- The Central Bank of Trinidad and Tobago (CBTT) chose to adopt India’s Unified Payments Interface (UPI) due to its maturity, readiness, and alignment with local needs.

- Building digital public infrastructure is crucial for improving payment systems, credit instruments, and digital identity, with technology serving as a layer for delivering public goods.

Above: Illustration by ElizaLIV/DepositPhotos

BitDepth#1499 for February 24, 2025

The conversation around e-money, digital cash transactions, digital payments and electronic value transfer has been a curious mix of blustery announcements and radio silence over the three months I’ve been asking questions in the space.

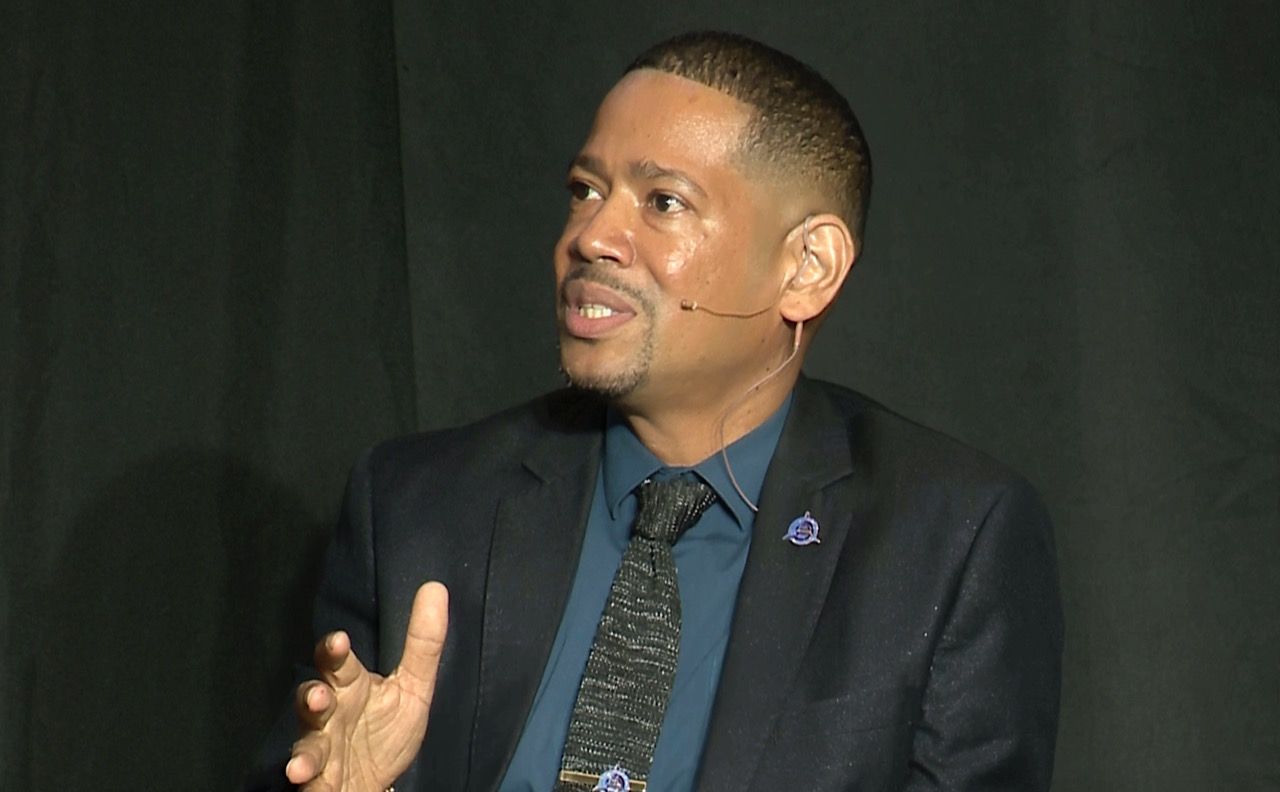

This column only became possible because, on the afternoon of the second day of the 2025 TT Internet Governance Forum on January 31, an unusually frank discussion between TTIFC CEO John Outridge, Paywise founder Ian T Alleyne and Pinaka Consulting’s Shiva Bissessar offered insight into some of the issues.

