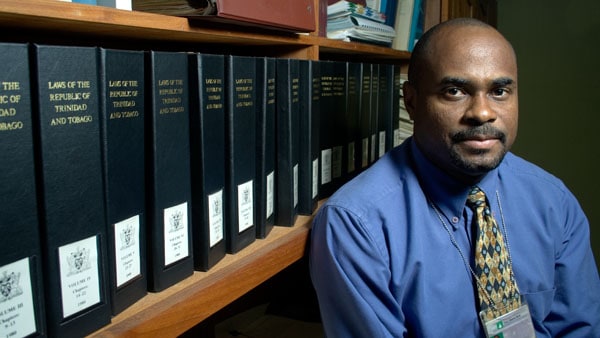

Above: Anthony St Clair at his office in First Citizens Bank. Photograph by Mark Lyndersay.

BitDepth#505 for December 27, 2005

It isn’t often that BitDepth gets taken to the cleaners by smartmen on the Internet. In fact, it’s only happened once, but it was a hell of a once.

I make frequent use of my bank’s telephone banking service, since there’s nothing like having no money to encourage you to check on the few shekels you have left. So it was, frankly, astonishing to discover the giant smoking hole that was left where my credit card account used to be.

It took two day’s worth of rare visits to my bankers to freeze what was left and sort the whole mess out, but really, I was a helicopter descending on the smoking remains and there certainly wasn’t any evidence to be found.

I took some small and barely registered comfort in noting that the guileful person who took off with my credit card identity on a jolly spending spree was buying Internet hosting and online training. Clearly this was someone who was living up to the spirit of this columnist’s efforts by trying to better themselves.

I was left to try to rebuild the mess that was left behind. That took almost three months, and while the bank quickly replaced the credit card account and instrument, there wasn’t any money to be spent for twelve weeks while each illicit purchase was queried and cross-examined before it could be reversed.

What’s particularly surprising about this is that it didn’t even count toward the million plus in fraud lost by local bankers in 2005, according to Anthony St Clair, the newly appointed Chairman of the Interbank Fraud awareness and Anti-money laundering sub-committee of the Banker’s Association.

All the spending of the phantom “me” was reversed to the merchants that got hit, St Clair and his colleagues are on the watch for more prosaic methodologies that hit the coffers of local banks.

The Fraud Awareness sub-committee gathers information about every conman’s trick in use in Trinidad and Tobago, and according to St Clair, the big losses come from ATM identity thefts, which account for more than half of the charges that had to be eaten by local banks this year.

Now given the profits of the big banks, a million dollars spread around the big players starts to look puny, but for bankers, any loss is unacceptable and there’s nothing like an internal auditor, which is Anthony St Clair’s day job at First Citizens Bank, to explain that to you.

A big part of the growing fraud headache is the steady evolution of fraud in recent years from a series of one-off efforts to cheat the system into an organised assault on the bank security.

Fraud has grown from forgeries of Manager’s checks, the last “unassailable” exchange instrument of the old paper trust systems to sophisticated con jobs executed in ATM booths.

Credit card fraud is still relatively minor in Trinidad and Tobago, but it’s growing fast in the US so if you have a credit card and you shop internationally; you need to be aware of the dangers.

The most common methods of getting credit card information involve some sleight of hand. Skimming is a way of gathering the information embedded on the magnetic stripe of your card and using it to generate cloned cards. Skimming devices are palm sized and can be made to look like common handheld devices like a pager.

Phishing is more commonplace and will usually be found in unsolicited e-mails for banking and commercial services that seem genuine but link to fronts for websites designed to capture sensitive financial information.

The most common phishing technique is a sophisticated looking e-mail for Paypal or a recognisable banking institution with a convenient link to “update” your financial information.

Recently, however, these links are embedded in more alluring invitations to collect free iPods, verify your order at Victoria’s Secret or apply for quotes and credit cards. What they all have in common is that at some point, to “verify” that you’re the right person, you’ll have to give up some personal information that can be used against you.

One good rule of thumb to follow when shopping or even browsing online is to divulge nothing more than you would tell a stranger in suspicious circumstances, but sometimes under virtual bright lights and in the most sophisticated of surroundings, someone is waiting to make off with your financial identity.

I’m pretty sure where I let down my guard while shopping line and it was a silly mistake that I won’t repeat. But there are a lot of people, both locally and abroad, who are just waiting for you to make exactly that type of mistake, trusting a website or a face that seems honest and letting down your guard just long enough to get your accounts emptied.