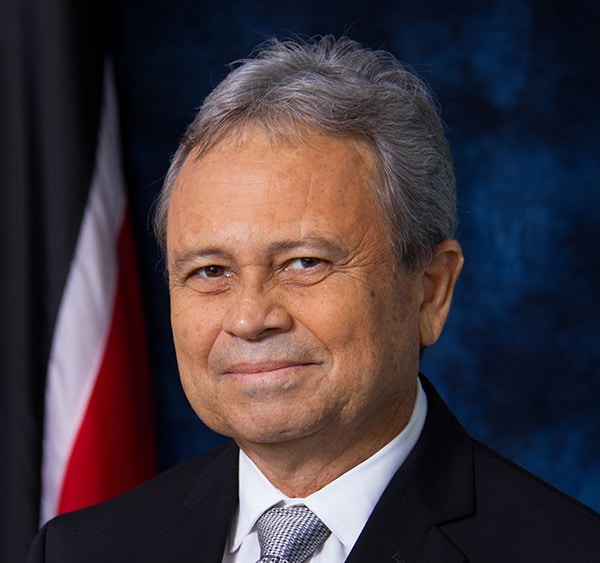

Above: Minister of Finance Colm Imbert, architect of the new tax schedule. Photo courtesy the Ministry of Finance.

The Government of Trinidad and Tobago has released its revisions to the Value Added Tax regime in order to meet shortfalls in revenue.

The PDF listing all of the items, primarily food, is downloadable from the Ministry of Finance.

Surprisingly, the Government has chosen, in a retrograde step, to add books, computers and computer peripherals to that list, ending an almost two decade long moratorium on those items, which also led directly to an explosion in, specifically computer use, placing this country in the lead for consumption of information on the Internet (though that consumption is primarily Facebook and YouTube).

The relevant listings come at the end, as items 22, 29 and 30, as follows…

Books namely literary works, reference books,directories,collections of letters or documents permanently bound in covers, loose-leaf books, manuals or instructions whether complete with their binder or not, amendments to loose-leaf books even if issued separately, school work books and other educational texts in question-and-answer format with spaces for insertion of answers, children’s picture and painting books, exercise books, other paper and paperboard of a kind used for writing, printing or other graphic purposes (Heading No.

4823.90.30)

along with…

The items contained in the First Schedule to the Customs Act under Tariff Heading No. 84.71, being automatic data processing machines and units thereof,magnetic or optical readers, machines for transcribing data onto data media in coded form and machines for processing such data, not elsewhere specified or included.

and finally…

Computer peripherals and mouse pads, not including audio compact discs of Tariff Subheading 8523.40.40 and digital versatile discs (DVD’s) of Subheadings 8523.40.60 and 8523.40.70.

Terminal equipment or other equipment to be installed or used for a public telecommunications network or telecommunications service or radio communications service and certified as such by the Telecommunications Authority of Trinidad and Tobago.

Taxing an established resource waiting to be properly exploited is a surprising step backward for a government aware that it has to diversify. The significant installed base of computers, tablets and smartphones in T&T need to be leveraged to another level, perhaps through a national campaign to encourage the learning of coding and other Internet based development tools.

It’s ill-considered and shortsighted to think that money harvested from book and computer purchases will somehow improve the country’s revenue earning prospects faster than encouraging those technology owners to press that computing power to interesting and productive use.

Only people who don’t understand the transformative power of technology move to restrict its use and acquisition through taxation.

“It’s ill-considered and shortsighted to think that money harvested from book and computer purchases will somehow improve the country’s revenue earning prospects faster than encouraging those technology owners to press that computing power to interesting and productive use.

Only people who don’t understand the transformative power of technology move to restrict its use and acquisition through taxation.”

I would have to disagree here. Computers are a part of everyone’s life now, and they have basically gotten off the hook in terms of taxation. How is taxing this for revenue not feasible? At this point, we are in a recession, and it seems logicial to apply taxes to commonly used things to recoup the funds in an effort to build back.

