- Lisa Agard was appointed TSTT's CEO on May 24, 2021 after acting for almost a year.

- TSTT is active in mobile broadband, fixed broadband cable TV and telephony.

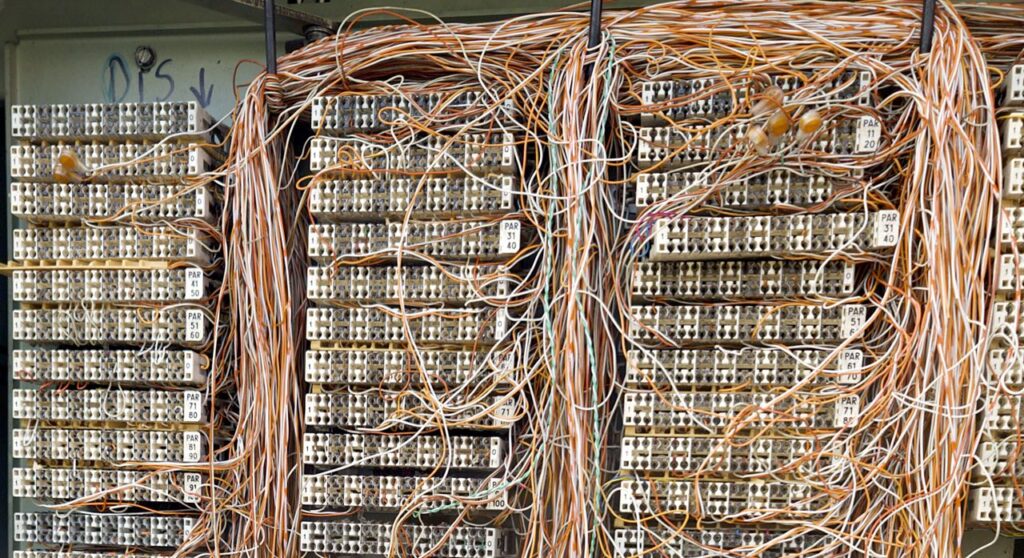

- The company will sunset its copper wired phone services on September 30.

Above: Lisa Agard. Photograph by Richard Cook, provided courtesy TSTT.

On May 27, the author, Mark Lyndersay, posed questions to newly appointed TSTT CEO Lisa Agard. The company finally responded on Tuesday this week after it discovered the early (and really quite quiet) publication of the questions put to them on this website under the headline “The questions TSTT won’t answer.” That post has since been removed, because the questions are here.

The questions were posted in the category Backgrounder to provide a more fulsome note to the BitDepth column originally planned for July 8, 2021, which examined reasons why the company might not have answered.

Early publication of such background material is necessary to provide a link in-copy for the TTNewsday version of the column, which is provided two days in advance of publication to meet press and editing requirements.

The responses to the interview questions, which had been in preparation, were submitted within an hour of the publication of the questions online. One final question was answered after the press deadline for Newsday and is included here.

Notes of clarification on the responses are included here and called out in bold type. The responses were edited for excessive capitalisation and overwrought corporate horn blowing. A version of this interview appeared in TTNewsday on January 08, 2021.

Q: You are back and in as CEO at TSTT, what is that like after all these years?

LA: A lot has happened in the telecoms industry since I left TSTT in 2012. I was involved in an adjacent industry (broadcasting) for a year and a half and jumped right back into telecoms with my involvement in Massy Communications.

At that time, Massy made a significant investment in a Fiber-to-the-Home project to serve residential customers in Trinidad. Massy and TSTT began to cooperate in some areas, and this led ultimately to TSTT acquiring Massy Communications in 2017.

It is great to be back. There are a lot of challenges facing the industry as a whole — not the least of which is the impact of the covid19 pandemic.

[Ms Agard is entirely too humble. Apart from a short year-long stint as CEO of Guardian Media, then still the Trinidad Publishing Company, she has offered herself for public service as chairman of the North-West Regional Health Authority and as chairman of the Caribbean New Media Group, taking up the role after the abrupt resignation of Helen Drayton and leading that state-owned broadcast company’s retreat to its TTT brand and championing a now largely abandoned effort to revive local programming at the television station.]

Q: What were your priorities when you were asked to act as CEO last year?

LA: When I was asked to act as CEO last year, the most important priority was dealing with the impact of the Covid-19 pandemic, and the negative impact on our revenue.

Intuitively, a lot of people think that telecommunications is an industry unaffected by a pandemic such as Covid-19, as a broadband connection becomes imperative to facilitate remote work and school.

