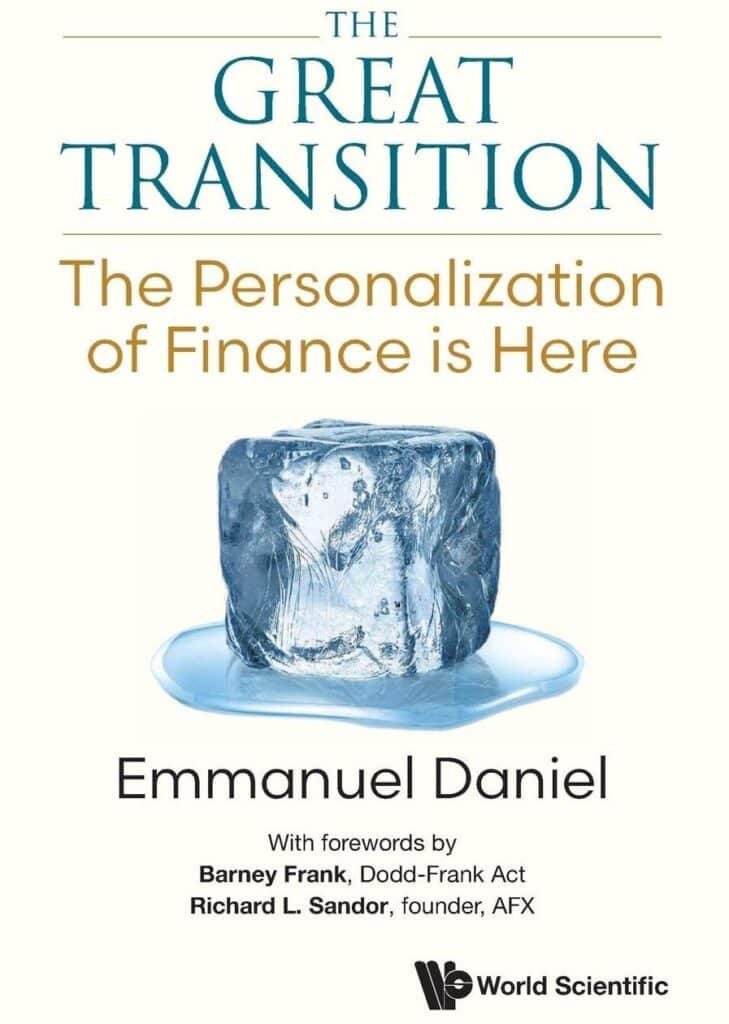

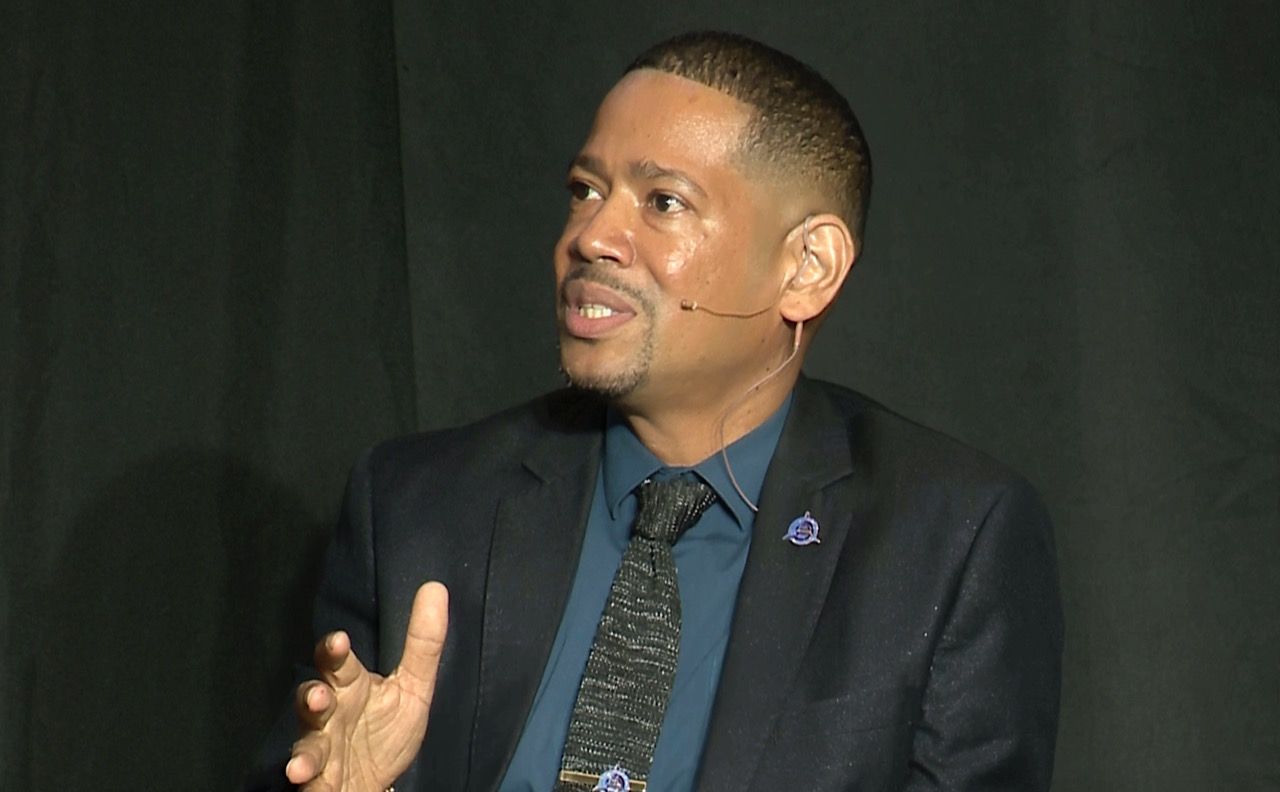

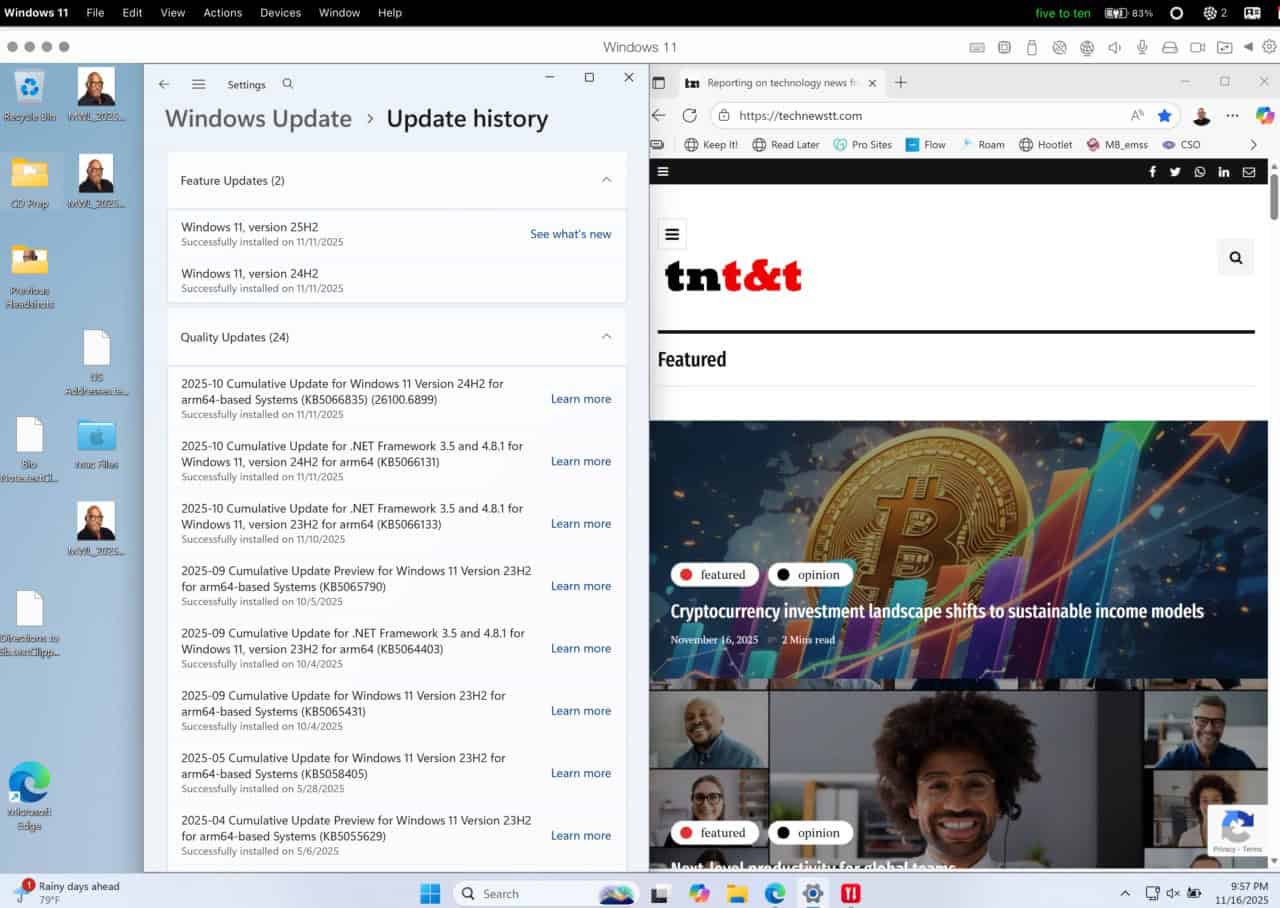

Above: Emmanuel Daniel.

BitDepth#1425 for September 25, 2023

Emmanuel Daniel, author of The Great Transition, a forward-looking evaluation of the state of financial technology agreed to answer regionally relevant questions about fintech following my review of his book.

Emmanuel Daniel is a 2021 and 2022 global top 10 influencer on the Fintech Power50 list and a researcher and consultant in the field.

On regional digital currencies and CBDCs

Q: The Eastern Caribbean Digital Currency is an example of a Central Bank pursing fintech to solve a problem, an island group that needed a more agile currency. Are there other models that might encourage Central Banks to engage with fintech?

ED: After publishing my book, I visited with the governors of several Latin American central banks, including the eastern Caribbean.

I was told in confidential conversations that the digital currency of the Caribbean countries had a take-up rate of less than two percent (I suspect it’s less than one percent) because these countries are wholly dependent on American tourists who swipe their credit cards, which are picked up mostly by the foreign banks that do business in their jurisdictions.

There are no “what’s in it for me” benefits with the banks that operate in these countries. In fact, the central banks expect these banks to invest in the processing capability for CBDCs (Central Bank Digital Currencies).

