Above: Illustration by digiart/DepositPhotos.com

BitDepth#1475 for September 09, 2024

Last month, the TT International Finance Centre (TTIFC) issued a summary of the results of its survey of financial inclusion in this country.

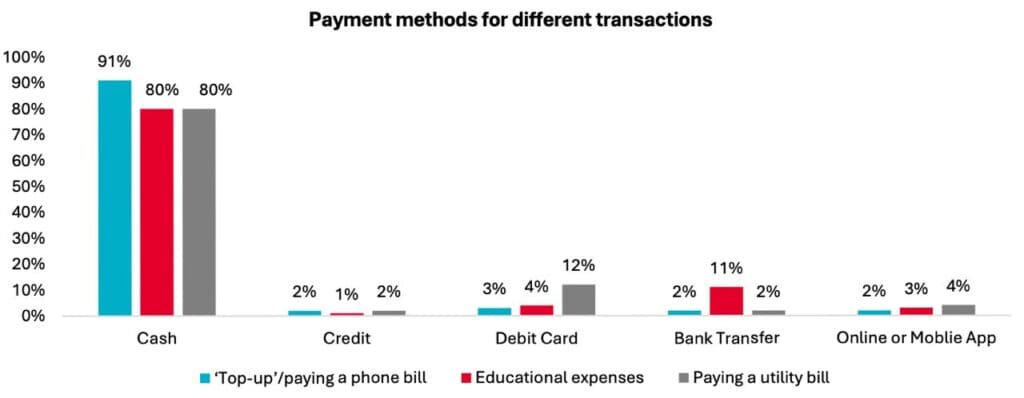

The Digitalisation of Payments and Inclusion Survey (DPI), which the TTIFC will use to design its National Financial Inclusion Strategy found, to nobody’s surprise, that despite efforts to transition TT society to a cashless society, we want to hold on to our dollar bills.

What is money? It is any medium of exchange that is centralised, generally accepted, recognised by all parties and acts to facilitate transactions of goods and services. It is value codified.

Its value as legal tender for that purpose can vary widely. The TT dollar is essentially useless outside of this country. Even the US dollar, while widely accepted as a representation of value, will sometimes fall into national sinkholes around the world where it has no value at all.

Gold, widely used as a store of value, is not particularly valuable or useful beyond its role in finance. It is surpassed by palladium and rhodium, which are used extensively in industry and iridium and osmium, which are even rarer minerals.

The value of a financial instrument is what we say it is. Collectively, Trinidad and Tobago is saying that cash is better than credit cards, debit cards and online transfers.

We are also saying, to an alarming degree, fiyah bun banks.

The percentage of citizens who have a bank account dropped from 81 per cent in 2017 to 75 per cent in 2023. Only 52 per cent of the more than 2,000 survey respondents preferred to save their money in a bank. Eighty-two percent preferred to save their money at home.

Among the banked, almost half were surprised by bank fees associated with ATM use, 29 per cent by account maintenance fees, 28 per cent by transaction fees and 25 per cent by opening and minimum balance fees.

Not recorded in the survey’s findings are the feelings of those surveyed about the staggering profits recorded by local banks and their relationship to this fusillade of fiscal attrition that targets their accounts.

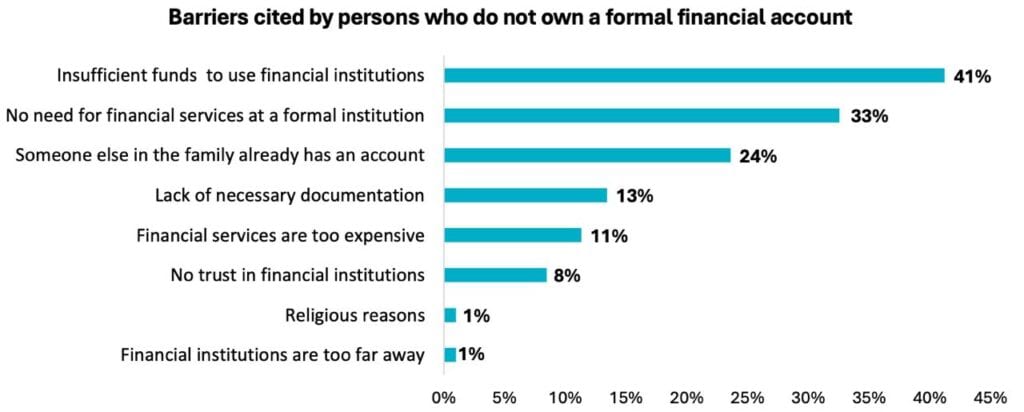

In the report’s conclusion is the following, “A concerning 41 per cent of the financially excluded believe they do not possess adequate funds to register an account.”

