- 5G adoption in the Caribbean has been slow

- There are issues of infrastructure and expense that telecommunications companies must manage

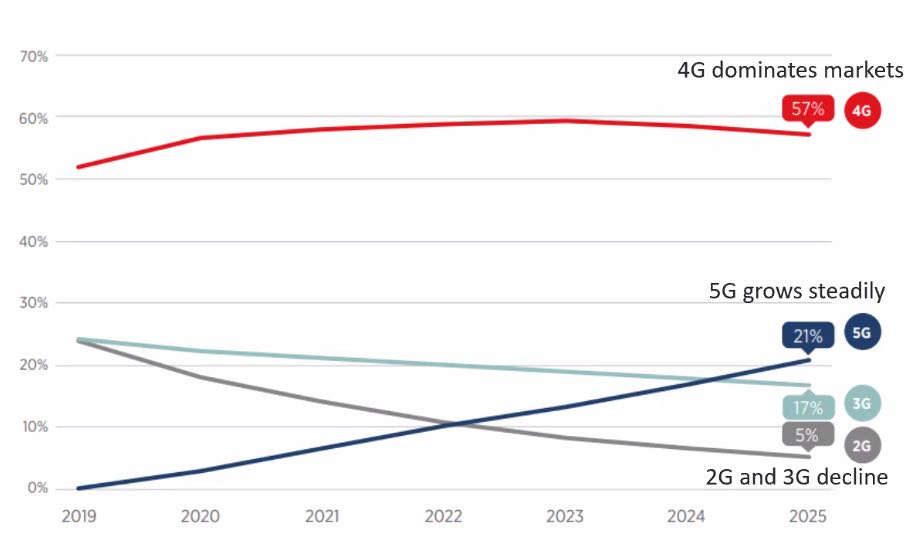

Above: Trends mapped by the ITU for future 4G and 5G growth

BitDepth#1322 for October 04, 2021

On Thursday, Jamaica’s Office of Utilities Regulation (OUR) and CANTO hosted a webinar to discuss the issues governing the future adoption of 5G technology in Latin America and the Caribbean.

The webinar was supposed to be to help journalists in the region understand the problems involved.

But beyond repeated reminders that electromagnetic radiation from 5G celltowers poses no significant threat to human health, the conversation seemed to be a running rumination on the challenges that the region faces in implementing the new technology.

According to Michael Charvis, OUR’s deputy director-general, Jamaica is a prime prospect for the advantages that 5G would bring to connectivity there.

Wireless technologies, he noted, are the best option for filling in the coverage gaps in Jamaica’s rugged rural mountains and forested regions.

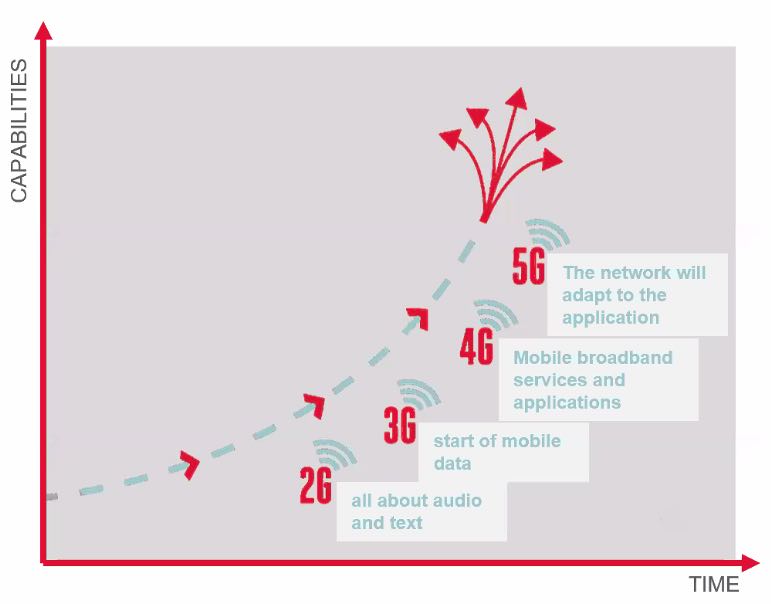

“Each generation of broadband brings benefits to society and the economy,” Charvis said.

He lamented that Jamaica has been ten years behind in every generation upgrade, from 2G onward.

According to Charvis, there was an explosion in telecommunications growth in Jamaica after the country made the switch from receiving parties paying for a call to calling party pays.

The move was resisted by the telecommunications incumbent, but they also benefited from the change as well.

“What other assumptions that are holding back the adoption of 5G?” Chavis asked.

Jamaica isn’t alone in its slow and measured roll-out of 5G technology in the region.

Trinidad and Tobago made the adoption list only because TSTT’s chosen technology for its zero-copper campaign was 5G-based WTTX, but the company, along with its competitor Digicel, remains guarded on the question of 5G for mobile.