At the time of writing, I was hoping that the cost-benefit of a central bank digital currency would work in places where getting to remote places was a factor and the Caribbean areas were prime examples.

But what I think I saw was that because the CBDCs are designed for the poor islanders who lived away from the more developed parts of the countries, the infrastructure further alienated the islanders from the mainstream economy, thus keeping them poor.

My clear opinion now is that “CBDCs are designed to fail” for several reasons.

The Chinese CBDC has suspiciously been in pilot mode since 2018. All the “use cases” being touted today belie the fact that the original directors have been removed, the pilots are all running only because of discounts and incentives at the expense of taxpayers, and the government is terrified of making the project go live because of possible unintended consequences to the traditional banking system.

The CBDC technology being introduced by central banks cannot keep up with the innovations taking place in cryptocurrencies and stable coins. Here, I notice that the BIS (Bank for International Settlements) has been, in parallel, introducing new rules for banks and central banks to carry cryptocurrencies on their balance sheets from 2025 while simultaneously promoting CBDCs.

Cross border CBDC pilots are designed to be superimposed on existing trade and FX markets, even working with the same wholesale banks that dominate global payments today, thereby negating the whole purpose of new technology, which is to introduce new methods of global payments and settlements.

Crypto and stable coins are 24-7, and each of the major crypto attracts more than 100,000 programmers (eg Ethereum, Solana, Tezos) working applications on each of them, something not matched by any CBDCs.

The CBDC technology being introduced by central banks cannot keep up with the innovations taking place in cryptocurrencies and stable coins.

On financial inclusion and the underbanked

Q: What fintech model would serve the “underbanked” in an environment in which cash is the dominant form of value exchange in the middle and lower class of a country’s society?

ED: Let me tackle the question of the “underbanked” and “financial inclusion” here. The CBDC technology being introduced by central banks cannot keep up with the innovations taking place in cryptocurrencies and stable coins.

So many fintech initiatives carry the moniker “financial inclusion” as if it was shorthand for helping the poor and an excuse to attract investors.

In my book, I say that “financial inclusion is a lie generally,” because these fintech models operate with the same motivation as all other platform models (think Facebook and Google) where the goal is to “on-board millions of users and then to monetise them.”

