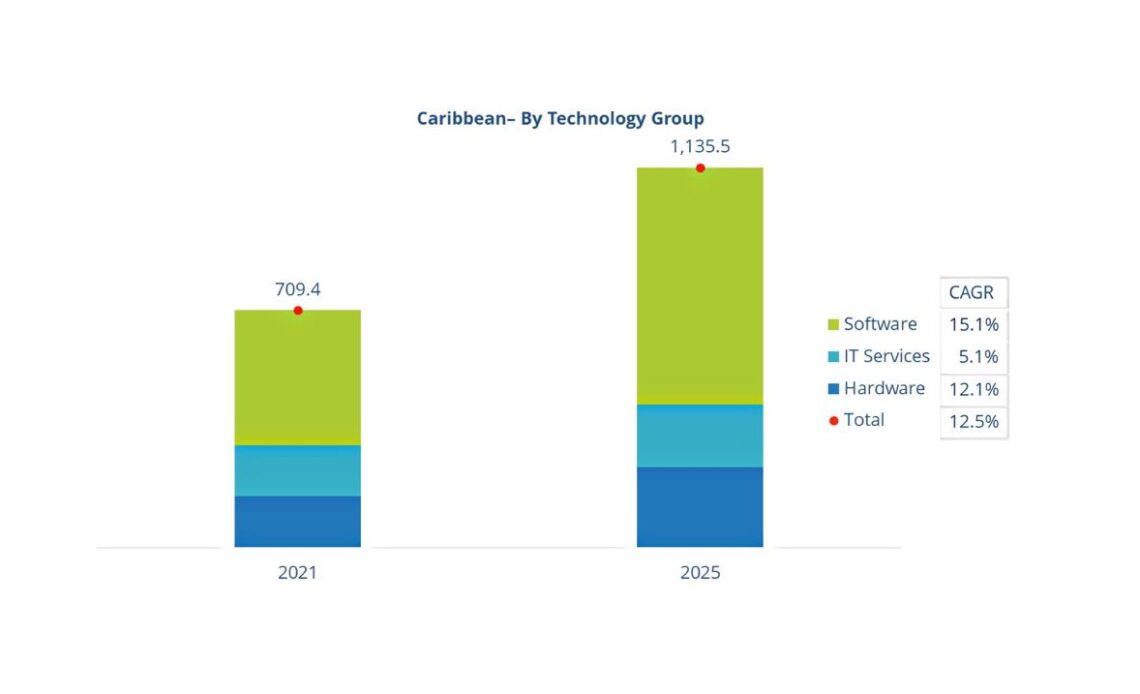

Above: Graph of IDC projections for the region.

A study conducted in the Caribbean region by IDC, a leading provider of global IT research, points to prefabricated and modular data centers as the answer to challenges that IT strategists face in the accelerating innovation and demand for data and services.

The study, sponsored by Schneider Electric, highlights the need for an agile, scalable and flexible infrastructure, even in limited spaces, to complement the need for data processing and storage. Therefore, prefabricated and modular data centers carry many advantages such as: time reduction in planning, construction, and implementation; managing the needs of the organization while keeping an eye on sustainability through costs, power, cooling and resources.

“Schneider Electric is able to be the ideal solution for this infrastructure deployment with our Modular (or Prefabricated) Datacenter solutions, designed to meet the growth of data, connected devices, increased traffic to the data center and the integration of new technologies that allow real-time and efficient processing, based on modules,” said Martin M. Jiménez, sales manager for EcoStruxure Modular Data Centers and Prefabricated Data Centers at Schneider Electric.

Trends

The IDC report also notes that in the Caribbean region, business IT investment (excluding devices) reached a total of US$709 million in 2021 and this investment is expected to grow nine per cent in 2022. This growth will accelerate hand in hand with the digital transformation process of organizations. Thus, investment in IT will have an average annual growth of 12.5 per cent between 2021 and 2025. Regarding hardware, the growth of IaaS stands out, which in 2021 already represented 31 per cent of IT investment. Between 2021 and 2025, that same investment in the Caribbean will grow at a CAGR of 45 per cent. By 2025, IaaS will account for 41 per cent of hardware investment.

IDC also estimates that by the end of 2022, 75 per cent of enterprises globally will implement a unified management system for their clouds, networks, and data centers to ease infrastructure costs and operational complexity.

This shows us that the architecture of the digital infrastructure must be transformed from silos to flexible resources that allow the implementation of ubiquity, autonomy of operations and a workload-centric approach (in cloud-native technologies). It also means a digital infrastructure ecosystem emerging and increasingly built on the foundation of the cloud, seeking to ensure faster delivery of innovative infrastructure hardware and software. Then, there’s resource abstraction and process technologies to support the ongoing development and refinement of digital services and digital experiences that are both sustainable and resilient.

All of this can be reflected in the adoption of edge computing, which can serve as a complement to the cloud, bringing computing closer to a place where things happen and data is produced, in order to reduce latency in a more cost-effective way.

In Latin America, even though this technology is still in the deployment stage, it is estimated that 70 per cent of the investment in Edge Computing is allocated to hardware and connectivity. In the Caribbean, this investment will have more emphasis on hardware, since, in this region in particular, the disparity in terms of connectivity, energy and its geographical peculiarities imply more challenges for the presence of data centers, making Edge Computing charge more sense.

IT infrastructure strategists must consider this trend in more dispersed data and devices, especially when it is estimated that, from 2020 to 2025, the volume of data in Latin America will triple, from 3.1 zettabytes to 9.5 zettabytes, which represents a compound annual growth rate of 24.7 per cent in that period, above the global average (22.9 per cent), a trend that will also be reflected in the Caribbean.