Sometimes, the problems are beyond operational or even financial matters.

Mike Antonius, CEO at Suriname’s Telesur, noted that “The digital divide that exists between develped and developing countries is not limited to ICT services.”

“You can imagine any kind of service and put an ‘e’ in front of it, Telesur is an e-enabler,” Antonius said, having pushed for a switch to 5G to improve e-services in the country.

He’s since discovered that there are challenges with devices, many of which don’t have 5G-capable radios and can’t access the country’s peak 1GB connection (Antonius demonstrated 951Mbps upload and 85Mbps download SpeedTest results).

The company is currently negotiating with Apple to “turn on something” so that iPhones with 5G capability can connect to the network at full speed.

Digicel’s Chandrika Samaroo said that many telecommunications companies are still “sweating the asset.”

“There is a danger of the network becoming obsolete before the investment can be recouped,” he explained.

Samaroo pointed to five important spokes that are necessary to make the 5G wheel spin, broad-minded regulatory oversight, progressive spectrum management, import duty reforms, sustained public education and a unified, robust over-the-top (OTT) tax regime to draw revenue from online services that pay no taxes, but extract advertising revenue while using network bandwidth.

According to the ITU’s Dr Bilel Jamoussi, 95 percent of international traffic is carried over fibre and 80 percent of traffic is video.

In the ITU’s analysis and projections, 50 per cent of mobile networks are currently on 4G and within ten years as many as 20 percent will be on 5G.

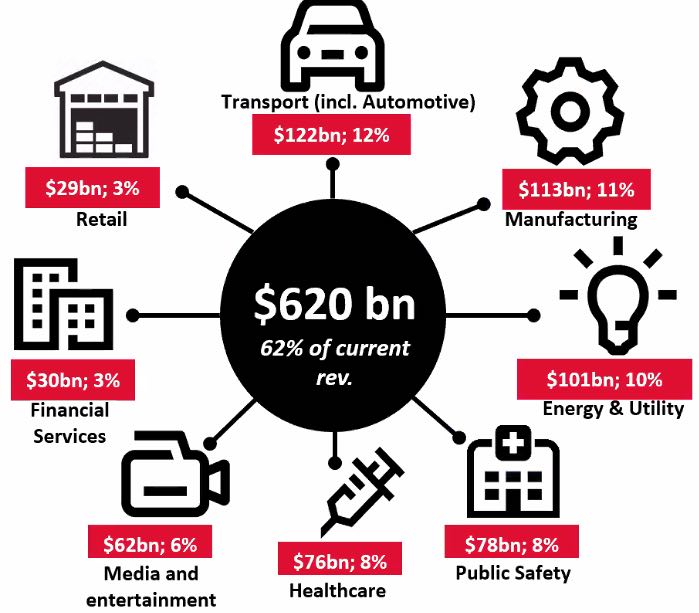

The global economy is projected to expand by US$2.2 trillion over the next 15 years because of 5G connectivity improvements, particularly in industry and enterprise and IoT applications.

Cable and Wireless’ Rodrigo Cardenas pointed to four factors that govern 5G implementation.

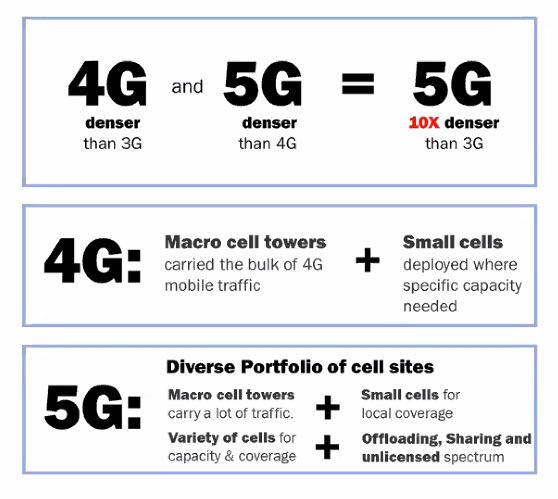

Networks benefit from lower frequency spectrum allocations, which give the best coverage.

But much of that spectrum is in use by 2G, 3G and 4G technologies and can’t be allocated until those broadcast ranges are shut down and that decline has been painfully slow.

The new broadcast technology also needs at least 100Mhz of contiguous spectrum or speeds drop to 4GLTE.

If latency is to be a selling point for the service, telecommunications companies will have to invest in a new core.

As an evolution of 4G, 5G has some technical similarities, but the new tech has its own requirements if it is to be executed properly.

The GSMA believes it is the mobile technology of the 2020’s and promises ubiquitious connectedness for mobile broadband with high connection speeds and pervasive presence.

But like all the boldest promises, it demands serious investment in its execution or there will, inevitably, be compromises.