This post was updated on the morning of July 12, 2021 with additional information on the online banking issues at Republic Bank. A Twitter message was embedded with a video produced by the bank intended to clarify verification procedures. A graphic produced the bank to introduce a new help email address was added. On the afternoon of July 12, the full apology statement issued by the bank’s managing director was added.

Questions put to Derwin Howell, Executive Director of Republic Bank on the morning of July 06, 2021 were answered this evening (July 08) in an email approved by him.

Q. The new version of the app is not available on the US version of Apple’s app store, why is that? There are customers who use the US app store by choice or are living/working in the US and need access to their accounts.

A. I believe this has been clarified.

Q. Users who have been able to access their accounts are now finding that their accounts are missing and all payment settings are gone.

A. We are not aware of this occurring on a large scale, and we have communicated directly with the few customers whose information has not been fully mapped.

Q. The new mobile app does not acknowledge special characters and limits the number of characters that can be used in a password, which seems like a step backward in a security conscious world. Why is that?

A. An updated app that includes characters beyond the standard set is currently under consideration.

Q. Why choose SMS as a verification method? It seems like a particularly insecure way to manage identification protocols. Many users are reporting serious issues with the SMS system, receiving their verification after it has timed out, not getting a verification at all. What steps are being taken to manage that aspect of the process?

A. This SMS [verification] is one of the 3 options used to verify identity on a system for two factor authentication. It’s the only non-data-connected authentication option that customers who don’t use the mobile app still find convenient.

Q. Many users also report not being able to access their accounts on the website either. Is the issue on the back end and rolling forward to the new app?

A. Most challenges experienced have been with the initial sign on process.

Q. Was this system put through user trials? Is there any option to roll back to a previous version? Three days in people are becoming very worried about their inability to do online banking.

A. While the first few days were challenging on the system, we have seen a steady increase in active users on the new system, with close to 40K active users.

Q. The older version of the mobile app was removed from your systems, which left customers unable to connect with no access to their accounts. Was the hard cut-over absolutely necessary?

A. Due to the nature of the systems, it would not have been possible for consumers to access their accounts via both the old and new apps, hence the hard cut-over was necessary in this circumstance.

Q. Was Republic prepared for the problems that ensued after the launch? By the second day after the launch it seems like all your help line services are completely swamped and the company is now resorting to mass emails to address customer problems.

A. These obstacles presented themselves unexpectedly. Callers to our Contact Center did have longer wait times, but this is to be expected during periods of high customer demand or service failures. The bank’s crisis communication strategy has historically depended on a variety of methods to reach out to clients and inform them of service concerns, including the use of the media.

Q. Technical users have concerns about using the app itself as a source of verification using the One Time Password system. That flies in the face of best practices for verification systems and password generation.

A. The app is a separate channel from the website and offers two options for second factor authentication, meaning they are to be used to strengthen access controls beyond a password only. These methods are also uniquely generated only at the time the user wants to login and expire shortly after, making them more secure than static passcodes.

Q. The company is not managing the social media and online response to the issues at all. Why is this?

A. The bank has communicated directly with all online banking clients, and additional communication will be shared with them in the following days.

On June 12, 2021, Nigel Baptiste, Managing Director at Republic Bank issued the following statement to the bank’s customers.

“I am deeply sorry for the inconvenience caused to not just our Internet/Mobile banking customers but also all of our other customers who would have experienced inordinate delays in trying to reach our Customer Contact Centre with their regular queries.” Says Nigel Baptiste, Managing Director at Republic Bank.

Republic Bank is constantly reviewing our technology and other services based on customer feedback in order to better serve our customers. Our previous platform, RepublicOnline, served us well for financial convenience, but changing customer expectations necessitated change.

The new platform launched on July 5 is more intuitive and user-friendly and offers additional services to customers at their fingertips. We sincerely hope that the 50,000 users that have since successfully accessed the platform can attest to this and are enjoying the enhanced experience.

Regrettably, the significant number of initial sign-in attempts resulted in issues that slowed down the system on the first day, but these were resolved within the first few hours following the launch. Even though these performance issues were resolved, some customers were still unable to access their accounts due to initial login issues that were, in many cases, customer-specific.

“With the help of our partners, as well as the dedication and loyalty of frontline team members across the organization, the process of restoring customer access begun and will continue. There are still some issues to resolve, but the system is back on track and we expect to clear the backlog of customer login issues within the next week.” Baptiste added.

The Bank has doubled the number of frontline workers assisting customers through this transition via the call centre and through emails. To further help affected customers, Republic Bank has released a series of short tutorial videos to assist those who need help getting onto the platform. The Bank’s social media pages, mobile applications, and websites will all feature these videos and other useful guides. These, plus the existing guides can be viewed at https://republiconline.republictt.com.

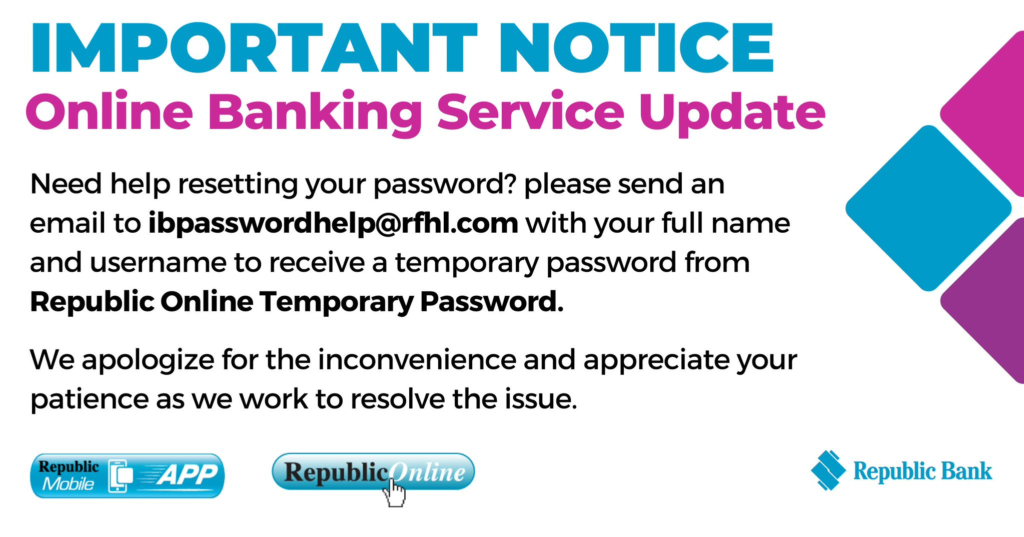

Customers who have been locked out of their internet banking account are being asked to send an email to [email protected] with their existing online or mobile username and full legal name to receive a temporary password within 48 hours.

Republic Bank again apologises for the inconvenience caused over the past week and assures its valued customers that all efforts are being made to ensure that all affected customers have their access restored as quickly as possible.

Stop lying out your ass… this new platform is a headache to get through to as well as being charged everytime you have to login to your account. Nothing was wrong with the old authentication method and I don’t know why it was not available as an OPTION.