Above: BitCoin as gold standard. Image by ulchik74/DepositPhotos

Niel Harper wrote this analysis for his Linked-In profile. It is reproduced here by courtesy of the author.

What is Bitcoin? Is it electronic money?

There’s a deluge of hype around Bitcoin and blockchain technologies right now, and policymakers and regulators in the Caribbean are doing their best to wrap their heads around the advantages and disadvantages of this virtual currency.

Similar questions are being contemplated in the ICTs for development (ICT4D) community, taking into account that electronic money (e-money) platforms such as Safaricom’s M-PESA have essentially solved the financial inclusion quandary for millions of people in Kenya. The service has now even expanded to Eastern Europe, Afghanistan, and India.

Besides sharing the characteristic of being digital, how do Bitcoin and e-money compare, especially with regards to reaching individuals who have previously been unable to access traditional financial services? Presently, there appear to be more differences than similarities between the two, and it’s critical not to confuse virtual currency with e-money.

Blockchain, in brief, is a record of digital events, distributed across multiple participants. It can only be updated by consensus between participants in the system, and when new data is entered, it can never be erased. The blockchain contains a true and verifiable record of each and every transaction ever made in the system.

Launched in 2009, Bitcoin is a virtual, private currency that uses blockchain as an underlying, immutable public ledger. Bitcoins are ‘mined’ using distributed processing power across a global network of volunteer software enthusiasts. The supply mechanism is designed to grow slowly and has an upper limit of 21 million units as determined by a built-in algorithm.

There is no central authority that controls blockchain or Bitcoin. There are no central banks that can be politically manipulated; and no way to inflate the value of a national currency by simply printing more money. Economic libertarians are ecstatic at the very thought of this. However, competing virtual currencies can be created that could have the net effect of devaluing the original.

Contrastingly, e-money is not a separate currency and is overseen by the same national regulatory authority that governs the printing of fiat money – as is the case with M-PESA and the Central Bank of Kenya. It’s an extension of a national currency like Jamaican dollars or Netherland Antilles guilders for use over digital networks to reduce the costs associated with handling physical cash.

More specifically, it’s a one-to-one electronic store of value pegged to the cash receipt of the equivalent amount. To mitigate against risks like money laundering, terrorist financing, consumer protection, etc., the cash against which e-money is issued most often has to be deposited with fully regulated financial institutions.

The issue of financial exclusion

The issue of financial exclusion can be summarized into two categories: unbanked and underbanked. Unbanked individuals do not have an account at a regulated financial institution, while underbanked individuals have accounts, but frequently use alternative or unregulated financial services.

Before elaborating on the key factors behind financial exclusion, it is important to detail the effects of being unbanked to illustrate the severity of the problem. Unbanked individuals are faced with a heavy economic burden when conducting even the most basic financial transactions.

For example, cashing a cheque can cost the average person with full-time employment as much as USD$20,000 over his/her lifetime. Retailers, which several people use for check cashing, charge non-trivial fees. For example, charges can be as high as USD5$ for cashing a check. Other alternative financial services providers employ even more extortionary fee structures.

Western Union, as an example, charges as much as USD$42 to send a USD$500 remittance to Barbados. ‘Underground’ alternative financial service providers levy as much as USD$10 on every USD$100 transferred. All in all, fees for conducting basic transactions can accrue large costs. And given that the majority of unbanked households are low- and medium-income families, this significantly reduces the monies available for daily consumption.

There are numerous interwoven reasons, both from the customer and supplier end, which contribute to the overall dilemma of financial exclusion. Fundamentally, the decision on whether or not to open a bank account can often be attributed to the volatility and quantity of the individual’s earnings. This means the more volatile a person’s income is, the higher the chance they are unbanked.

Simply put, they are large numbers of Caribbean nationals who do not have enough money to maintain a bank account. As the majority of banks require a mandatory minimum deposit to open an account, as well as an average balance to avoid monthly services fees, an inadequate and/or inconsistent flow of income automatically serves as a barrier to using banking services for low-income earners who live paycheck to paycheck.

