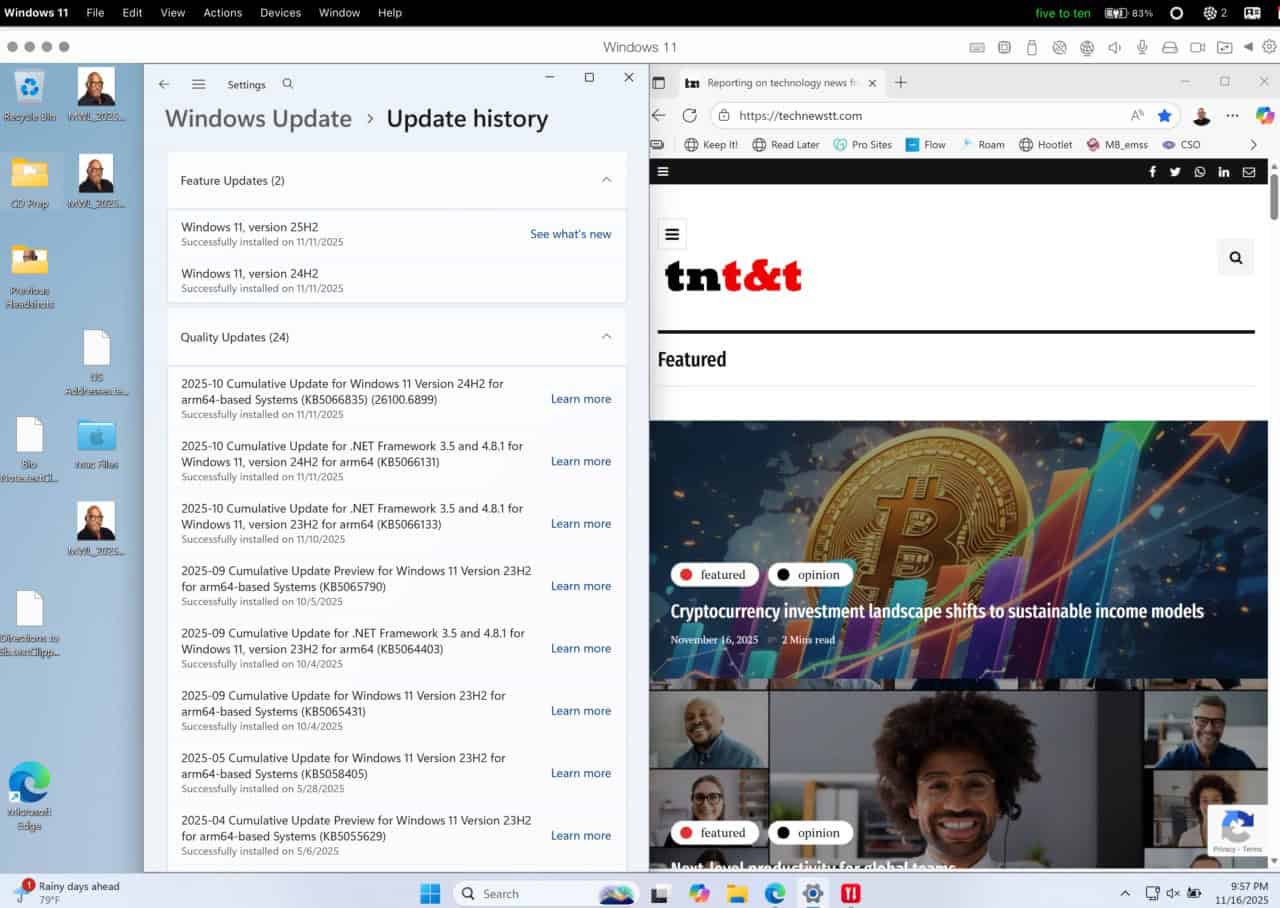

Above: A section of the book by Emmanuel Daniel.

BitDepth#1424 for September 18, 2023

Emmanuel Daniel’s first book occupies an interesting space. The Great Transition, subtitled The Personalisation of Finance is Here, doesn’t shirk from considering big ideas in a turbulent and confusing business sector.

Reading the work reminded me of the way that formerly firm ground became quicksand while reading Marshall McLuhan’s The Medium is the Message and Nicholas Negroponte’s Being Digital.

Those books introduced ideas that were considered to be revolutionary and potentially outrageous when they were published.

