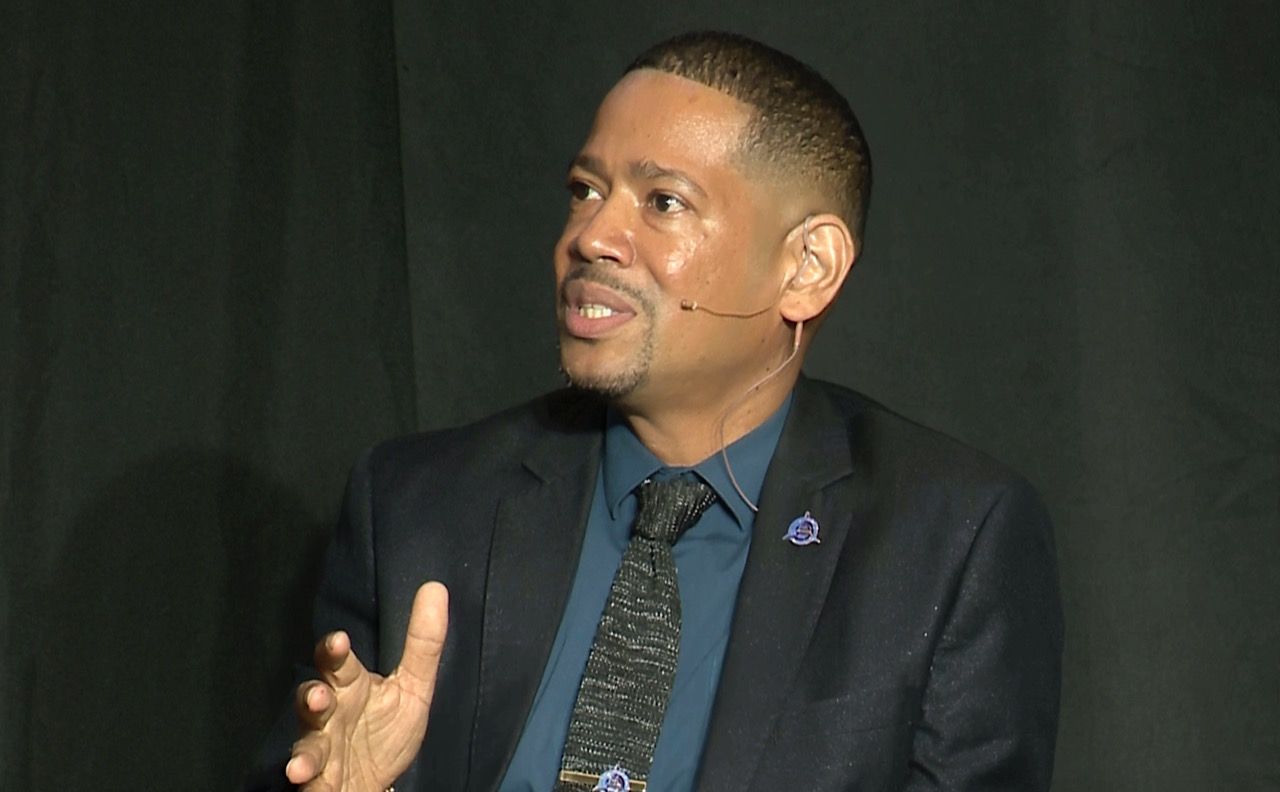

Above: Denis O’Brien. Photo courtesy the Digicel Foundation.

BitDepth#1443 for January 29, 2024

In 2001, Irish businessman Denis O’Brien saw an opportunity in the Caribbean. The telecommunications sector, dominated by Cable and Wireless was lazy, comfortable and wildly profitable.

Beginning with an outpost in Jamaica, Digicel quickly expanded its reach over the next fifteen years throughout the Caribbean and then the Pacific. Business was good, robust enough to finance partnerships in Latin America.

But to do that, the company had to invest heavily in infrastructure, building competitive networks to establish a decisive market advantage.

In 2015, O’Brien planned to write down the company’s debt by putting 39 per cent of the business on the market.

At the time, O’Brien owned a commanding 92 per cent of the company. The initial public offering (IPO) was expected to raise US$1.7 billion, which would have given his share of the company a valuation of $3 billion.

Most of the money to be raised by the IPO, $1.4 billion worth of it, would pay down company debt.

At the last minute, the company cancelled the IPO. O’Brien didn’t like the price and he clearly felt his rising star company, active in 32 Caribbean and Pacific markets with 13 million customers, had the backbone to hold out for a better price.

But there were fiscal termites at work.

For one, O’Brien had extracted millions from the company as dividends on his shareholding, which Moody’s described as “debt-funded shareholder payouts,” the company borrowing to pay its principal shareholder a sum cumulatively estimated to be around $1.9 billion between 2007 and 2015.

O’Brien also created several special purpose companies to provide services to Digicel. One O’Brien-owned company rents Digicel the private jet he’s been using over the last three years, costing the company $26.2 million.

The biggest problem the company has faced has been the collapse of voice calls as a source of revenue. Over the last decade, revenue from voice calls has fallen off a precipice in the Caribbean.

Digicel’s debt is denominated in US dollars, but it receives payment in a range of currencies used across the Caribbean. When the US dollar strengthens against a Caribbean currency, as it has in Haiti following instability in that country, effective revenue declines.

Digicel’s debt burden is also enumerated in US dollars, and has soared to $6.7 billion, which attracts $450 million in annual interest. That money comes directly out of declining operating revenue.

The sale of the company’s Pacific operations to Australia’s Telstra for $1.6 billion brought a temporary respite and a small write-down of overall debt, but not nearly enough, as $925 million in company bonds came due in February 2023.

A deal was struck with a consortium of business interests and creditors, Golden Tree Asset Management, PGIM Fixed Income, and Contrarian Capital Management, who agreed to a debt-for-equity swap that will reduce the company’s debt by $1.7 billion and transfer 62 per cent ownership of the company to its lead creditors.

Digicel group chief executive officer Oliver Coughlan stepped down from the role in December after delaying his departure by a year. Maarten Boute is currently listed as Interim Group Chief Executive Officer & Group Chief Operating Officer.

Bondholder appointee Rajeev Suri is expected to be the next Digicel chairman.

Under the equity swap, Denis O’Brien’s shareholding is expected to drop to 10 per cent of the company but he may end up with as much as 20 per cent if certain incentive warrants are successfully invoked.

Digicel will be operating under the guidance of bondholders who are likely to press the company to be leaner and operate more aggressively in pursuit of debt reduction and profit maximisation.

With some of Digicel’s maturing bonds trading at 15 cents on the dollar, the emphasis by the bondholders is likely – and this will be driven by the board that is appointed to run the company – to be on rebuilding share value and putting the company in a position to refinance its debt on terms that are supported by its revenue.

The math on this is simple, despite the layered debt that Digicel is carrying on its books. The incoming shareholders believe that their best option for recovering their investment is to steer the company to where its books are manageable.

The Digicel of 2024 will be tasked to operate with a simple, clear mandate. Maximise return on existing assets, reduce non-core costs, and position for sustainable refinancing.