Initially, this may seem paradoxical as alternative financial services are very expensive, yet they are primarily used by low-income individuals. Nonetheless, it must be acknowledged that alternative financial services do not have strict requirements for maintaining a consistent account balance, and consequently are easier to access up front. The high costs of alternative financial services accumulate due to prolonged usage, or at the conclusion of a lending agreement, whereby the interest rates are regularly double or triple of those offered by traditional banks. Basically, the cost of regular bank accounts is known in advance of setting up an account, whereas the true cost of alternative financial services emerges over time. This is a major reason that alternative financial services are more appealing to low-income households.

Another reason for unbanked individuals is attitudinal and behavioral; they really do not trust banks. A large percentage of them believe that banks are not in any way interested in serving their needs. This sentiment may not be all that unfounded, as a number of the banks across the Caribbean region have been reducing the teller services that unbanked individuals are familiar with and prefer, forcing more (non-technical) customers to online channels, regularly increasing service fees, and even worse, looking to divest their retail operations in favor of corporate banking and wealth management business units.

Even though the commercial reasons may be legitimate, these types of actions are not improving the already unfavorable views of traditional banks.

However, it must be emphasized that the reasons for being unbanked are not restricted to consumers. The actions, or rather inaction, of private sector commercial banks play just as large of a role in the issue. The prior discussion of low-income households being unable to obtain bank accounts due to the high minimum balances highlights the unavailability of inexpensive banking options for this specific market segment. The commonly held belief is that banks lose too much money in servicing accounts for low-income individuals to make them a valuable market.

Actually, one can forcefully contend that banks are pricing their products intentionally to keep these customers away. For example, as of June 2017, CIBC FirstCaribbean (Barbados) charges a $15 monthly service — in addition to various other transactional fees — and offers to waive the fee for customers who can maintain an average balance of $1,000. These types of pricing structures and expectations are difficult for poor people to meet.

Why Bitcoin isn’t a financial inclusion panacea

Bitcoin currently has no formal strategy or roadmap to guarantee, for instance, that even at its current rate of adoption, it can replace the variety of fiat currencies across the region. Investment is key to solving these types of problems. However, in quantitative terms, invest in bitcoin at its nascent stages was several orders of magnitude greater by comparison.

There is a lot of controversy around attempts to regulate Bitcoin. It is not very clear to what social and economic areas and most importantly, to what extent the state or agencies will be admitted into the development process to design compliance into the system. One theoretical problem lies in the fact that blockchain’s main strengths (security, legitimacy, privacy, safety and availability) are patterned off a set of algorithms — math, cryptography and distributed computing.

Renowned writer and amateur cryptographer Edgar Allan Poe once stated “… it may be roundly asserted that human ingenuity cannot concoct a cipher which human ingenuity cannot resolve… Thus, what is encrypted by one person, can always be decrypted by another.” Similar thought processes have led many security experts to claim that Bitcoin is one major hack away from total failure (can anyone say ‘quantum computing’?).

My concerns about Bitcoin’s future, and more importantly its status as a solution for financial inclusion, are nowhere close to being so ominous or skeptical. In the sections that follow, I will fully outline why I think Bitcoin has a long way to go before it solves the financial inclusion dilemma in the Caribbean region.

To obtain Bitcoin, you must already be “economically included” – both in terms of Internet and financial access. Let’s be very honest here; the average unbanked or underbanked individual is not mildly interested in the highly technical and costly process of mining Bitcoin. In terms of investing in Bitcoin, individuals participate based on trust in the private currency and at their own risk (speculative investment is usually not the realm of low- to medium-income earners). The exchange rate of Bitcoin to US dollars has fluctuated wildly in its short existence.

Once you have discretionary income available and use debit or credit cards to purchase Bitcoins on a cryptocurrency exchange such as Coinbase or BitStamp, Bitcoin has two characteristics of traditional money: when you buy products or services at participating merchants, transactions are largely anonymous and irrevocable. Again, free market advocates love this, but it garners unnecessary attention from tax agencies and law enforcement.

Anonymity is a deliberate choice for the unbanked. Simply put, the unbanked live in a cash-driven economy. They prefer to remain anonymous for a bevy of reasons: immigration status, tax purposes, fear, or general mistrust of banks. One of the ways to remedy this is to overhaul the burdensome regulations linked to closed networks like Western Union and MoneyGram to permit the unbanked to utilize completely anonymous platforms.