“This sentiment is pervasive across all demographic groups, underscoring that costs associated with maintaining these accounts are disproportionate to the amounts that such consumers may save or hold in their accounts. This is a significant disincentive to opening, maintaining, and using an account.

The preference for cash, perceived as ‘free’ by users, further accentuates this point.”

But cash is not free. It costs money to mint each note and to replace damaged bills, reasons why the Central Bank switched from cotton based bills to a hardier, more secure material that would last longer and resist counterfeiting.

That production cost is borne by the state as part of its duty to manage the economy.

So let’s talk about friction.

If you go shopping with a fifty-dollar bill, at the end of your spree, you will have exchanged the cash for fifty dollars worth of goods or services and the merchants you patronised will have each received their portion.

If you pay with a debit card at a point of sale terminal, there is a fee, which can range between free and $4.00, depending on who issued the terminal. Does anyone check that? No, because you can’t choose to use another terminal to pay.

Some banks also charge a fee on declined transactions (The Central Bank’s PDF record of electronic payments fees is here).

Credit cards are even more costly. Micro merchants and small businesses (MSME’s) almost universally don’t want to accept credit cards as a payment instrument because each transaction costs them three to four per cent of the payment.

Some vendors will even add the difference to the cost of the item, leaving you with a choice of accepting the unfair and contract-breaking practice or leaving the store.

Merchants are hardly blameless in this running recalcitrance to embrace cashless and electronic transfer systems. Last week I contacted a well-known air-conditioning company whose products I’ve used for 30 years about scheduling a repair.

Their service team arrived with no card readers and were dissuaded by their home base from encouraging an ACH transfer because “customers were entering incorrect numbers and not settling their bills.”

Financial institutions have an extensive know your customer (KYC) requirement because of FATCA, but it seems that requirement goes only in the direction of international compliance and hasn’t been used by businesses to offer their customers any real world benefits based on familiarity with their business history.

To this company, I was a stranger who had to go to their office to make a payment, doubly galling since they figured out how to accept payment from me when a service was scheduled during covid restrictions and such in-person visits were prohibited.

Overall, it seems that all the lessons in online payments and transactions that were forced on companies have not just been forgotten, but aggressively reversed.

Customers also get stung if they don’t pay off their credit card balances in time, incurring fines as high as ten per cent of the full amount past due.

This is friction, the cost of moving money from one place to another and it’s present in almost all online transactions. Pay with cryptocurrency and you must also chip in a bit for “gas” the fee for moving crypto values from one wallet to another.

These concerns have led to debit card adoption dramatically outpacing credit cards among the banked. In 2017, 16 per cent of users owned a credit card, a figure that dropped to 15 per cent by 2023. By contrast, debit cards were held by 61 per cent of the banked in 2017 rising to 88 per cent in 2023.

Debit cards are almost always cheaper to use as a payment instrument for both vendor and customer, but are limited to local transactions.

Far and away the best and least expensive option for transferring money online is the Automated Clearing House (ACH) system, which rose to prominence during covid lockdowns and adds a flat fee per transaction of between $1.00 to $3.00 to move money thats usually deducted from the account of the payor.

It’s a lot to keep track of, and banks do a terrible job of explaining these issues to their customers, largely leaving them stumbling to find their way by trial and payment.

If you have a sense that maybe I’m not a champion of the local banking system, well, there’s a lot of words available online about why.

The challenge facing the TTIFC is daunting. The banking community offers lip service to the cashless society concept. A quarter of adults do not have a banking account and 13 per cent do not have the documentation to open one.

More than half do not understand how to use a mobile banking app.

Finance Minister Colm Imbert wants the country to go cashless, but doing more of what isn’t working won’t change anything.

Any solution will need to specifically target the needs of customers who are not being addressed by the banking sector and that won’t make those institutions happy.

But there are thousands of unbanked citizens who are not being addressed by the financial products of today. Until that changes, until the friction of non-cash transactions is reduced, nothing will.

Would be nice to use cashless option for things like I don’t know say paying property taxes.

Oh! That’s today’s editorial over at @ttnewsday. https://newsday.co.tt/2024/09/16/hot-air-over-property-tax/

[…] Trinidad and Tobago – Last month, the TT International Finance Centre (TTIFC) issued a summary of the results of its survey of financial inclusion in this country… more […]