That is not the case. While residential broadband customers have remained relatively unchanged, the negative macroeconomic headwinds have severely impacted the mobile business, in particular the prepaid segment.

So, in order to ensure the sustainability of the business, we had to introduce austerity measures to reduce operational expenditure.

[TSTT remains in a troubled position in the local telecommunications market despite its purchase of Amplia. Once the dominant and monopoly provider of telecoms services in Trinidad and Tobago, its presence is dwarfed by the multinational companies Digicel and Liberty Latin America, which owns the assets of Flow and C&W. In addition, C&W owns 49 percent of TSTT, an untidy situation which is only partly resolved through C&W’s silent role as shareholder in a situation which has found the majority shareholder, the Government of Trinidad and Tobago, unable to find a buyer for an unpalatable minority shareholding in the company.]

Q: What did you believe were the pain points of the company at that time and what actions have you taken to manage them?

LA: In our Annual Operating Plan for fiscal 2021/22, we have embedded the operational cost savings that we implemented in the last fiscal [year]. We have to continue that focus.

That positively impacts our cash outlay and we also have devised strategies around cash collection, which is a growing challenge in the current economic environment.

We continue to actively engage our customers by providing exemplary customer service, while we invest in developing innovative products and services like smart home and fintech solutions.

In order to grow revenue, we will leverage our capabilities being a full-service provider offering Mobile, Fixed, Broadband, Entertainment, Security and Enterprise Products.

In addition, we plan to enhance our array of digital service offerings, our e-Tender, IaaS and SaaS [products, while] utilising our Tier-3 TIA-942-B fully redundant Data Center to support those digital solutions as well as provide hosted solutions, public and private cloud.

I certainly do not accept that we were crushed by Digicel’s marketing and sign-up strategies. That is not accurate.

Q: How has Amplia performed as a business sector since it was bought by TSTT?

LA: In each of the financial years since the acquisition by TSTT in August 2017, Amplia has exceeded its financial and customer growth targets.

Leveraging TSTT’s core capabilities has enabled Amplia to resell some of TSTT’s products and services which were not initially part of its service offering.

Q: Amplia was announced and deployed in competition with Digicel Play and was widely perceived as being crushed by Digicel’s marketing and sign-up strategies. Are you happy with your stewardship of that broadband company since its inception?

LA: It is no secret that Digicel invested significantly in the deployment of its fiber network. Its fiber footprint was always much larger than Amplia’s.

Even with the transfer of residential fiber customers from TSTT to Amplia, Digicel still has a much larger geographical footprint.

I certainly do not accept that we were crushed by Digicel’s marketing and sign-up strategies. That is not accurate. Amplia has always exceeded its annual operating plan and has exceeded its customer acquisition targets.

The fact that as General Manager of Amplia I was appointed to act as CEO of TSTT and later confirmed in that role after an extensive local and international recruitment process, speaks positively, I believe, of my stewardship of Amplia.

Q: TSTT announced its zero-copper initiative in 2018. Very little has been heard about that project since the launch in September of that year. On a personal note, I asked to test the service at the launch and to date, it has not been made available in St James, where I have my home-office. What is the status of that project and has TSTT set a date for the sunset of its copper line service?

LA: Since the launch of our Zero Copper initiative in 2018, we have been aggressively working towards our goal of migrating all customers off our copper network.

To date, we have migrated over 70,000 residential/single-line business customers from our copper network to the fixed wireless and fiber networks.

We aimed to complete the project in October 2021, however, the covid19 pandemic regulations pose a challenge, and as such this date may be difficult to meet.

We are acutely aware that the copper network continues to age, switching equipment is unsupported by suppliers, and our customers on the copper network require more broadband services. As such, we remain steadfast in our resolve to complete the project.

Our combined wireless and fiber footprint in Trinidad and Tobago provides greater than 90% population coverage for our customers. Our network expansion and improvement strategy will address the remaining 10% of customers not currently within our wireless/fiber footprint.

[A letter to customers signed by Pernel Roberts, the company’s acting GM for Traditional Services was issued in May, offering one month’s free service and free local calls to anyone who signs up before June 30, in advance of a forced sunset of the company’s copper connected services on September 30.]

Q: The company experienced several rocky years with its billing services and backend software. Can you state decisively that all those issues have finally been resolved to your satisfaction as CEO?

LA: Around 2019, there were some challenges with our billing platform which impacted our customer experience.