Onerous rules are stymying advancements in digital movement of money because they were developed for a bygone era. For the cloud over the industry to disappear, efforts need to be made to vanquish the idea that anonymous money sending is only for terrorists and criminals. Allowing $100 in cash to move anonymously helps a poor farmer a lot more than it does an ISIS jihadist. The belief of libertarians that money will become totally anonymous, absent of any oversight or intervention by government and regulators, is illusory.

The ultimate objective is to deploy technology that empowers individuals, but in tandem we need common institutions like the judiciary and regulators that protect consumers and the integrity of the currency that drives the economy. At the end of the day, millions of people aren’t going to discard the existing financial system in favor of Bitcoin on faith alone.

Predatory businesses are convenient where the unbanked live. Rural areas like Trelawny, Jamaica or Mayaro, Trinidad are home to large swathes of unbanked households. Traditional banks don’t see a viable business case for locating a branch or satellite office in such districts. This means that check cashing and money changing businesses that charge exorbitant rates are the only real means of conducting transactions.

New concepts like human ATMs are popping up in locations such as Hong Kong where low-income individuals can send money home, and where several minor Bitcoin remittances players have been successful. However, like rural areas in the Caribbean, these are small markets that are in no way appealing to large banks or major investors. Kenya’s M-PESA succeeded because it leveraged an existing network of agents and vendors.

Bitcoin does not preclude the need for extensive networks of agents in remote locations who can provide physical cash to those seeking remittances in a local currency. There are also questions about the viability of Bitcoin in countries with poor technology infrastructure (i.e. poor cellular coverage or lack of broadband Internet in rural areas).

Traditional banks need to come to the table. Traditional banks in the Caribbean have shown little to no interest in embracing Bitcoin or distributed ledger technologies. They see it as a threat to their monopoly over transaction-based services, instead of as an opportunity to revolutionize their operations. Globally, mobile banking is overtaking branch-centered activity more and more – for example, in Norway, 91% of the population use online banking channels.

The explosion of fintech companies that are ‘unbundling’ traditional banking functions, added to the maturity of the first generation of Internet banking solutions, are hastening this trend. Consequently, the amalgamation of omni-channel banking, fintech platforms, and open APIs are obscuring the lines between traditional and alternative finance. New banking institutions such as Skandiabanken, are making strides towards accepting Bitcoin and its altcoins as trustworthy assets.

If this trend is sustained, expect cryptocurrencies to become more firmly implanted in the evolving fintech landscape. Legislators will then be under pressure to formulate comprehensive proposals for regulating a new asset class. It will also have the net effect of encouraging the development of the next generation of cryptocurrency-based services.

Bitcoin maybe better off as a back-office solution. The transparency and auditability features of distributed ledger technologies like Bitcoin could address a number of different challenges in the financial services industry. It could address the de-risking issues that are seriously impacting the Caribbean region. It could reduce compliance expenses, given that banks and other financial institutions need such personnel to ensure that regulatory requirements are being met or to respond to regulator audits.

It serves up the potential of instantaneous movement and settlement of funds, which is appealing to merchants with regards to working capital requirements, given they presently have to wait 2-3 days for each payment. As it pertains to customer service costs, fraud reduction decreases the number of incoming calls, and improved auditability lends to faster responses to customer queries.

For instance, utilizing Bitcoin at the core of a payment gateway that integrates with existing core banking applications to facilitate international wire transfers, would result in significant cost savings (it would also eliminate the need for correspondent banks and provide real competition for the monolith that is SWIFT). Combining these savings with others would allow financial institutions to better service lower income customers. Akin to the underlying protocols behind email, Bitcoin can drive common services, and users will never have to interface with it.

Smaller countries do not have Bitcoin liquidity. Many fintech startups have failed because emerging economies – especially small island developing states (SIDS) – have serious challenges with Bitcoin liquidity. For example, there are some realistic obstacles that weaken Bitcoin’s efficacy as an apparatus for remittances. Remittances demand that a liquid market exists between Bitcoin and the receiving nation’s currency.

Liquid currency markets tend to be strongest in countries with robust market institutions and entrenched local intermediaries. Countries that depend on remittances usually don’t have such institutions for their national currency, far less a totally new virtual currency. This is why the leading mobile money players are focusing on airtime top-ups, bill payment, and peer-to-peer (P2P) transfers. These are alternative forms of value that can surface in countries lacking adequate infrastructure or access to cryptocurrencies and immediately help the poorest.