As long as there is a venture capitalist behind the initiative, the goal is exactly that and none other, because the VC has to be rewarded at some stage.

The best working model of serving the underbanked – and here I compare the original model pioneered by Muhammad Yunus of Grameen Bank against the VC-backed Indian versions – suggests that it only works if the focus is on the community.

I must point out that the per capita GDP of Bangladesh, which was once described by Henry Kissinger as a “basket case” in 1971, is today higher than that of India precisely because of the role of the NGOs (non-government organisations) and microfinance credit agencies working at the grassroots level.

They enable extremely poor people to afford productive assets from bicycles and cotton looms to increase their per capita wealth, whereas indiscriminate lending to the poor on the back of conspicuous consumption in India led to the profound damage that microfinance did in India.

So, onboarding of the poor to an existing banking system alone is not the answer to poverty alleviation.

I also question what exactly about the current banking system, with its layers of financial institutions generating income from their passive intermediation role, is desirable for on-boarding the unbanked.

The current baking system extracts value and does not generate value to its user.

Financial inclusion is firstly digital inclusion. Giving digital access to the poor to be able to navigate the internet and find their customers and their friends and family is a human right second only to drinking water.

It does not then follow that plugging them into the traditional banking system is a desirable goal.

There are today millions of unbanked in countries like Kenya, Uganda, Burundi and even Nigeria who are able to get on with their everyday lives and generate income on the back of a telecommunications SIM card without ever having to have a bank account. A bank account is the worst curse you could wish on them.

If the overall priority for Trinidad and Tobago is to increase tourism and generate manufacturing jobs, CBDCs are not important at all.

On the regional status quo of finance and the challenge to fintech

Q: Trinidad and Tobago has a conservative banking sector and the country’s political governance tends to side with existing financial systems. Yet there is also a growing segment of the society which champions fintech and digitally managed systems of value exchange. How might those almost diametrically opposed perspectives on currency be resolved?

ED: Having met some of the governors of the central banks in the region, I can see how they are pressed between a rock and a hard place.

These governors attend the annual meetings of the BIS, where they have to subscribe to the same traditional banking rules as all other countries.

CBDCs are a current fad so that they cannot go wrong if they said that they are introducing CBDCs.

But when they return home, they find that their banking system is dominated by foreign (Canadian and European) banks that make sufficient income through foreigners, including Trinidadian emigres, who do play an important role in sustaining the valuation of properties and businesses listed in Trinidad from which more wealth is created.

If the overall priority for TT is how to increase tourism and generate manufacturing jobs, CBDCs are not important at all. In some of the Caribbean countries with more dispersed islands, the case for CBDCs are much stronger because of the need to move cash across thousands of remote miles.

The challenge for these countries is in getting the support of the foreign banks that operate in them – but they simply don’t care. They are not going to change all the payment acceptance devices in the shops and hotels to accept CBDCs. All these have to be funded by the state.

It is for this reason the cleverest thing these states can do is to allow local and foreign investors to set up their own payment systems, as is being done in Africa today (think Flutterwave, Skrill, M-Pesa). Allowing local stable coins to operate on shore will enable the state to avoid investing in anything.

At the end of the day, a payment is a message transmitted between two users. If telecommunication messages can be done at close-to-zero costs, so can payments. It is not necessary to carry the expensive traditional bank-owned credit card infrastructure along.

The existence of a well-run treasury department and a functioning legislature and a stable banking system all work together to slow down the acceptance of innovation.

On Trinidad and Tobago’s fintech challenge

Q: There have been attempts to bring greater acceleration to trade and value exchange of fiat currency by two providers, Paywise (conservative and aligned with existing systems) and WiPay, (aggressive and forward looking).

Are such fundamental conflicts of perspective to be expected in the evolution of fintech and how might they be engaged by civil society to better result?

ED: The answer to this is to be found in the self perception of the Trinidadian elite. Trinidad is actually a well-regulated country and herein lies its problem.

When we examine why Alipay and WeChat took off so dramatically in China, and dominates its payment system today, it is because both were launched in 2010 when the financial system in China was regulated at multiple levels, by the provincial as well as central governments, so that the fintechs were able to arbitrage between the different regulators.

It was 2014 before China started to think about coordinating its payments regulations and 2018 when it was finally able to. In that time, the digital wallets grew dramatically.

Well regulated regimes do run the risk of over regulating innovations out of existence. The existence of a well-run treasury department and a functioning legislature and a stable banking system all work together to slow down the acceptance of innovation. Even the US does not change until it absolutely has to.