Our legacy Operations Support System/Business Support System (OSS/BSS) was end-of-life and regrettably, the transition to our new system was not as seamless as it should have been.

We have made considerable progress since then.

We have been deploying the Ericsson OSS Billing and provision system and we are on the final phase of this journey.

The new OSS/BSS system has proven beneficial to both TSTT and our customers. Most notably, our service fulfilment process has significantly improved. This means that we can now provide services in days instead of weeks, and in some cases, hours.

This is also facilitated by our integrated network inventory system.

We have come a long way along our OSS/BSS journey, but this is by no means the end state. We want to continuously improve customer service at all touch-points.

Our goal is to have an OSS/ BSS platform that provides customers with a portal to access self-service features allowing them to make changes to their service packages in real-time.

[TechNewsTT broke that story here]

Q: In a world of IP driven content and real-time delivery, what is the strategy to make TSTT’s cable offerings relevant to its business strategy? Has that business sector performed to expectations? Is it time to cut that cable?

LA: TSTT consistently aims to be at the forefront of cutting-edge technology. As such, we have observed these trends and tailored our cable TV offering to respond to these new media consumption habits and the overall change in consumer behaviour.

Our subscribers can enjoy their cable TV subscription at home on their televisions or on-the-go by using our TV Everywhere option via the Amplia Over-the-top (OTT) app.

TSTT is working to meet the needs of our customers and the wider population by offering an affordable standalone Mobile TV package and residential tiered TV packages delivered over our Fixed Wireless network. This will give our customers the ability to receive a suite of local and foreign channels at a fraction of the cost.

‘Cutting the cord’ has been topical for some time. In essence, it relates to the cutting of the traditional linear Cable TV service for a purely on-demand OTT TV service.

Cable TV has now transformed into an ecosystem of information tailored towards the consumer with built-in AI to monitor and recommend shows, the ability to pause, rewind and restart live TV, catch-up on programming missed, record series automatically, and be able to do it all on any device.

With the enhancements made to cable TV, there has been low traction to the ‘Cutting the cord’ discussion.

[Pricing remains an issue for TSTT’s cable service offerings. The cost of the base product offered by Amplia for its fixed broadband and cable channel service is $450 for 100MB download speeds and 115 channels. Digicel’s base product runs $349 for 100MB/30 channels and Flow costs $365 for 100MB/96 channels. TSTT is the only provider to offer fixed broadband connectivity without cable TV for $149.]

Q: Is there a long-term strategy for the Vigilance product? I am a customer and it represents the greatest value among equivalent offerings locally but it is neither aggressively marketed nor is it being developed technologically in any significant way. The product I paid for five years ago is still the same product that is being delivered now.

LA: When TSTT introduced our home security solution, Vigilance, in 2009, our primary focus was on offering homeowners greater peace of mind.

We were — and still are — intent on using technology to make Trinidad and Tobago a better, safer place one home at a time.

We are presently upgrading the technology for this product and other related services, all part of our strategic roadmap. Very soon, customers will enjoy a significantly enhanced user experience and functionality, utilising the latest in home security technology.

Q: TSTT’s anchor product appears to be mobile broadband. What is the strategy for making a stronger push into that space?

LA: Trinidad and Tobago has one of the highest mobile penetration rates in the Caribbean. For TSTT, customer satisfaction will always be at the forefront. We remain laser-focused on ensuring that we are in the best possible position to adequately respond to our customers’ diverse and growing needs.

About a year ago, we took a strategic decision to revamp and upgrade all our mobile plans, placing targeted emphasis on data.

We increased the data allowances on all our plans while the prices remained unchanged. Previously, a $199 plan came with a 3Gb data allotment but with the revamp, customers pay the same $199 but receive 20Gb of data instead.

It must be noted that all our plans are 100% LTE. There is no throttling so once a customer is in an area with LTE coverage, they will enjoy the LTE experience. We believe in freedom, choice, and value so in the last year, we have also introduced a shared plan which allows customers to divide data and minutes among up to five people, and our Bproductive plan which specifically targets students and online learning.

TSTT has been continually enhancing the coverage and capacity of our mobile network to ensure ubiquitous voice and data service throughout Trinidad and Tobago for our prepaid and postpaid customers.

As mobile video consumption continues to increase, we have been evolving our 4G FDD LTE network by deploying LTE-Advanced technology enablers such as Carrier Aggregation and Massive MIMO (multiple-input multiple-output) antennas for increased data throughput.