Many of these applications can run on feature phones and use basic SMS technology to enable movement of digital value. It will take a long time before the really poor become familiar with Bitcoin, and even longer for them to actually care about it. Conversely, Bitcoin ought to be the shining star in the constellation of financial inclusion, and fintech should be engaging in the heavy lifting to develop policies today that will positively impact everyone, not just the wealthy.

Financial inclusion is more than remittances. If I got a dollar for every Bitcoin enthusiast who waxes poetically about ‘Bitcoin’, ‘financial inclusion’ and ‘remittances’, I would be a wealthy man. The truth of the matter is that financial inclusion is a complex issue, difficult to evaluate due to the diverse viewpoints that have to be considered to understand and quantify it. While there is no de facto definition of financial inclusion, there are three elements that are most important: access, use, and quality of financial services.

Moreover, besides remittances, financial inclusion also includes micro-credit, micro-insurance, cooperatives, peer-to-peer lending, rural/agricultural credit, mobile money, mobile vouchers, and a number of other alternative financial services. Financial inclusion is multi-faceted, and Bitcoin has yet to distinguish itself in any of the aforementioned categories. What it does is position itself as a potential alternative payments system, but it has yet to effectively demonstrate how it will deliver financial inclusion tangibly and comprehensively.

From the architecture and engineering perspectives, Bitcoin is not a ‘finished product.’ The cost of Bitcoin transactions depends on network demand and capacity at a given time. While the number of transactions employing Bitcoin have gradually risen in the last couple of years, the processing capacity of the network (that is, the volume of transactions that can be processed per second) has remained static.

In layman’s terms: If transaction volumes continue on this steady trajectory without a corresponding increase in processing capacity, transaction fees will quite possibly surpass those of traditional banking services. Additionally, wait times for transactions to be completely processed have become increasingly unreliable. Contributing to these performance issues are the built-in limits on the number of transactions that can be processed at a given time. Bitcoin was not built to successfully scale, due to all their transactions and smart contracts existing on a single public blockchain, rather than on state channels.

State channels are a two-way transaction channel between users or between machines. The problem of how to increase the processing capacity of the network, while simultaneously preserving its critical decentralized features, is one that needs a near-term resolution. These early ‘teething problems’ emphasize some of the important architecture and engineering decisions that have to be made before Bitcoin can be viewed as a reliable platform for the world’s poorest.

The Caribbean region has serious online trust issues. Trust is a social, economic and political binding instrument. When trust is absent, all kinds of societal afflictions unfold – including paralyzing risk-aversion. In 2016, OAS and IDB published a report titled, ‘Cybersecurity: Are We Ready in Latin America and the Caribbean?’

Researchers conducted assessments of 13 Caribbean nations, including Bahamas, Barbados, Jamaica, and Trinidad & Tobago. The methodological framework covered ‘Culture & Society’, and one of the key findings was the extremely low levels of online trust in the region. More specifically, very high percentages of the populations in the countries surveyed did not trust the Internet as a whole.

When you drill down into the data, the findings are even more alarming: Caribbean people do not trust that their online activities aren’t being monitored, they do not trust their service providers, they do not trust social networks, they do not trust their search engine provider, they do not trust companies to keep their personal data safe and secure, and most relevant — they do not trust online and mobile banking platforms.

Culture is extremely difficult to change; it comprises an interlocking set of goals, roles, processes, values, practices, attitudes and assumptions. It is essentially the DNA of a country. Tossing all other issues aside, getting the residents of Caribbean nations to trust in Bitcoin may be the hardest obstacle to overcome.

Conclusion

History has shown that two factors affect how a foundational technology and its commercial applications evolve. The first is novelty – the extent to which any technological use case is new to a market or to the world at-large. The more novel it is, the more effort needs to be expended on ensuring that consumers understand what problems it realistically solves. The second is complexity, characterized by the amount of ecosystem coordination required – the quantity and diversity of actors and stakeholders that must collaborate to create value with the technology.

For example, a social network with a single member is useless; its value increases only when your friends, family, colleagues, etc. have signed up. Other users of the application must be ‘converted’ to generate value for all involved. The same holds true for distributed ledger technologies like Bitcoin. And, as the scale and impact of such applications increase, large scale uptake will necessitate major social, legal, and political change.