It’s not a matter of the government trying to restrict your use of technology, it’s trying to solve a problem that the last two idiot government administrations caused through their wild spending. Trust me, you aren’t going to like it. This is because Trinidadians live in a delusional ‘eat ah food’ society, one fostered by curs such as Kamla Persad Bissessar who ignored Obama when he advised them to not rely on America for oil imports. And look at where we’re at now.

The cause of the economic situation is down to the price of oil. If previous governments are tk be faulted, it would be more down to their failure to diversify the economy than their wild spending (though the overboard spending was ill advised as well). Even if the last two administrations were thrift, we would still be facing tough times because of the price of oil.

I can agree with you with computers. However, not books. Computers may lead to expanded consumption, but books expand knowledge. Especially:

“school work books and other educational texts in question-and-answer format with spaces for insertion of answers, children’s picture and painting books, exercise books”

So if it’s not in the book list, pay extra for it.

Printed books are on their way out. People will just read more online or ebooks. The computer tax should take care of that bit.

No Kindle or tablet or cell phone or PDF document writer or reader has been able to replicate the touch and texture of paper, or the sound of turning a page. That’s part of the leisure and intoxicity of books… actual books… a medium that well pre-dates the computer. It bares historical signifance, is a largely educative format… and perhaps ages away from being expelled from one of its core purposes – communication.

when’s the last time you bought a book? For non academic purposes. Be honest. It’s like any medium. There are the early adopters. That phase is done. Once people begin using their cellphones,tablets etc it will become mainstream. Also in developing economies such as ours. As to your point about it’s history, intoxicity and so on, that’s a really nice way to look at it. But there is literally no difference in the content. None. I think you are overstating how much people care about the feel of paper in their hands. *Chuckle*. Would you pay 100+ TT for a best seller or get it on your smart device for peanuts. I suspect the only people who talk about the historical significance and all that probably haven’t tried it.Conclusion: They can tax books one million percent. It’s a short term measure and probably will make the transition to digital media faster.

I bought a non academic book for Christmas, I like the feel, the fact that there is no illumination from the book and also no apps to distract me. People have been using their smart phones for years so there is no ‘once people begin’. No one is overstating anything. I work in the programming industry and my team all agree that even though ebooks are convenient we cant stand reading more than a couple pages on any device. and as for our clients, many still prefer that all project reports be printed and bound as a book along with the digital copy. im not saying ebooks are a waste, they are reasonably priced and if you cant get a specific book in time, they are a life saver. But nothing beats siting in your room at the end of a work day and flipping the pages of an epic fantasy

Printed books are on their way out? Far from it. Printed books still form the bulk of all book purchases.

http://www.pewresearch.org/fact-tank/2015/10/19/slightly-fewer-americans-are-reading-print-books-new-survey-finds/ft_15-10-09_books_310px/

You might like to curl up with an ebook reader, but the vast majority of people disagree.

Sachin

Like music purchases? Give it a couple years. We’ll see how you feel about it then…

Sorry but no, Ebooks have been been trying to dominate the market for quite some time now but to no avail. With the increase in tech savvy individuals on a global scale, paperback books still own the spotlight. Many major booksellers who tried to promote ebooks have admitted that it still cannot dominate the market where paper is concerned. In fact many global shopping areas such as Barnes and Noble, Amazon and others have reported that buyers still prefer printed books to eboooks even among the younger generation.

http://www.theguardian.com/books/2013/nov/25/young-adult-readers-prefer-printed-ebooks

However, see http://legacy.guardian.co.tt/archives/2007-06-27/bussguardian10.html

I don’t think these changes refer to computers and tablets therefore.

That story only dealt with the issue of VAT on optical media. Computers were zero rated the on the schedule.

But computers and tablets don’t require TATT approval. You may need to take a look at the Tariff Schedule to see exactly what VAT is being applied to now. By the description, 29 looks like duplicators, tape drives, etc, 30 is peripherals and 30A looks more like network equipment utilised by telecommunication providers. The Customs Tariff Headings are usually very specific with respect to the items they cover.