Above: Derwin Howell. Photo by Abigail Hadeed, courtesy Republic Bank.

BitDepth#1292 for March 11, 2021

Last week, Republic Bank introduced a product offering a digital equivalent to cash transactions in Trinidad and Tobago.

The problem it targets is real and relevant. Cash transactions above petty cash levels are unwieldy at best and often dangerous.

Moving money around as paper, no matter how slick and shiny it’s become recently, adds friction to transactions that should remain digital, even as covid19 pushes more businesses to become contactless and virtual.

The biggest problem that Endcash may face is being introduced by Republic. It wasn’t clear to me at first, and possibly to other potential users, that the Endcash transaction system is bank agnostic.

While the demands of covid19 have significantly sped up transactions between banks using Interbank Systems TransACH – dropping from an average of three days to 36 hours – that’s still far from fast enough.

Endcash is more consumer facing, though it does tie into TransACH to move money back into the traditional banking system.

An Endcash user pays two charges to use the system, a $3.50 fee to put money into their digital wallet and a $10 fee to transfer money to a traditional banking account.

The digital wallet can be loaded using any credit card up to a $10,000 limit.

“With cash,” Republic Bank executive director Derwin Howell explained, “the money just gets spent, it’s difficult to figure out how much got spent where.”

“The digital wallet give you control over your spending; you can see where every cent was spent.”That’s a useful feature, but digital natives will be keen about being able both pay for goods and services and get paid using smartphones.

The app, available for iOS and Android is a cleanly designed tool that is uncluttered to use. But all four of my attempts to load the card with a token sum were rejected by my bank, RBC.

When I reached out to Howell about my experience, he responded quickly. “Yes, we are seeing them rejecting loads. We are working with them on it.”

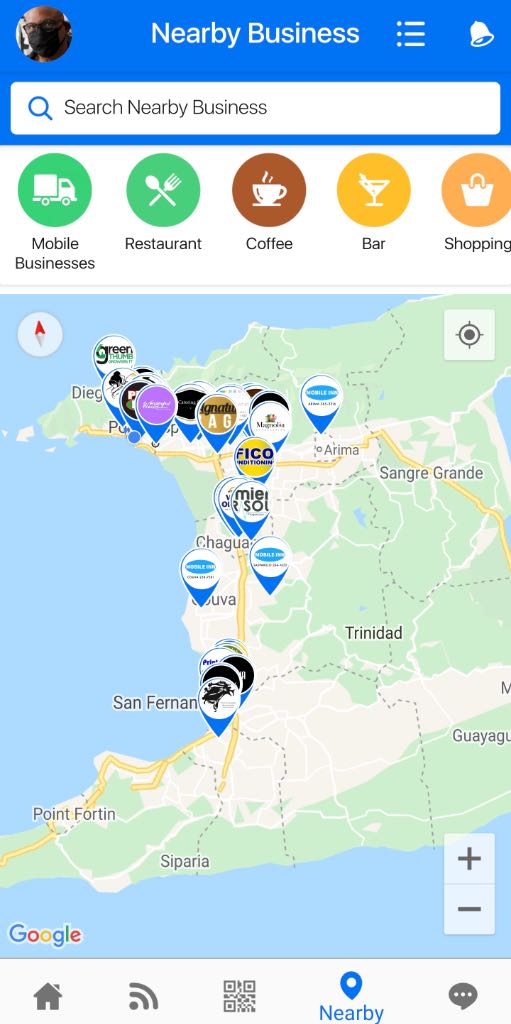

That isn’t unreasonable for first week’s jitters, but the map function that lets you know which vendors near you are accepting Endcash is rather sparse, particularly when you zoom to street level.

For Endcash to catch on, it mustit’s become as usable as cash and that means signing up a lot of merchants, particularly marquee sellers like grocery chains and fast food franchises.

“The immediate use case is in heavy cash transactions which are vulnerable, but vendors need to be able to spend their Endcash somewhere,” Howell said.

“You need people on both sides, people who accept it and people who use it.”

“There’s been quite a lot of interest in the merchant sector and some uptake on the merchant and consumer side.”

“There’s a demographic that would gravitate to this, younger people for sure and contactless transactions are important now.”

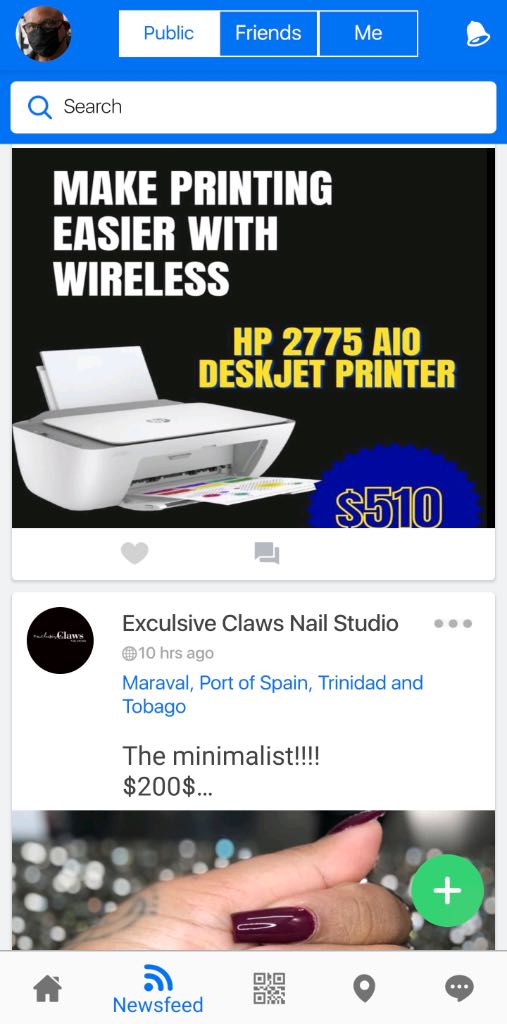

One lively space on the app is the Newsfeed, which is a continuous stream of promotions and ads for products, most of them from small, niche businesses that have taken advantage of a way to sell potential customers everything from camisoles to cryptocurrency.

Putting the system into the hands of individual users and merchants is the first mission for Endcash.

Republic’s merchant customers will have verified information in their systems, so signup will be faster, but most merchants should be approved within two days.

Individual signups happen in a matter of minutes, unless you go for two-factor authentication, which takes much longer and requires another security app from Google. It’s probably worth it if you end up loading a lot of money into the digital wallet.

Republic hopes to reach the unbanked and the underbanked with the Endcash solution.

“You don’t need a bank account to use this, you just need a smartphone with data,” Howell said..