Prior to that, questions sent to e-money issuers Alleyne went unanswered. An email requesting a Q&A on the status of’ Republic Banks EndCash, sent to Parasram Salickram of Republic Finance, was opened but there was no response.

TSTT has not begun operations of its Paypr e-money project. PBS Technologies announced last week that it was ending its payment system in Trinidad and Tobago. WiPay has stopped promoting its services as a medium of digital value transfer.

Simon Fortune of Pesh Money declined to disclose transaction volumes and explained that it is beginning operations with an emphasis on collaborations, pointing to a partnership with the Project You Foundation to enable “effortless charitable giving.”

“At this time, we do not offer a business/merchant service, and that is a deliberate choice,” Fortune said.

“The infrastructure required to support a merchant payment system at a standard we would be proud to uphold simply does not exist yet. Building a merchant platform presents its own set of challenges, including interoperability, regulatory considerations, and market readiness. Rather than rushing to introduce a solution that involves too many trade-offs, we are taking a measured approach.

Questions put to the Central Bank (CBTT) after the announcement of an MOU to license India’s Unified Payments Interface (UPI) went through weeks of contemplation and a resubmission for clarification on the responses took more than two months.

At the TTIGF discussion, several themes emerged that seemed to clarify the current situation and future challenges.

UPI is expected to be a major force in the electronic payments sector. It is a fast payments platform, digital from end to end, and according to the CBTT in its responses to questions, will cost its users “either very little or zero to use.”

In responses attributed to Alister Noel, CBTT’s Senior Manager, Macroeconomics and Payments, but clearly massaged by lawyers and corporate communications professionals, the bank cagily explained that the government collaborated with the National Payments Cooperation of India (NPCI) and the NPCI International Payments Limited (NIPL) operation to use UPI.

“The Bank assessed several fast payment systems globally and, in collaboration with the Digital Transformation Ministry, concluded that the UPI system was considered the most mature, readily available, aligned with the needs of the TT population, a proven concept, and certified,” Noel explained.

“The MDT has indicated that, in their judgment, directly partnering with an experienced entity like NIPL will expedite the deployment process and leverage proven expertise.”

It’s important to note here that while TT will own the hardware used for this project, the software is being licensed from NPCI for a fee. The CBTT declined to disclose the costs to be incurred for its use, citing an NDA.

“In December, we had the team from UPI in Trinidad and Tobago”, said John Outridge at the forum. “They were looking at the [financial] landscape, they visited the different players, they had meetings with fintechs, credit unions, different stakeholders. So right now, it’s at the point of functional requirements.”

“UPI is a vanilla switching platform, but you have different functionalities, bill payments, person to person payments, you can even do subscription payments.”

It’s worth noting here that there does not appear to have been any prior consultation with the stakeholders who will actually be expected to integrate this new fast payment system into their businesses.

That stakeholder body includes eight commercial banks, five e-money issuers and 129 credit unions.

According to the CBTT, a year was spent examining fast payment systems in countries where they had been deployed successfully and systems such as Brazil’s Pix the IDB’s FuSSE, developed specifically for Latin America and the Caribbean, were rejected in favour of India’s UPI.

It seems unusual for a financial market as fiercely competitive as ours with as many players delivering services on only marginally interoperable systems to have not been extensively consulted or included in the considerations of the Digital Transformation Ministry and the CBTT.

Was this process an instance of ‘government knows best’ in decisionmaking?

Technology is only part of this problem, Shiva Bissessar noted.

According to Bissessar, the blockchain initially evolved as a way to solve the double-spend problem with cryptocurrency, in which a token could be used more than once.

“Since then, blockchain has been employed in other spaces, not just payment and even Bitcoin isn’t primarily used to transfer value, it’s used to hoard, to retain capital gains over a period of time.”

“And blockchain technology is just one aspect of digital financial services. Over the past ten years, we’ve seen expansion in the Caribbean, an uptick in different types of projects and deployments that explore fintech. But utilising the technology beyond a technical means to deliver a public good, that’s the important part.”

“Digital public infrastructure needs to be built up to improve payment systems, credit instruments, digital identity, the technology is just a layer on which you deliver that public good.”

[…] Trinidad and Tobago – The conversation around e-money, digital cash transactions, digital payments and electronic value transfer has been a curious mix of blustery announcements and radio silence over the three months I’ve been asking questions in the space… more […]

[…] TechNewsTT article, Is e-money a solution in search of a problem? […]