The introduction of FedNow, the instant payment infrastructure in the US this year was done at the behest of the regulators, and long after many other countries had implemented instant payment infrastructure including the UK, the EU, Singapore, Australia and a host of other countries.

In many of these jurisdictions the traditional banks actually opposed the introduction of instant payments because they made their money from the float – the longer it took to clear a cheque, the more money the banks made.

In the US and other jurisdictions, in matters of finance, it is not the involvement of civil society but an enlightened administrator who makes this possible.

The discussions in the legislature should be focused on listing the countries that have moved ahead, and learning from them.

It is unfortunate that TT does have the entrepreneurial talent that was able to identify the problems and work on pinpointed solutions, but was stymied by the incumbents.

Having visited Trinidad, I find parallels with a country called Fiji in Australasia, which is also dominated by Indian immigrants brought in by the British.

I notice that the immigrant populations in both countries master the form but not the substance of the Westminster style of government.

On Caricom’s role in regional fintech

Q: The Caribbean is an archipelago of nation states which pursues greater interaction and interoperability through an umbrella body, Caricom. Might fintech be one way to bring more seamless value exchange between nation states of the Caribbean in the same way that the Euro brought greater unification to the European Union?

ED: I study carefully the different regional economic cooperative models in existence around the world – ASEAN in Southeast Asia, COMESA in South and Eastern Africa, EC the East Africa Community, the EU, NAFTA and a fledgling one in South America. Also, APEC and RCEP which are essentially trading blocs.

Very simplistically, two factors make any one of these successful regional economic groupings functional – one large member state playing the role of the economic driver and sponsor state, and the second is a common enemy.

In COMESA, the sponsor state is played by South Africa which volunteers to provide the clearing system and liquidity for the steps needed towards currency union. Because none of the ASEAN members want to provide this function there is no ASEAN equivalent on the currency front. In the EU, both Germany and France provided this backstop and arguably still do.

All efforts at economic integration have no sense of urgency until some external threat forces the situation. In the EU, it was Russia and the prevention of another World War. In most of the others there are none, hence the lack of urgency.

The problem with Caricom becoming a serious regional grouping has one added issue – the sum of the parts does not create the critical mass required for the region to negotiate with the rest of the world on trade or investments.

The Bahamas, Bermuda and Saint Kitts each have the ability to become large financial centers, except that unlike other financial centers like Dublin, Dubai, Singapore or Hong Kong, these are essentially booking centers with not much onshore financial activities that could make them regional population centers as well.

Against this background, the idea of a seamless financial value exchange for its own sake is a piped dream for the region because each member of such a coalition will have its own economic priorities that are always not shared by the other.

Can cryptocurrencies become an asset class that could create new frontiers for these countries? For the moment, the region benefits from regulatory arbitrage against the United States and so a number of these are off-shore centers to the US. But this will disappear as regulation becomes clearer in the US, which it always eventually does.

But one benefit that fintechs do bring to the region is to have the profits in financial transaction and infrastructure to remain domiciled in the region instead of paying large foreign banks to take the profits home.

I have seen this taking place in Africa where the new payment players are profitable and paying tax within their respective countries – South Africa, Nigeria and Ghana – instead of having the profits of the payments business being spirited away by Visa and MasterCard to outside the countries.

On the new horizons for fintech

Q: Have there been any changes in fintech since the publication of your book that you wish you had been able to discuss in it?

ED: My book was published at a time when most fintechs either wanted to become banks themselves or had reduced themselves to becoming feeders into the existing banking system.

I left it as “if the product does not change, nothing changes,” which means that if fintechs see themselves as selling the same products as banks, then they will have the same cost and regulatory base as the traditional banks and it is not inconceivable that they should become banks themselves.

The advent of generative AI gives a new lease of life to the platform and peer-to-peer players. Now I am saying that “the conversation is the product”.

I will be discussing this in greater detail in an updated edition of the book that fintechs should now focus on generating more conversations on their sites and between their customers without a focus on selling the traditional products that banks have been always selling.

From the processing of these conversations, these fintechs will be able to design new products and services that did not exist before.

[…] Caribbean – Emmanuel Daniel, author of The Great Transition, a forward-looking evaluation of the state of financial technology agreed to answer regionally relevant questions about fintech following my review of his book… more […]