Daniel opens his work with a consideration of the ice trade of a century past.

I’m just old enough to remember the ice sellers who worked the streets of Port of Spain with their melting product couched in burlap sacks nestled into rickety handmade wooden carts, going from door to door selling ice to consumers who had an icebox to store it.

In Daniel’s view, modern finance parallels the business model of the ice merchants who built a business with liability factors for a perishable product only to have it all swept away by the refrigerator, which moved an industry from shipments to the kitchen.

In Daniel’s futuring of the finance industry, the world is already in the midst of a similar shift to the personal, as finance, with its associated accumulation of data and convoluted speculation on capital, assets and futures, moves from industrial oversight to individual discretion.

There’s a lot here for the financially adept to consider.

It is not an exaggeration to say that it takes only about ten people to start a digital bank today. It is virtually possible to do this in a garage at the lowest possible cost. All the technology required to run a digital bank today can already be set up or bought on the cloud.

-Emmanuel Daniel in The Great Transition.

I’ve only a nodding acquaintance with some of the high-level concepts here. The more esoteric concepts of modern finance – which turned debts into securities and abstracted assets into money market instruments far removed from any tangible object or service system – remain an area of darkness for me.

The evolution of fintech in China, as demonstrated by the rapid growth of China UnionPay, was fuelled by distributed servers and an open programming language, enabling a nimbler execution of traditional payment processing.

Despite those advantages, UnionPay faced robust challenges from AliPay and WeChat Pay, which skipped the entire credit card system for digital wallets, sparking rapid growth and technology-driven competition.

“By keeping Visa and MasterCard out of China, the Chinese platforms Alipay and WeChat Pay introduced a whole new universe of connected supply chains that transformed lifestyles forever, but the West did not catch on to this trend,” Daniel writes.

Collectively, these alternative value transfer systems now dwarf the transaction volume of Visa and Mastercard by orders of magnitude.

But even these centrally controlled transaction systems will be replaced, if Daniel’s predictions hold true, with new, peer to peer, networked business models for finance which will be fuelled by cryptography, blockchain and other technologies yet to be invented.

It isn’t until the last few dozen pages of the book that Daniel drops his ace, an application of David Ronfeldt’s theory of how social systems adapt to the evolution of finance.

In Ronfeldt’s evolution tree, social constructs begin in a tribal phase, become institutional, before changing into market driven relationships and finally arrive at a networked state, in which individuals connect directly with fewer intermediaries.

In Daniel’s view, finance is entering this latter stage, but it’s a change that will bring new challenges.

Fintech businesses must have a profit centre, at least in this transitional stage, but many new neo-banks and transaction systems have been founded without addressing this issue.

The business at the core of most banks is managing a deposit business. It’s boring, but it delivers a financial base.

“The truth is that the majority of fintech innovations eventually fail due to the unexpected costs of running digital products,” Daniel writes.

“At the end of the day, digitizing the same financial products from the legacy world still requires armies of marketing and sales teams (which never meet their targets) as well as compliance and funding costs, all in a finite marketplace.”

“Applying too much technology to an incumbent system only reinforces the status quo. It is not the way to create the future. A standard mortgage on a house in a quiet neighbourhood of a reasonably small country does not need the AI that banks are purporting to pour into their products.”

In an era of personal finance, Daniel posits, identity will be the premium and deception the threat.

Today’s threat of fraud can be managed by programming, but deceit is more difficult to detect, but in a networked world can be equally dangerous.

“Deception exists outside stated intention and has to be accounted for differently,” Daniel writes.

“Something can be deceptive but not fraudulent (unless a crime is established), but perpetrators can still secure a pecuniary advantage that they may not have been entitled to. The innovation required to overcome financial crime in a networked world is completely different from anything established in the past.”

The push, the author believes, will come in in moving financial liquidity from markets, where value often earns interest unrelated to production, to networks, where it can be accessed dynamically by participants in peer-driven systems.

McLuhan and Negroponte, along with business futurists like Peter Drucker, were never completely accurate in their predictions, but Daniel’s book offers a persuasive roadmap of how finance will move from its legacy past to an uncertain future.

[…] excerpts from Daniel’s The Great Transition. About a five minute read. […]

[…] Trinidad and Tobago – Emmanuel Daniel’s first book occupies an interesting space. The Great Transition, subtitled The Personalisation of Finance is Here, doesn’t shirk from considering big ideas in a turbulent and confusing business sector… more […]