Virtual currencies must be perceived as simple, instinctive, and easy to use even in the most functionally and financially illiterate parts of the world. Talking heads often promote financial literacy and educational programs as the lynchpin in transitioning poor people to technology-based money. But the most effective adoptions happen when people learn by imitation. So, to truly demonstrate its value, Bitcoin must become ubiquitous. People should observe its use by rich and poor alike, and in developed and developing countries, in really similar ways.

No one offered Internet literacy classes or programs when the technology was introduced 30 or so years ago, but Internet usage skyrocketed as the costs fell sufficiently low. Now more people use the Internet than any other technology ever known to man. Along the same vein, Bitcoin is likely to grow when middle-class consumers start using it regularly, even when transacting with the poor. My fear is that Bitcoin and its value chain are not up to the task.

Bitcoin is a commercial application or use case, but blockchain is the foundational technology (like TCP/IP which is at the core of the Internet). And similar to the Internet in the late 1990s, we have no clue how the blockchain will evolve, but I am certain that it will. Much like the Internet, blockchain must also be permitted to grow without restrictions.

This will require awareness, competency, and recognition that the core technology and the applications that run on it are not the same. TCP/IP enables several financial applications that are regulated, but TCP/IP is not regulated as a financial instrument. Blockchain should be treated similarly. While the most popular and pervasive use case for blockchain today is Bitcoin, this will not be the case in a couple of years. Had Internet regulation been heavy-handed in the initial stages, humanity would have been deprived of many innovations that have become embedded in our daily existence.

Blockchain is no different. Disruptive technologies seldom fit neatly into the confining spaces of regulatory oversight, but inflexible regulatory frameworks have continually stifled innovation. Chances are that innovations in distributed ledger technologies will outpace legislation. Let’s not retard their progress.

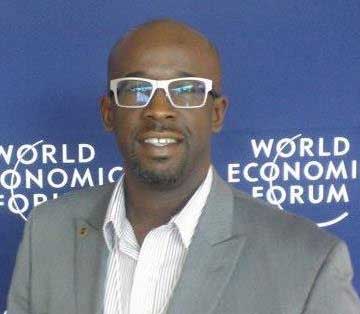

About the author

Niel Harper is the Managing Director & Principal Consultant at Octave Consulting Group, a management consulting firm that assists organizations in combating online threats and safeguarding digital assets. The organization works with business leaders to not only prevent and respond to cyber attacks, but to effectively manage the full spectrum of cyber risks in a manner that adds business value and creates market opportunities.

Throughout his career, Niel has had management responsibility, consulting engagements, and short-term assignments in over 20 countries. He has held leadership roles at or provided advisory services to organizations such as AT&T Wireless, Bemol, Bermuda Commercial Bank, CIBC, Cingular Wireless, European Union, First Global Bank, Internet Society, Lex Caribbean Attorneys-At-Law, and the Sint Maarten Telephone Company, among others. He has been recognized by the World Economic Forum as a Young Global Leader for his international achievements in Internet development, telecoms regulation & policy, and capacity building.

Bitcoin isn’t going to cure financial inclusion anywhere – period. Neither will centralized currencies – currencies aren’t at issue with financial inclusion, and one can argue – should argue – that forex issues themselves that deal with centralized currencies are a large issue of financial inclusion. So the premise of all of this seems odd to me.

The comparison with centralized currencies runs completely against why it was created and why it is as it is. It has the potential to make markets more porous in some regards, though it hasn’t done so because of adoption – and centralized currencies and those who make money off of them are often found arguing against these currencies. It’s nothing new. I recall when Second Life’s Linden Dollar met with some pretty harsh issues itself – and when threatened to play nice with centralized currencies, which the Linden Dollar was effectively a derivative of, Linden Labs took the easier path – which was wise.

Blockchain currencies are different in this regard because their value, while often compared to that of centralized currencies, do not derive value itself from these currencies. There is a cost for a centralized currency, but since they have to be mined, the value itself is in the mining – as well as what people wish to exchange them for. In this way, it’s value is actually determined by demand – the gold standard, as an example, as opposed to an more artificial standard where economies are based on a currency controlled by the banks of one nation.

Just sayin’.