TSTT also continues to expand the coverage and capacity of our Fixed Wireless TDD LTE network which provides affordable fixed wireless voice and Internet solutions to our residential customers and allows for self-installation and remote troubleshooting to reduce the mean time to repair.

Q: Digicel’s CEO recently made a call for greater collaboration on delivering connectivity to the underserved in Trinidad and Tobago. Is that an initiative and a challenge that TSTT under your leadership is willing to take up?

LA: We have been and will continue to play a role in addressing the connectivity challenges of underserved communities. In fact, there is great industry cooperation in this regard.

TSTT, Digicel and Flow recently participated in a Joint Select Committee of Parliament which looked at availability of internet for students as well as access to devices. The focus was on online learning and for the Committee to get a better understanding of which communities were underserved.

TSTT was happy to report that it has invested TT$1.6 billion between 2015 and 2020 improving and upgrading its networks.

As a result of that and prior year investments as well as industry investments, TATT’s own market assessment (as set out in TATT’s Annual Market Reports) illustrates that such investments have correlated with substantial increases in access to and quality of telecommunications services, such that:

- Broadband subscriber penetration (itself a subset of broadband accessibility) increased from 52% of households in December 2012 to more than 84% of households in September 2020 [per TATT Annual Market Reports], which exceeds the metric of some OECD jurisdictions;

- The modal average broadband in the market increased from approximately 5Mbps in December 2012 to 70Mbps in September 2020;

- Mobile internet penetration continues to increase and reflects that the majority of the national population are subscribers to mobile internet services which blanket over 95% of the geographic area of Trinidad and Tobago.

- Over 95% of households in Trinidad and Tobago have access to broadband-enabled networks.

- In those circumstances, there has been an effective elimination of any access gap existing in Trinidad and Tobago and the situation is constantly improving.

Despite strained financial circumstances, TSTT has funded specific initiatives to enhance their service offerings to the public at large, in part as a response to the negative impact of the COVID-19 Pandemic, at an additional cost of TT$25 million.

One of these initiatives is a special $100 (VAT inclusive) internet package (15 Mbps download speed), for households identified by the Ministry of Education as well as the Catholic Archdiocese acting as coordinator for other denominational schools, as not having internet access.

In total 6000 households will be served split equally among FLOW, Digicel and TSTT.

[The following question and response arrived too late for publication in NewsdayTT and is included here.]

Q: TSTT’s board announced a five-year strategic plan in 2016. That should, logically, end this year. Is there a new plan in the works? Has the company benchmarked its achievements for the first five-year plan against what was planned?

LA: It is accurate that the Company’s Strategic 5-year plan 2016 -2021 ended on the 31st March 2021. The plan revolved around some key pillars including but not limited to, evolving and upgrading technology, revenue growth and customer service

With regard to (A) TSTT invested significantly in network upgrades and expansion.

- The mobile 4G-LTE providing national mobile coverage was expanded.

- A 4G-LTE Fixed Wireless Access providing 95% population coverage was deployed.

- Zero Copper with WTTx.

- Fiber passed 147K homes.

- Wetside capacity was increased from 50 Gb to 70Gb.

- Public Wi-Fi buildout.

- Voice core upgraded with C20 VoIP Soft switch

With regard to (B), while TSTT’s revenue projections were not realized primarily because in the last year of the plan we were adversely impacted as a consequence of COVID 19, we did see revenue growth in as a result of our investment in digital services such as our data center and hosted solutions.

TSTT expanded its data center build out and deployment of its public cloud network, allowing the company the ability to offer several hosted solutions such as private and public cloud, IP PABX and data storage for business continuity applications in the business sector.

TSTT’s Cloud Business achieved 50% growth in 2018/2019, 78% growth in 2019/20, and 33% growth for 2020/21.

The company launched E-tender Software as a Service to other corporate, national and regional entities (FY19/20).

With respect to (C), while there were challenges with the migration off our old billing system, we did deploy an OSS/BSS Solution Delivery solution to improve service assurance and fulfillment and in supporting the Zero Copper Customer Migration program which reduces the timeframe from customer request to installation, moving from weeks to days and hours in some cases.

We also implemented certain Customer Experience Enhancements as follows:

- Launched monthly Customer Experience feedback program (t-NPS)

- Implemented a new Call Centre Platform that allowed us to launch

- New Channel of Support – Webchat; Artificial Intelligence – Human to System

- Self Service – IVR payments and customers balance inquiry

- Launch Online Billing

We are now in a new financial year and remain focused on matters already set out above, as we navigate the continuing negative impact of the Covid-19 Pandemic.